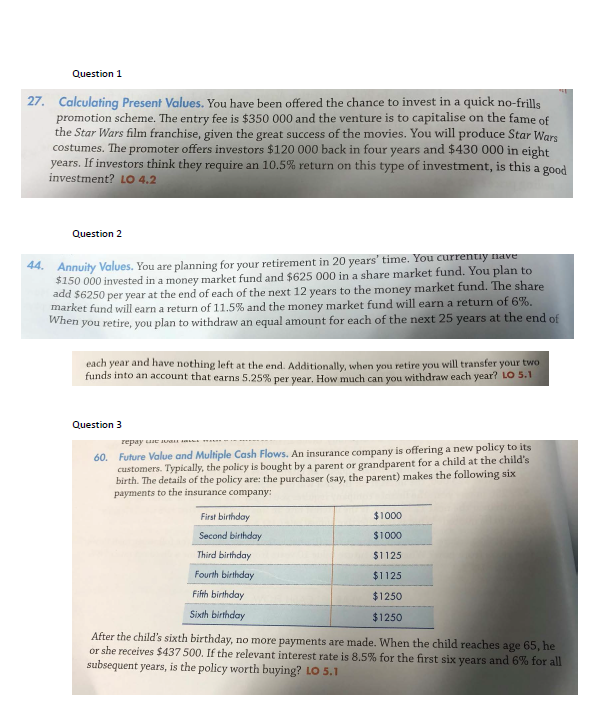

Question: Question 1 27. Calculating Present Values. You have been offered the chance to invest in a quick no-frills promotion scheme. The entry fee is $350

Question 1 27. Calculating Present Values. You have been offered the chance to invest in a quick no-frills promotion scheme. The entry fee is $350 000 and the venture is to capitalise on the fame of the Star Wars film franchise, given the great success of the movies. You will produce Star Wars costumes. The promoter offers investors $120 000 back in four years and $430 000 in eight years. If investors think they require an 10.5% return on this type of investment, is this a good investment? LO 4.2 Question 2 44. Annuity Values. You are planning for your retirement in 20 years' time. You currently nave $150 000 invested in a money market fund and $625 000 in a share market fund. You plan to add $6250 per year at the end of each of the next 12 years to the money market fund. The share market fund will earn a return of 11.5% and the money market fund will earn a return of 6%. When you retire, you plan to withdraw an equal amount for each of the next 25 years at the end of each year and have nothing left at the end. Additionally, when you retire you will transfer your two funds into an account that earns 5.25% per year. How much can you withdraw each year? LO 5.1 Question 3 repay au 60. Future Value and Multiple Cash Flows. An insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The details of the policy are: the purchaser (say, the parent) makes the following six payments to the insurance company: First birthday $1000 Second birthday $1000 Third birthday $1125 Fourth birthday $1125 Fifth birthday $1250 Sixth birthday $1250 After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $437 500. If the relevant interest rate is 8.5% for the first six years and 6% for all subsequent years, is the policy worth buying? LO 5.1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts