Question: Question 1 (3 points) A $1,000 par value bond with 15 years to maturity has a 4.8% coupon rate with semi-annual coupon payments. If the

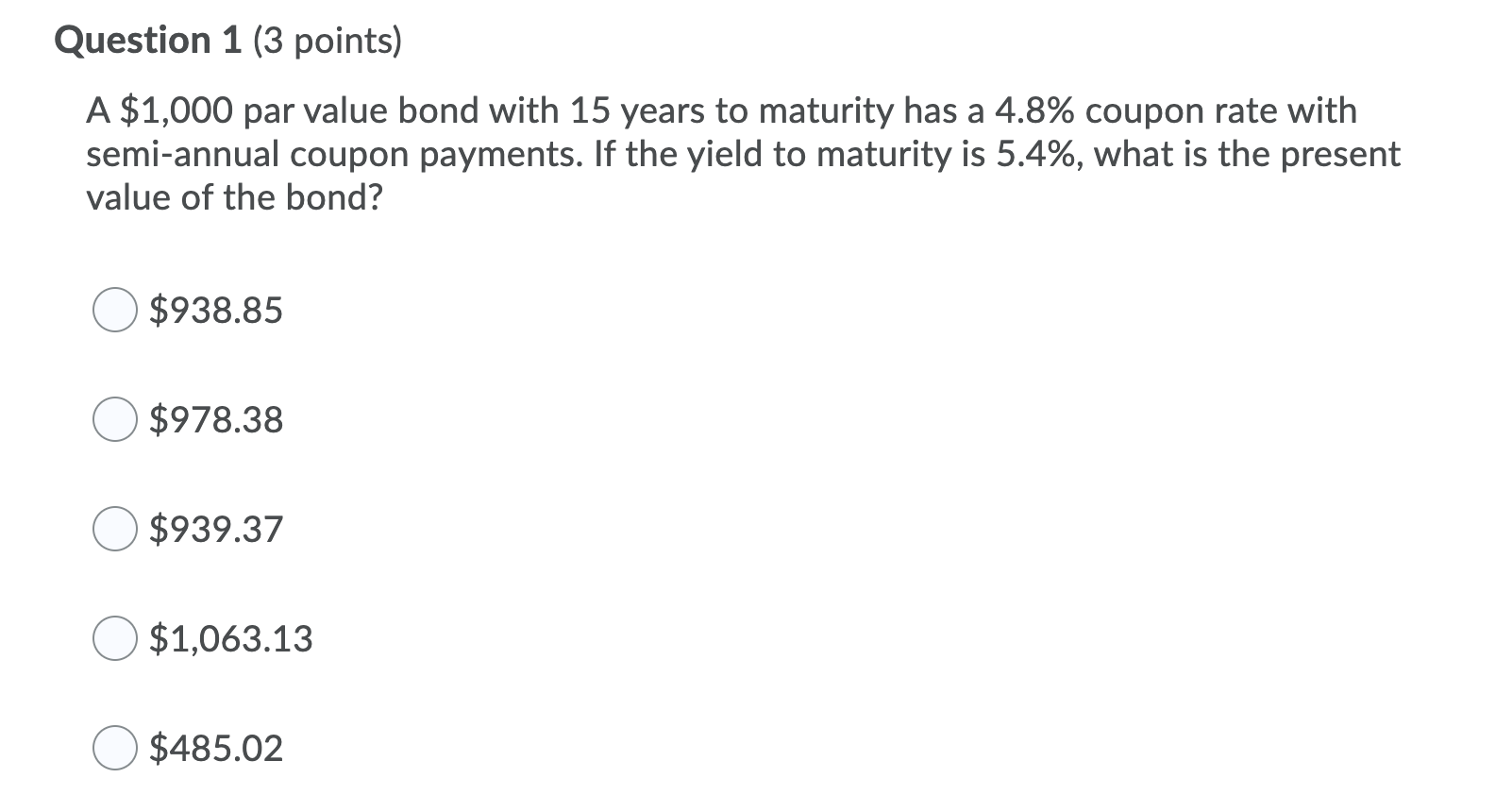

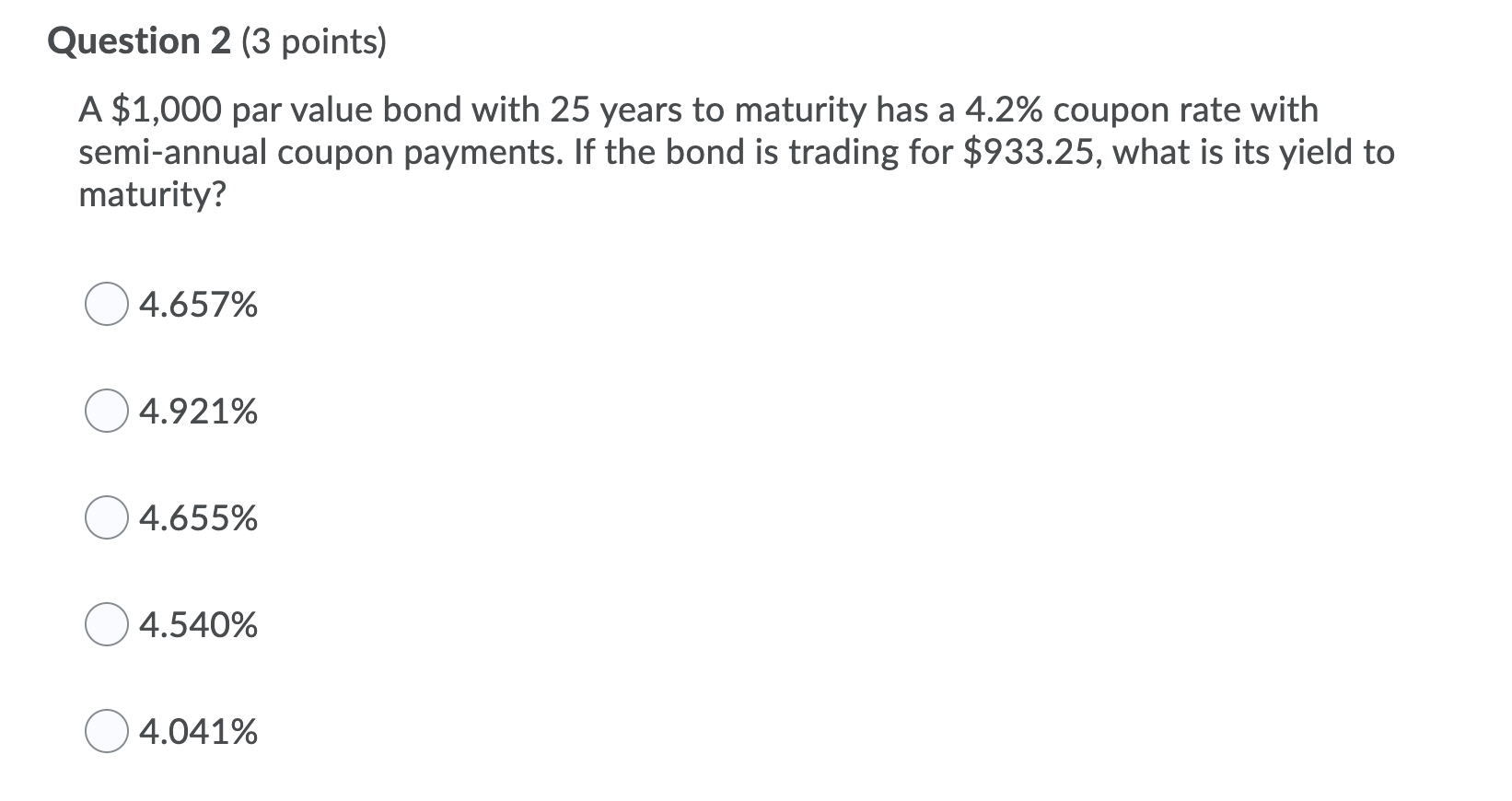

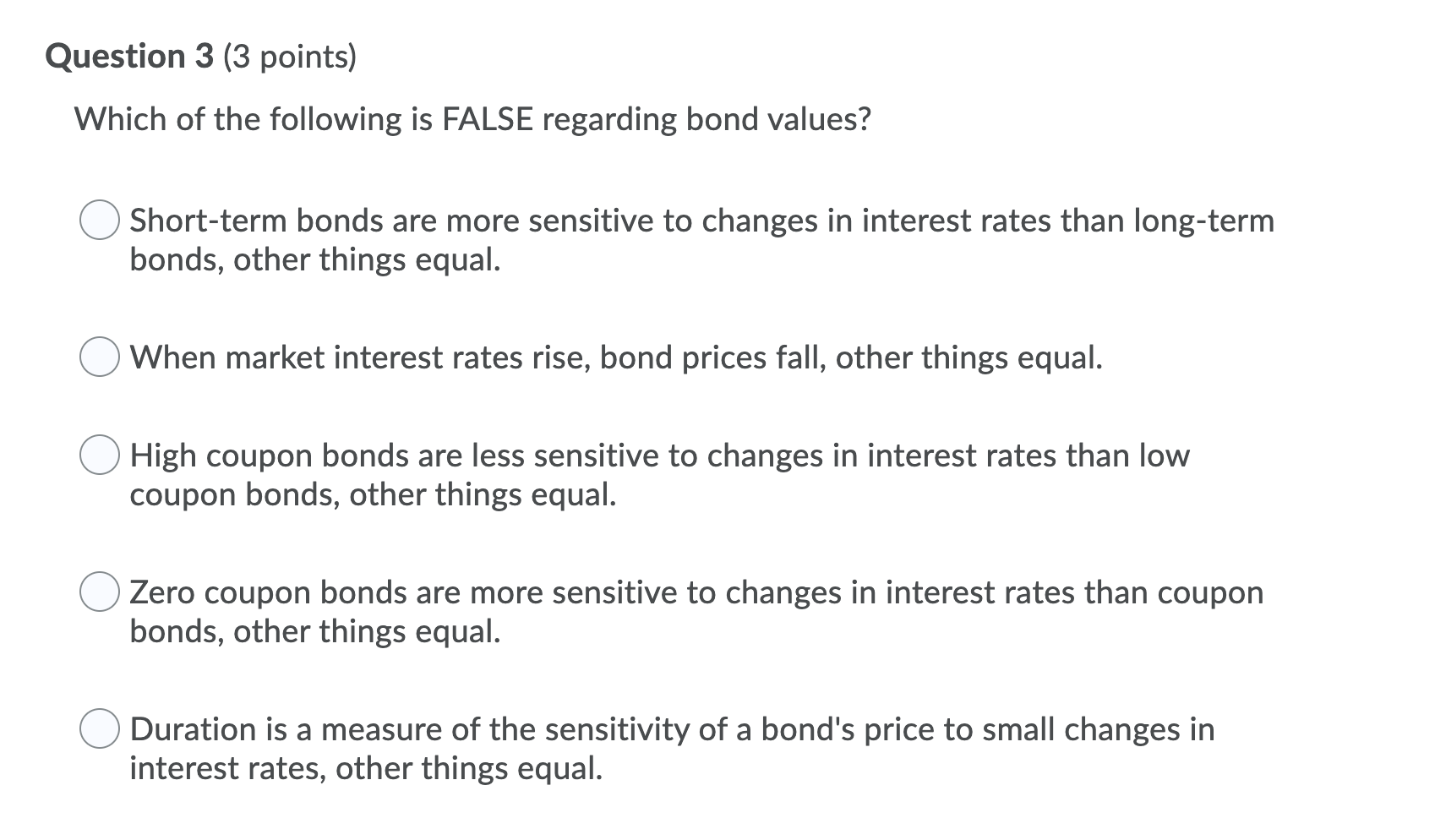

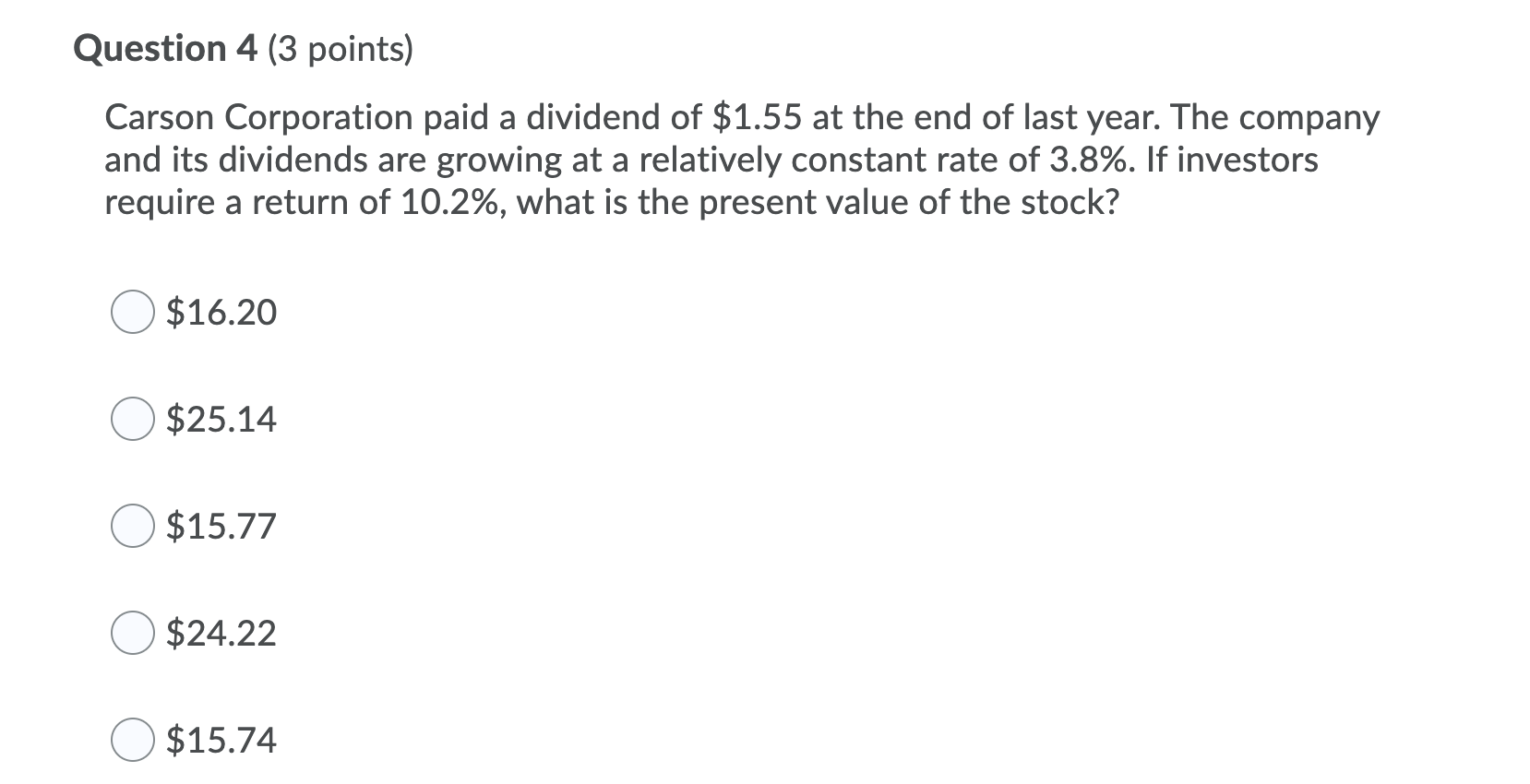

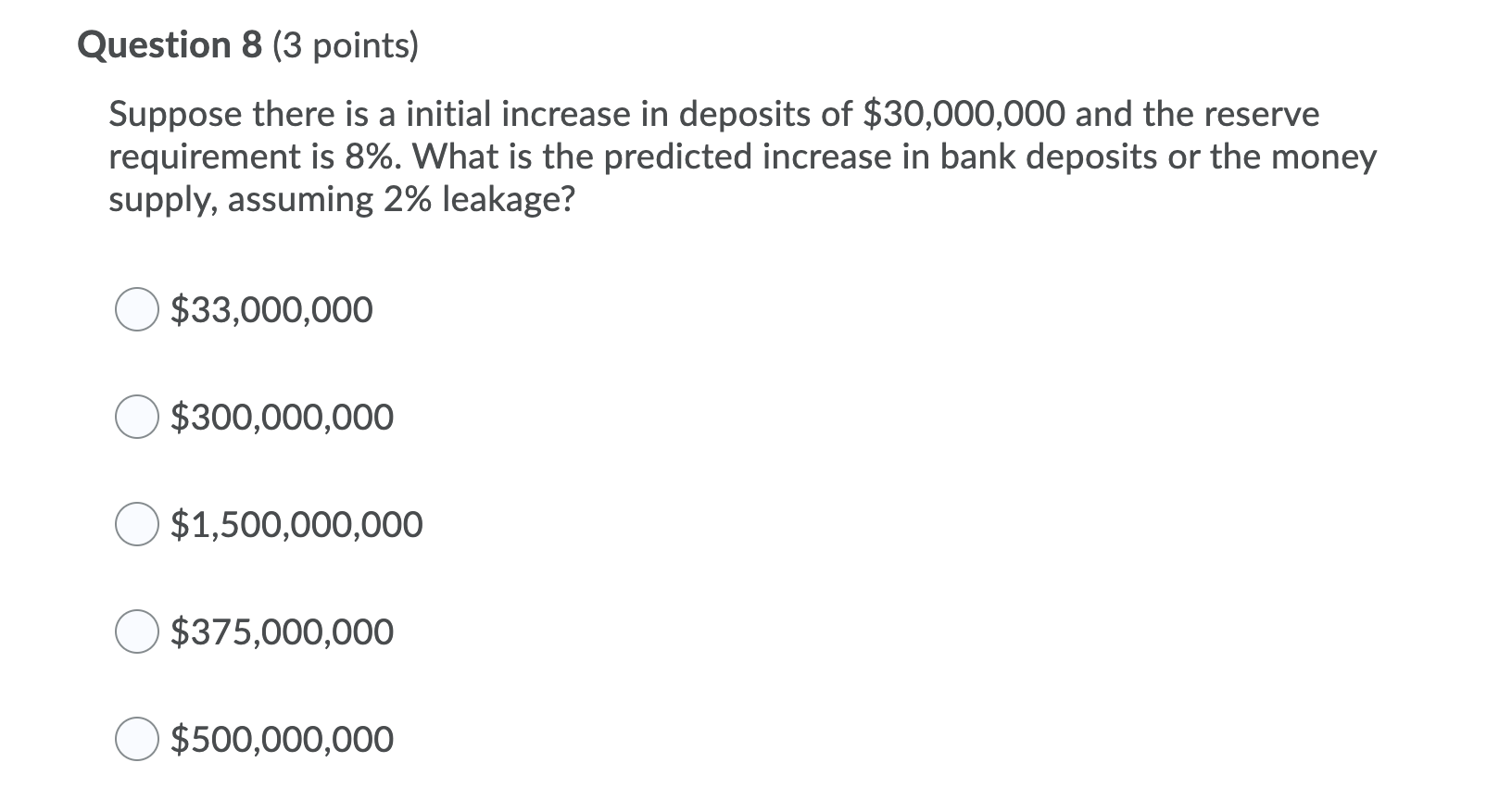

Question 1 (3 points) A $1,000 par value bond with 15 years to maturity has a 4.8% coupon rate with semi-annual coupon payments. If the yield to maturity is 5.4%, what is the present value of the bond? $938.85 $978.38 $939.37 $1,063.13 $485.02 Question 2 (3 points) A $1,000 par value bond with 25 years to maturity has a 4.2% coupon rate with semi-annual coupon payments. If the bond is trading for $933.25, what is its yield to maturity? 4.657% 4.921% 4.655% 4.540% 4.041% Question 3 (3 points) Which of the following is FALSE regarding bond values? Short-term bonds are more sensitive to changes in interest rates than long-term bonds, other things equal. When market interest rates rise, bond prices fall, other things equal. High coupon bonds are less sensitive to changes in interest rates than low coupon bonds, other things equal. Zero coupon bonds are more sensitive to changes in interest rates than coupon bonds, other things equal. Duration is a measure of the sensitivity of a bond's price to small changes in interest rates, other things equal. Question 4 (3 points) Carson Corporation paid a dividend of $1.55 at the end of last year. The company and its dividends are growing at a relatively constant rate of 3.8%. If investors require a return of 10.2%, what is the present value of the stock? $16.20 $25.14 $15.77 $24.22 $15.74 Question 8 (3 points) Suppose there is a initial increase in deposits of $30,000,000 and the reserve requirement is 8%. What is the predicted increase in bank deposits or the money supply, assuming 2% leakage? $33,000,000 $300,000,000 $1,500,000,000 $375,000,000 $500,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts