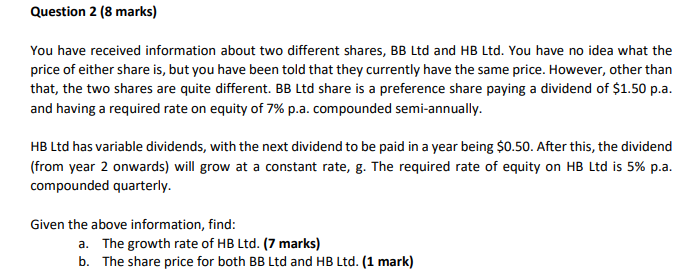

Question: Question 1 [3 marks} You have received information about two different shares, EE Ltd and HE Ltd. You have no idea what the price of

Question 1 [3 marks} You have received information about two different shares, EE Ltd and HE Ltd. You have no idea what the price of either share is, but vou have been told that they currently have the same price. However. other than that, the two shares are quite different. EE Ltd share is a preference share paving a dividend of $1.5D pa. and having a required rate on equitv of 195 p.a. compounded semi'annuallv. HE Ltd has variable dividends, with the next dividend to be paid in a vear being 50.50. After thiso the dividend [from vear 2 onwards} will grow at a constant rate. 3. The required rate of equity on HE Ltd is 595 p.a. compounded quartedv. Given the above information, find: a. The growth rate of HE Ltd. I? mark} h. The share price for both EE Ltd and HE Ltd. [1 marld

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts