Question: QUESTION 1 ( 3 8 marks ) Food Gallore Ltd ( Food Gallore ) is a large food wholesaler and retailer which sells various food

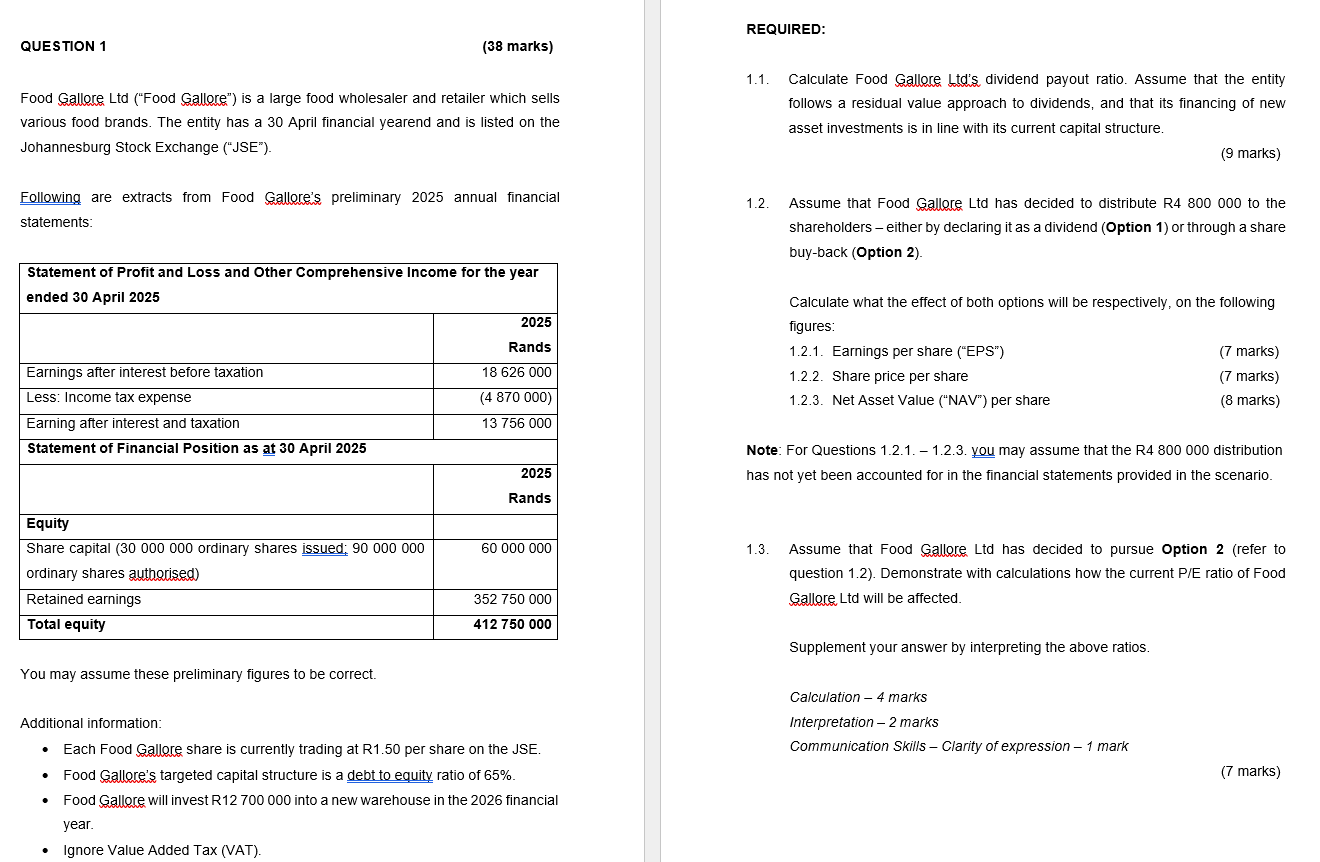

QUESTION marks Food Gallore Ltd Food Gallore is a large food wholesaler and retailer which sells various food brands. The entity has a April financial yearend and is listed on the Johannesburg Stock Exchange JSE Following are extracts from Food Gallores preliminary annual financial statements: Statement of Profit and Loss and Other Comprehensive Income for the year ended April Rands Earnings after interest before taxation Less: Income tax expense Earning after interest and taxation Statement of Financial Position as at April Rands Equity Share capital ordinary shares issued; ordinary shares authorised Retained earnings Total equity You may assume these preliminary figures to be correct. Additional information: Each Food Gallore share is currently trading at R per share on the JSE. Food Gallores targeted capital structure is a debt to equity ratio of Food Gallore will invest R into a new warehouse in the financial year. Ignore Value Added Tax VAT REQUIRED: Calculate Food Gallore Ltds dividend payout ratio. Assume that the entity follows a residual value approach to dividends, and that its financing of new asset investments is in line with its current capital structure. marks Assume that Food Gallore Ltd has decided to distribute R to the shareholders either by declaring it as a dividend Option or through a share buyback Option Calculate what the effect of both options will be respectively, on the following figures: Earnings per share EPS marks Share price per share marks Net Asset Value NAV per share marks Note: For Questions you may assume that the R distribution has not yet been accounted for in the financial statements provided in the scenario. Assume that Food Gallore Ltd has decided to pursue Option refer to question Demonstrate with calculations how the current PE ratio of Food Gallore Ltd will be affected. Supplement your answer by interpreting the above ratios. Calculation marks Interpretation marks Communication Skills Clarity of expression mark marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock