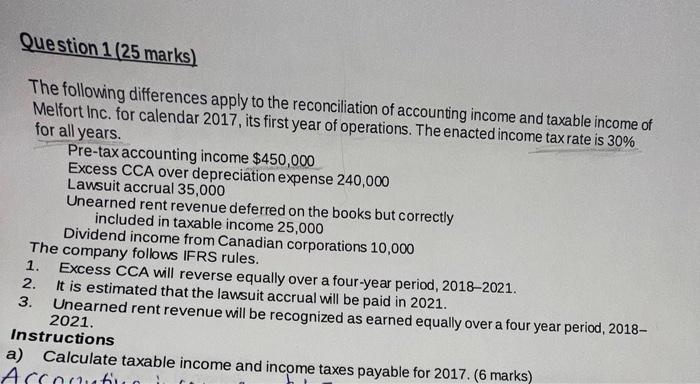

Question: Question 1 (25 marks) The following differences apply to the reconciliation of accounting income and taxable income of Melfort Inc. for calendar 2017, its first

The following differences apply to the reconciliation of accounting income and taxable income of Melfort Inc. for calendar 2017, its first year of operations. The enacted income tax rate is 30% for all years. Pre-tax accounting income $450,000 Excess CCA over depreciation expense 240,000 Lawsuit accrual 35,000 Unearned rent revenue deferred on the books but correctly included in taxable income 25,000 Dividend income from Canadian corporations 10,000 The company follows IFRS rules. 1. Excess CCA will reverse equally over a four-year period, 2018-2021. 2. It is estimated that the lawsuit accrual will be paid in 2021. 3. Unearned rent revenue will be recognized as earned equally over a four year period, 20182021. Instructions a) Calculate taxable income and income taxes payable for 2017. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts