Question: QUESTION 1 ( 3 0 marks ) Sihle Mamba ( 2 3 years old ) is employed as a Creative Consultant at Seamless Multimedia (

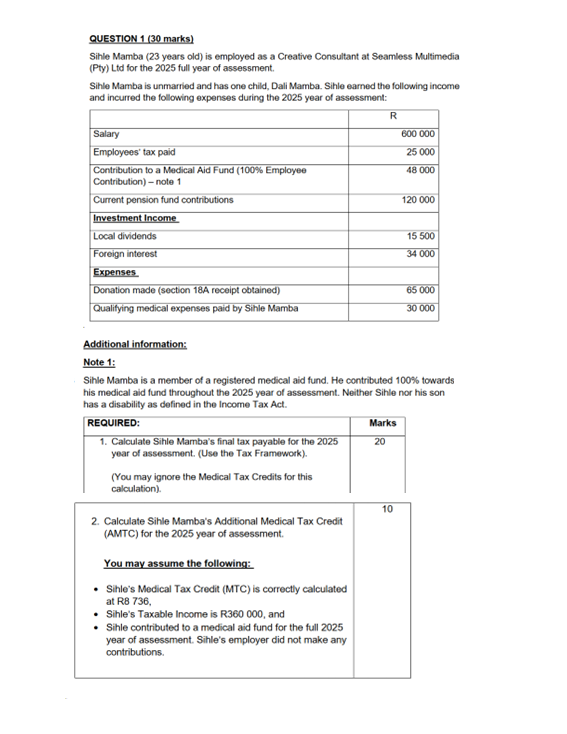

QUESTION marks Sihle Mamba years old is employed as a Creative Consultant at Seamless Multimedia Pty Ltd for the full year of assessment. Sihle Mamba is unmarried and has one child, Dali Mamba. Sihle earned the following income and incurred the following expenses during the year of assessment:Contribution to a Medical Aid Fund Employee Contribution note Additional information: Note : Sihle Mamba is a member of a registered medical aid fund. He contributed towards his medical aid fund throughout the year of assessment. Neither Sihle nor his son has a disability as defined in the Income Tax Act Calculate Sihle Mamba's final tax payable for the year of assessment. Use the Tax FrameworkYou may ignore the Medical Tax Credits for this calculation Calculate Sihle Mamba's Additional Medical Tax Credit AMTC for the year of assessment. Sihle's Medical Tax Credit MTC is correctly calculated at R Sihle's Taxable Income is R and Sihle contributed to a medical aid fund for the full year of assessment. Sihle's employer did not make any contributions.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock