Question: Question 1 (25 marks) You are a security analyst in ABC Investment Company Limited and are asked to analyse BBA Company, an IT employment agency

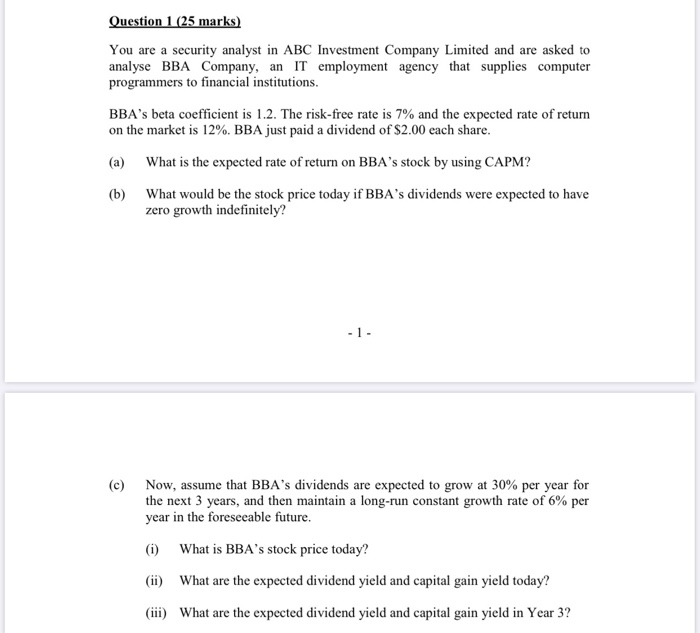

Question 1 (25 marks) You are a security analyst in ABC Investment Company Limited and are asked to analyse BBA Company, an IT employment agency that supplies computer programmers to financial institutions BBA's beta coefficient is 1.2. The risk-free rate is 7% and the expected rate of return on the market is 12%. BBA just paid a dividend of $2.00 each share (a) What is the expected rate of return on BBA's stock by using CAPM? (b) What would be the stock price today if BBA's dividends were expected to have zero growth indefinitely? -1- Now, assume that BBA's dividends are expected to grow at 30% per year for (c) the next 3 years, and then maintain a long-run constant growth rate of 6 % per year in the foreseeable future. ( What is BBA's stock price today? (ii) What are the expected dividend yield and capital gain yield today? (ii) What are the expected dividend yield and capital gain yield in Year 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts