Question: Question 1 25 pts (CHAPTER 17) From the theory about firm's capital structure by Merton Miller and Franco Modigliani, we know that for a tax-paying

![a tax-paying firm, a larger debt amount results in [Select] annual tax](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe52a86ddfc_33566fe52a7eaa2c.jpg)

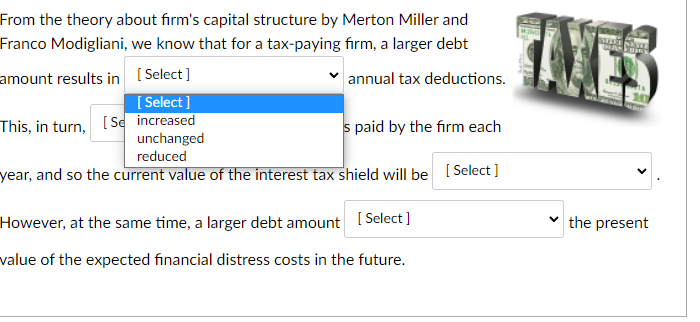

Question 1 25 pts (CHAPTER 17) From the theory about firm's capital structure by Merton Miller and Franco Modigliani, we know that for a tax-paying firm, a larger debt amount results in [Select] annual tax deductions. This, in turn, (Select] taxes paid by the firm each year, and so the current value of the interest tax shield will be [Select] However, at the same time, a larger debt amount Select] the present value of the expected financial distress costs in the future. sayar DES From the theory about firm's capital structure by Merton Miller and Franco Modigliani, we know that for a tax-paying firm, a larger debt amount results in [Select] annual tax deductions. [Select] This, in turn, (Se increased s paid by the firm each unchanged reduced year, and so the current value of the interest tax shield will be [Select ] However, at the same time, a larger debt amount [Select] the present value of the expected financial distress costs in the future. (CHAPTER 17) From the theory about firm's capital structure by Merton Miller and Franco Modigliani, we know that for a tax-paying firm, a larger debt amount results in Select] annual tax deductions. This, in turn, [Select] taxes paid by the firm each year, and so the current value of the interest tax shield will be [Select] [ Select ] However, at the same time, a larger debt amount (Select] higher unchanged value of the expected financial distress costs in the future. lower

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts