Question: Question 1 [25 Marks) Grains Pty(Ltd) must replace a machine that is used to produce flour for bread The existing machine does not have the

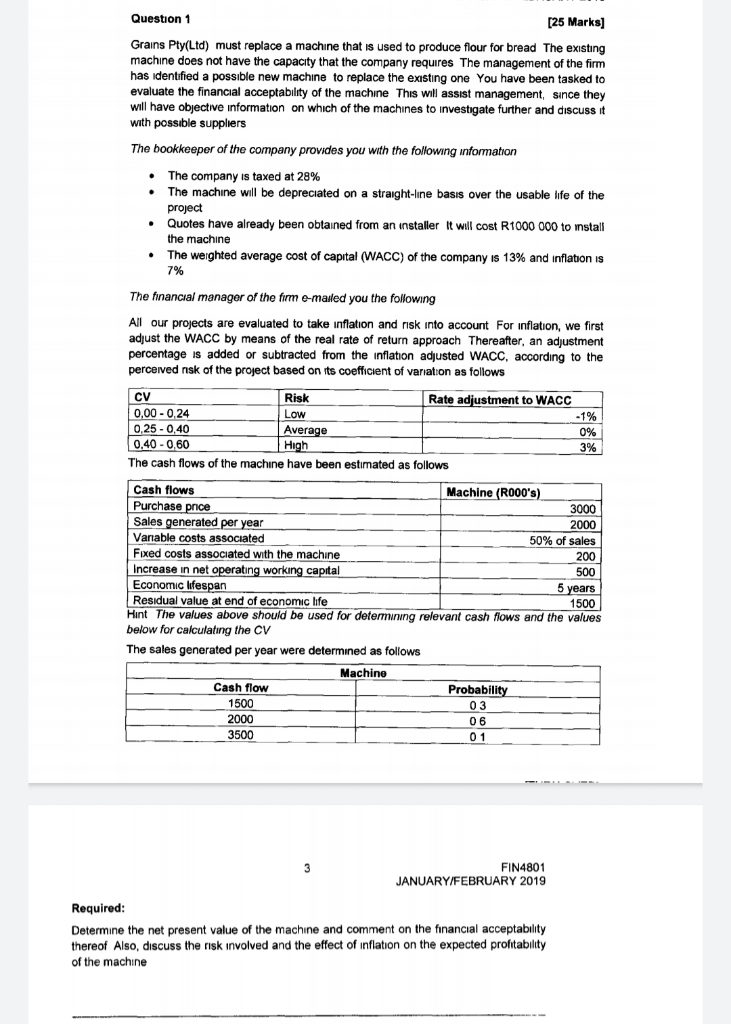

Question 1 [25 Marks) Grains Pty(Ltd) must replace a machine that is used to produce flour for bread The existing machine does not have the capacity that the company requires the management of the firm has identified a possible new machine to replace the existing one You have been tasked to evaluate the financial acceptability of the machine This will assist management, since they will have objective information on which of the machines to investigate further and discuss it with possible suppliers The bookkeeper of the company provides you with the following information The company is taxed at 28% The machine will be depreciated on a straight-line basis over the usable life of the project Quotes have already been obtained from an installer It will cost R1000 000 to install the machine The weighted average cost of capital (WACC) of the company is 13% and inflation is 7% The financial manager of the firm e-mailed you the following All our projects are evaluated to take inflation and risk into account For inflation, we first adjust the WACC by means of the real rate of return approach Thereafter, an adjustment percentage is added or subtracted from the inflation adjusted WACC. according to the perceived risk of the project based on its coefficient of variation as follows CV Risk Rate adjustment to WACC 0,00 -0.24 Low -1% 0,25 - 0,40 Average 0% 0.40 -0.60 High 3% The cash flows of the machine have been estimated as follows Cash flows Machine (R000's) Purchase price 3000 Sales generated per year 2000 Vanable costs associated 50% of sales Fixed costs associated with the machine 200 Increase in net operating working capital 500 Economic ifespan 5 years Residual value at end of economic life 1500 Hint The values above should be used for determining relevant cash flows and the values below for calculating the CV The sales generated per year were determined as follows Machine Cash flow 1500 2000 3500 Probability 03 06 01 FIN4801 JANUARY/FEBRUARY 2019 Required: Determine the net present value of the machine and comment on the financial acceptability thereof Also, discuss the risk involved and the effect of inflation on the expected profitability of the machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts