Question: Question 1 ( 3 5 marks ) A financial planner tries to determine how to invest 1 million dollars for one of his clients in

Question marks

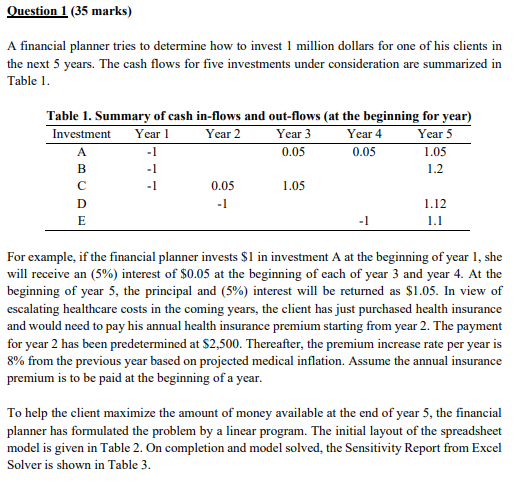

A financial planner tries to determine how to invest million dollars for one of his clients in the next years. The cash flows for five investments under consideration are summarized in Table

Table Summary of cash inflows and outflows at the beginning for year

Investment Year Year Year Year Year

A

B

C

D

E

For example, if the financial planner invests $ in investment A at the beginning of year she will receive an interest of $ at the beginning of each of year and year At the beginning of year the principal and interest will be returned as $ In view of escalating healthcare costs in the coming years, the client has just purchased health insurance and would need to pay his annual health insurance premium starting from year The payment for year has been predetermined at $ Thereafter, the premium increase rate per year is from the previous year based on projected medical inflation. Assume the annual insurance premium is to be paid at the beginning of a year. To help the client maximize the amount of money available at the end of year the financial planner has formulated the problem by a linear program. The initial layout of the spreadsheet model is given in Table On completion and model solved, the Sensitivity Report from Excel Solver is shown in Table

a What is the optimal investment plan for the next five years? marks

b What is the expected maximum amount of money available at the end of year marks

c Is there any alternative optimal plan? Explain. marks

d Apart from the last year year is there any year with excess cash left after reinvestment and payment for the annual health insurance premium? If there is how much is left? Why is money left uninvested which would imply opportunity loss? Explain. marks

e What is the impact of the change in budget currently million dollars on the maximum amount of money available at the end of year State the range of the budget in which this impact can be predicted by the given information without resolving the model. Explain. marks

f What is the impact of a increase in the current premium increase rate per year on the maximum amount of money available at the end of year Up to what limit would this impact be predictable from the sensitivity report, assuming all other factors remain unchanged? Alternatively, explain why it could not be determined. marks

g What if there is a minimum requirement of $ for each investment, if selected? How to determine an optimal investment plan with this additional requirement? You may make changes to the linear program base model in mathematical notations. The resulting model should be a linear program or integer linear program. Do NOT solve. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock