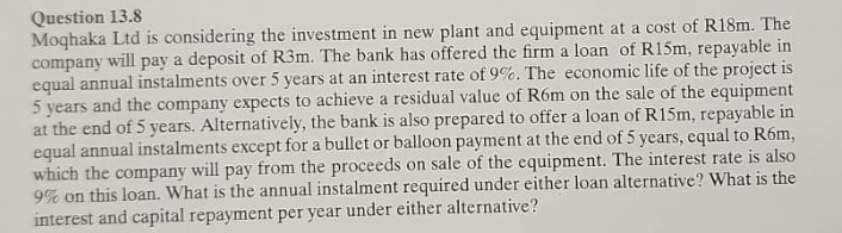

Question: Question 1 3 . 8 Moqhaka Ltd is considering the investment in new plant and equipment at a cost of R 1 8 m .

Question Moqhaka Ltd is considering the investment in new plant and equipment at a cost of Rm The company will pay a deposit of R m The bank has offered the firm a loan of R m repayable in equal annual instalments over years at an interest rate of The economic life of the project is years and the company expects to achieve a residual value of R m on the sale of the equipment at the end of years. Alternatively, the bank is also prepared to offer a loan of R m repayable in equal annual instalments except for a bullet or balloon payment at the end of years, equal to Rm which the company will pay from the proceeds on sale of the equipment. The interest rate is also on this loan. What is the annual instalment required under either loan alternative? What is the interest and capital repayment per year under either alternative?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock