Question: Question 1 (2.5 points) Use the following data for Super Hot International Technology (NYSE: SITH) to answer the following questions: questions 1-9. Interpret the ratios

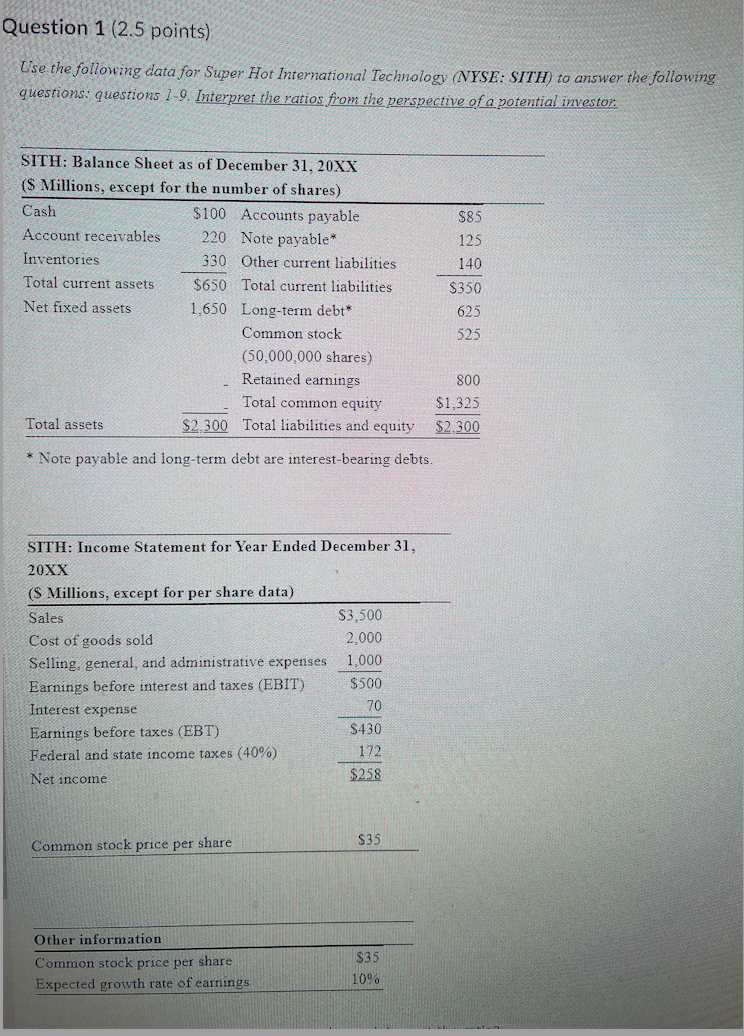

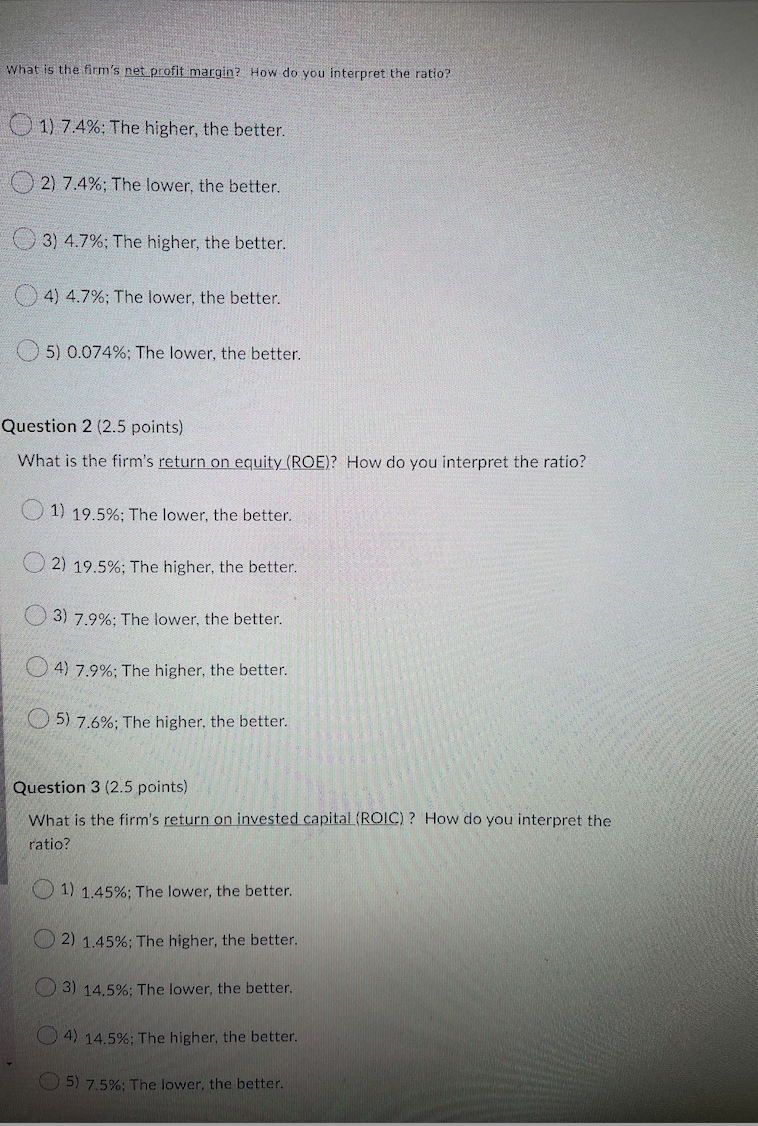

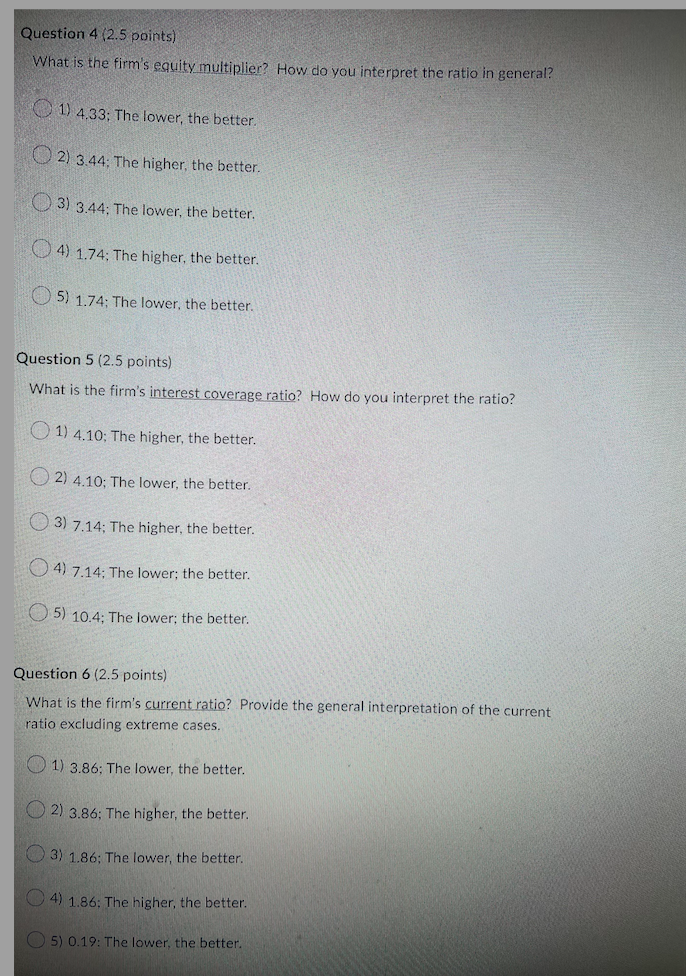

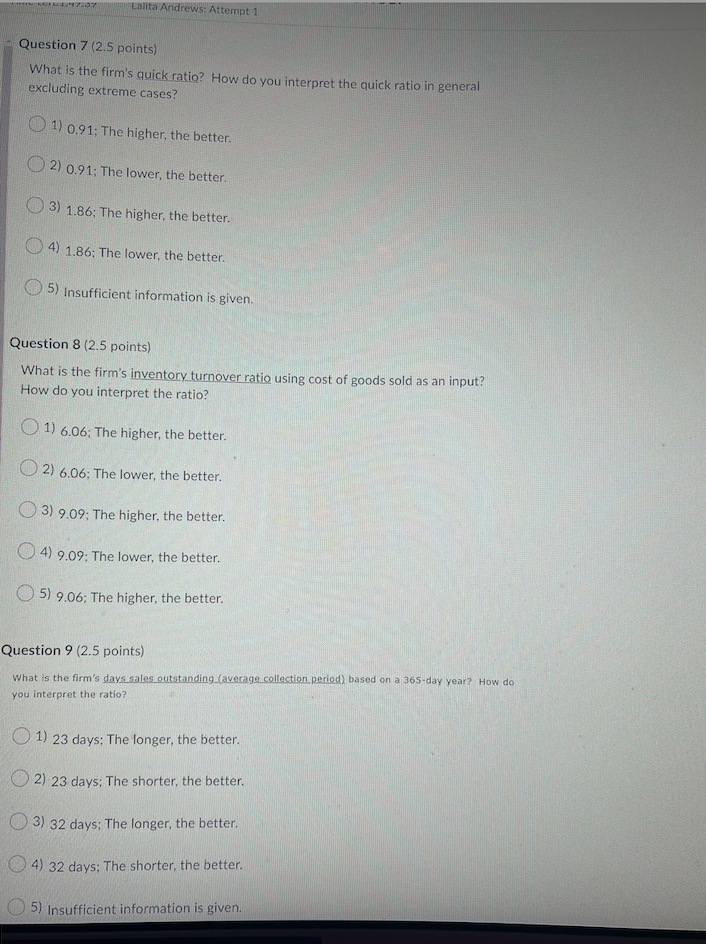

Question 1 (2.5 points) Use the following data for Super Hot International Technology (NYSE: SITH) to answer the following questions: questions 1-9. Interpret the ratios from the perspective of a potential investor. $85 125 140 SITH: Balance Sheet as of December 31, 20XX (S Millions, except for the number of shares) Cash $100 Accounts payable Account receivables 220 Note payable* Inventories 330 Other current liabilities Total current assets $650 Total current liabilities Net fixed assets 1.650 Long-term debt* Common stock (50,000,000 shares) Retained earnings Total common equity Total assets $2.300 Total liabilities and equity $350 625 525 800 $1,325 $2.300 * Note payable and long-term debt are interest-bearing debts. SITH: Income Statement for Year Ended December 31, 20XX ($ Millions, except for per share data) Sales S3,500 Cost of goods sold 2.000 Selling, general, and administrative expenses 1,000 Earnings before interest and taxes (EBIT) $500 Interest expense 70 Earnings before taxes (EBT) $430 Federal and state income taxes (40%) 172 Net income $258 $35 Common stock price per share Other information Common stock price per share Expected growth rate of earnings $35 10% What is the firm's net profit margin? How do you interpret the ratio? 1) 7.4%; The higher, the better. 2) 7.4%; The lower, the better. 3) 4.7%; The higher, the better. 4) 4.7%; The lower, the better. 5) 0.074%; The lower, the better. Question 2 (2.5 points) What is the firm's return on equity (ROE)? How do you interpret the ratio? 1) 19.5%; The lower, the better. 2) 19.5%; The higher, the better. 3) 7.9%; The lower, the better. 4) 7.9%; The higher, the better. 5) 7.6%; The higher, the better. Question 3 (2.5 points) What is the firm's return on invested capital (ROIC)? How do you interpret the ratio? 1) 1.45%; The lower, the better. 2) 1.45%; The higher, the better. 3) 14,5%; The lower the better. 4) 14.5%; The higher, the better. 5) 7.5%; The lower, the better. Question 4 (2.5 points) What is the firm's equity multiplier? How do you interpret the ratio in general? 1) 4.33: The lower the better 2) 3.44: The higher, the better. 3) 3.44: The lower the better. 4) 1.74; The higher, the better. 5) 1.74; The lower the better. Question 5 (2.5 points) What is the firm's interest coverage ratio? How do you interpret the ratio? 1) 4.10; The higher, the better. 2) 4.10: The lower the better. 3) 7.14; The higher, the better. 4) 7.14: The lower; the better. 5) 10.4: The lower the better. Question 6 (2.5 points) What is the firm's current ratio? Provide the general interpretation of the current ratio excluding extreme cases. 1) 3.86: The lower the better. 2) 3.86; The higher, the better. 3) 1.86: The lower the better. 4) 1.86: The higher, the better. 5) 0.19: The lower the better. 707 Lalita Andrews: Attempt 1 Question 7 (2.5 points) What is the firm's quick ratio? How do you interpret the quick ratio in general excluding extreme cases? 1) 0.91; The higher, the better. 2) 0.91: The lower the better. 3) 1.86; The higher the better. 4) 1.86; The lower the better. 5) Insufficient information is given. Question 8 (2.5 points) What is the firm's inventory turnover ratio using cost of goods sold as an input? How do you interpret the ratio? O 1) 6.06; The higher, the better. 2) 6.06; The lower, the better. 3) 9.09; The higher, the better. 4) 9.09; The lower, the better. 5) 9.06; The higher, the better. Question 9 (2.5 points) What is the firm's days sales outstanding (average collection period) based on a 365-day year? How do you interpret the ratio? 1) 23 days: The longer, the better. 2) 23 days: The shorter, the better 3) 32 days; The longer, the better. 4) 32 days: The shorter, the better. 5) Insufficient information is given

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts