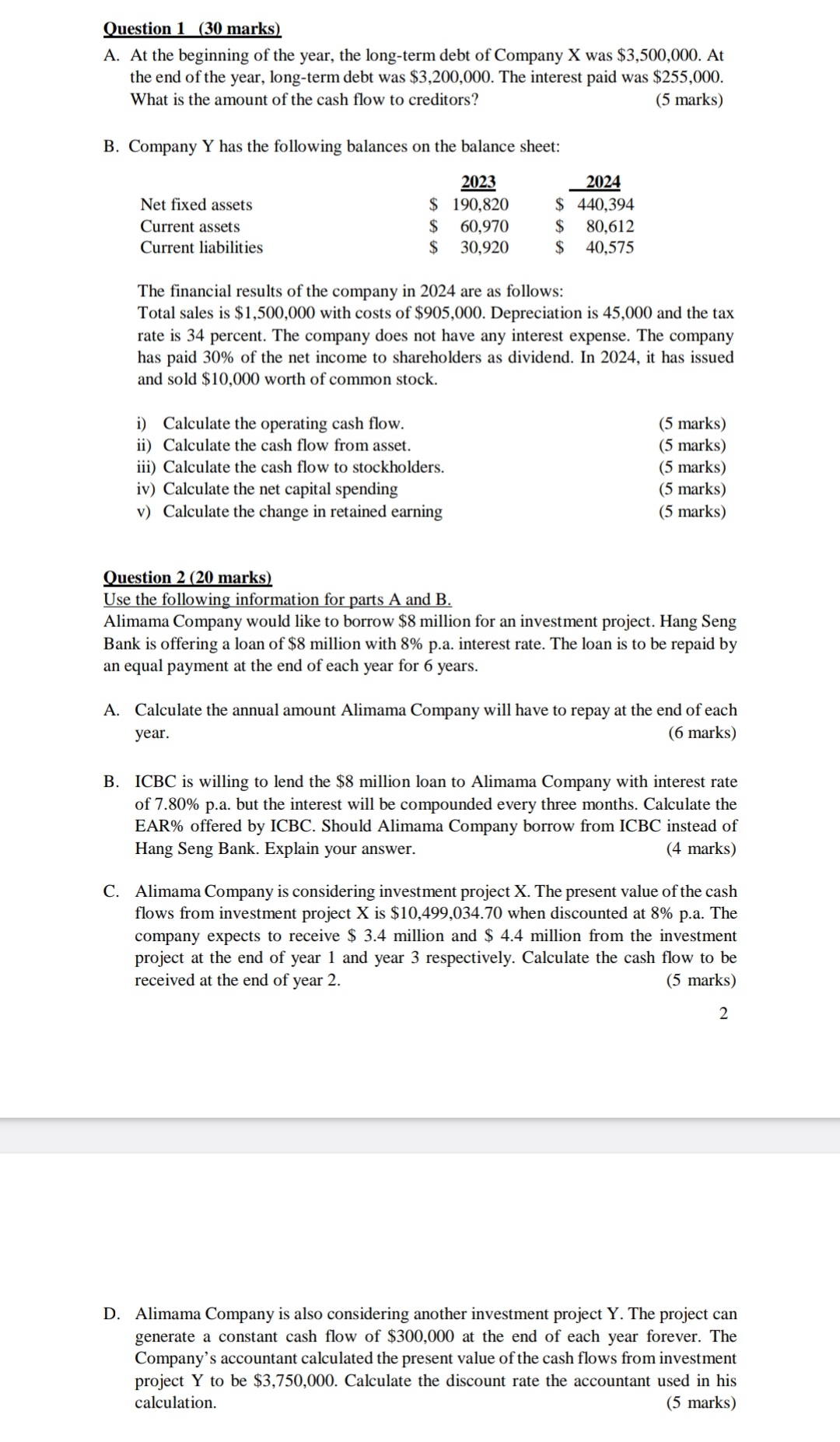

Question: Question 1 ( 3 0 marks ) A . At the beginning of the year, the long - term debt of Company x was $

Question marks

A At the beginning of the year, the longterm debt of Company was $ At

the end of the year, longterm debt was $ The interest paid was $

What is the amount of the cash flow to creditors?

marks

B Company Y has the following balances on the balance sheet:

Net fixed assets

Current assets

Current liabilities

The financial results of the company in are as follows:

Total sales is $ with costs of $ Depreciation is and the tax

rate is percent. The company does not have any interest expense. The company

has paid of the net income to shareholders as dividend. In it has issued

and sold $ worth of common stock.

i Calculate the operating cash flow.

ii Calculate the cash flow from asset.

iii Calculate the cash flow to stockholders.

iv Calculate the net capital spending

v Calculate the change in retained earning

marks

marks

marks

marks

marks

Question marks

Use the following information for parts A and B

Alimama Company would like to borrow $ million for an investment project. Hang Seng

Bank is offering a loan of $ million with pa interest rate. The loan is to be repaid by

an equal payment at the end of each year for years.

A Calculate the annual amount Alimama Company will have to repay at the end of each

year.

marks

B ICBC is willing to lend the $ million loan to Alimama Company with interest rate

of pa but the interest will be compounded every three months. Calculate the

EAR offered by ICBC. Should Alimama Company borrow from ICBC instead of

Hang Seng Bank. Explain your answer.

marks

C Alimama Company is considering investment project The present value of the cash

flows from investment project is $ when discounted at pa The

company expects to receive $ million and $ million from the investment

project at the end of year and year respectively. Calculate the cash flow to be

received at the end of year

D Alimama Company is also considering another investment project Y The project can

generate a constant cash flow of $ at the end of each year forever. The

Company's accountant calculated the present value of the cash flows from investment

project to be $ Calculate the discount rate the accountant used in his

calculation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock