Question: Question 1 25 points Save Answer You are considering the purchase of a common stock that just paid a dividend of $4. You expect this

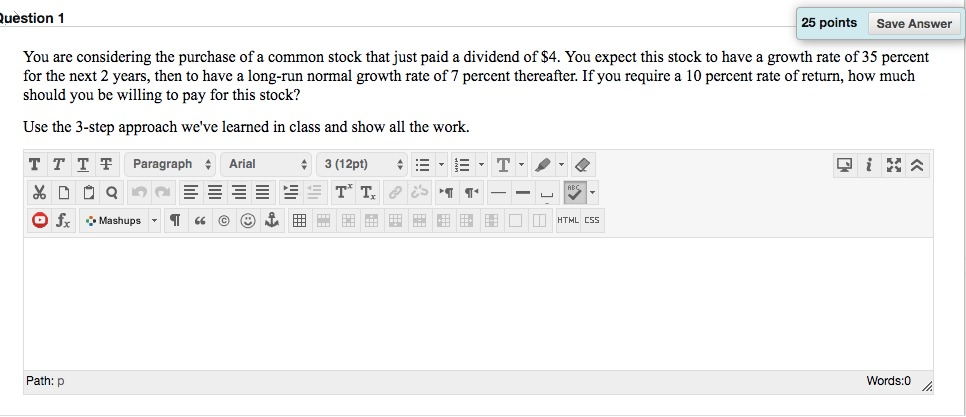

Question 1 25 points Save Answer You are considering the purchase of a common stock that just paid a dividend of $4. You expect this stock to have a growth rate of 35 percent for the next 2 years, then to have a long-run normal growth rate of 7 percent thereafter. If you require a 10 percent rate of return, how much should you be willing to pay for this stock? Use the 3-step approach we've learned in class and show all the work. TTTF Paragraph - Arial 3 (12pt) - E-T- Fx Mashups - 16 2E EEEE 22 - HTML css Path:p Words:0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts