Question: Question 1 (3 points) Choose the answer. Employee regular earnings are calculated as: O regular hours times regular rate O total hours divided by regular

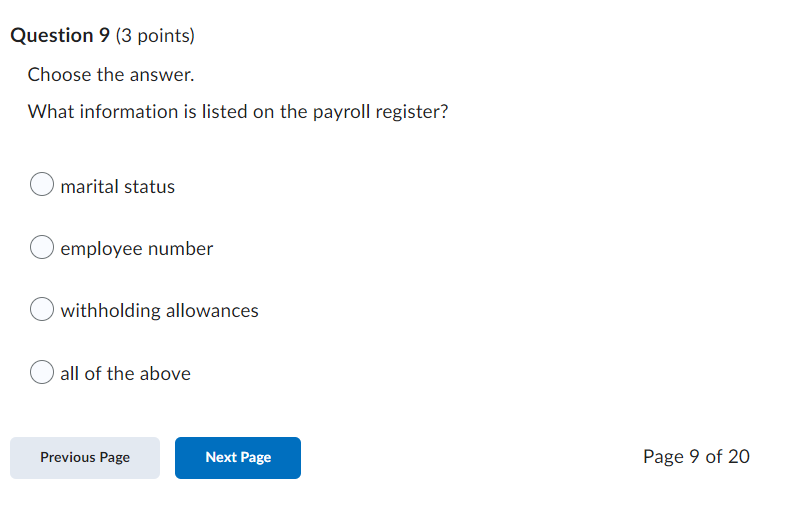

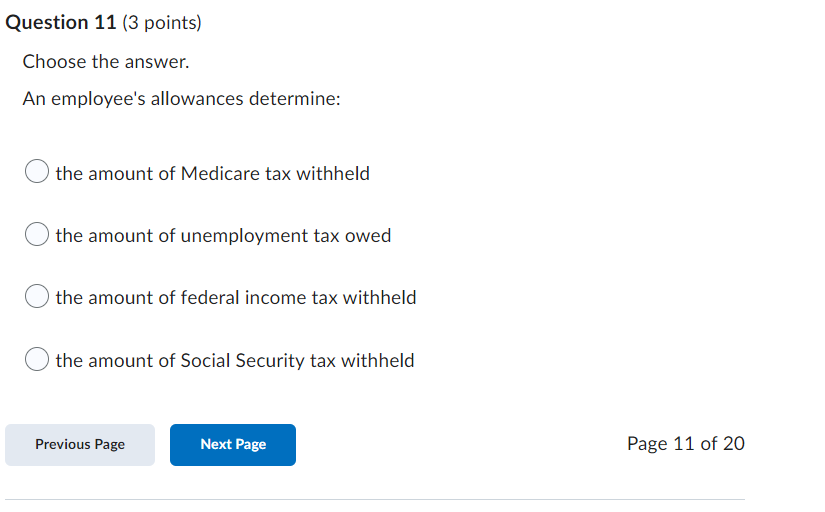

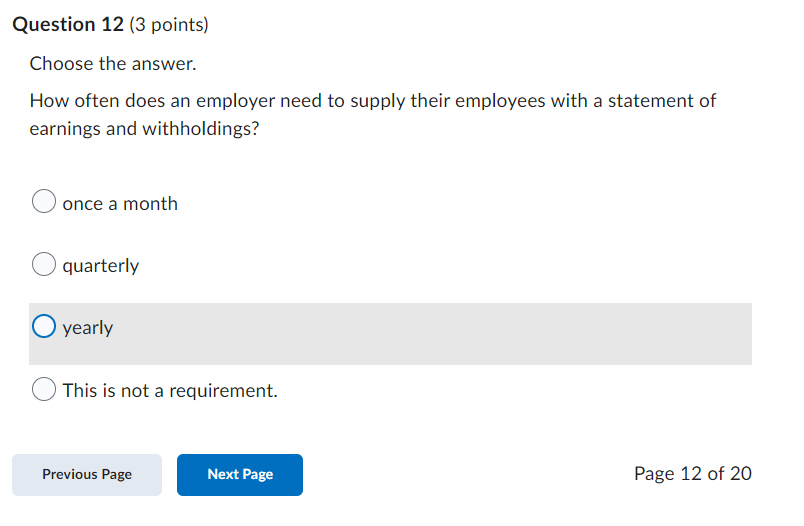

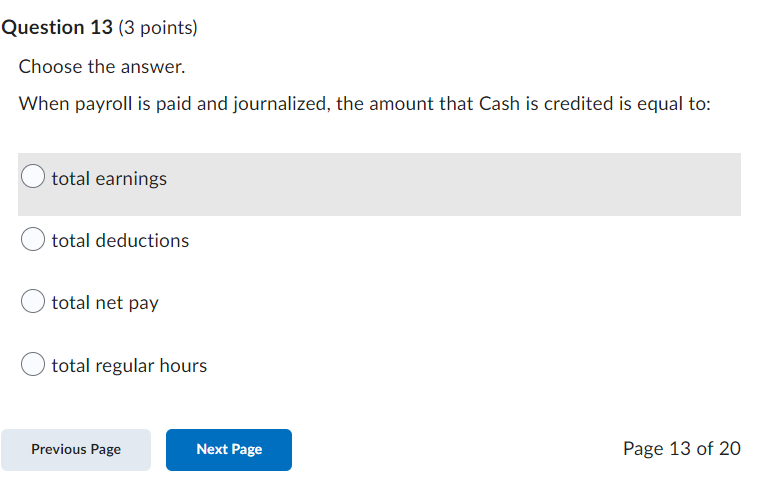

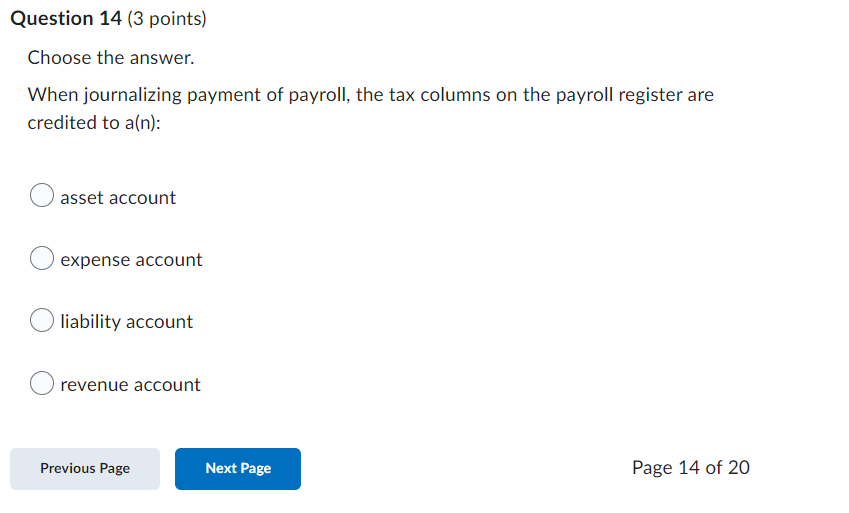

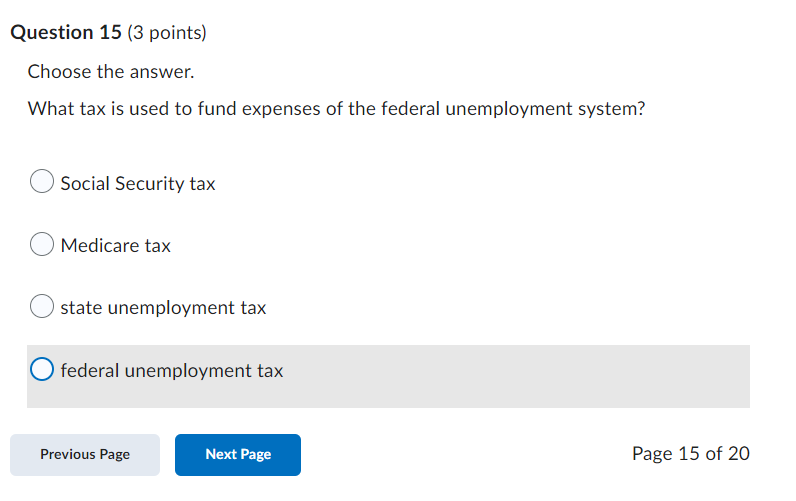

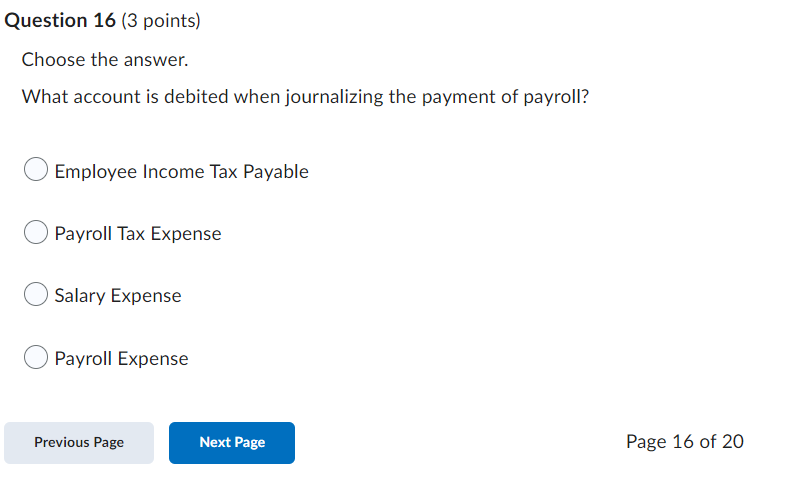

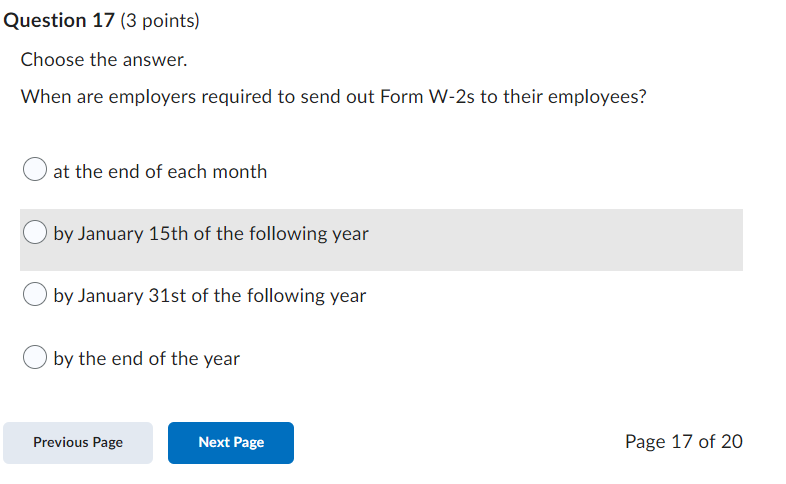

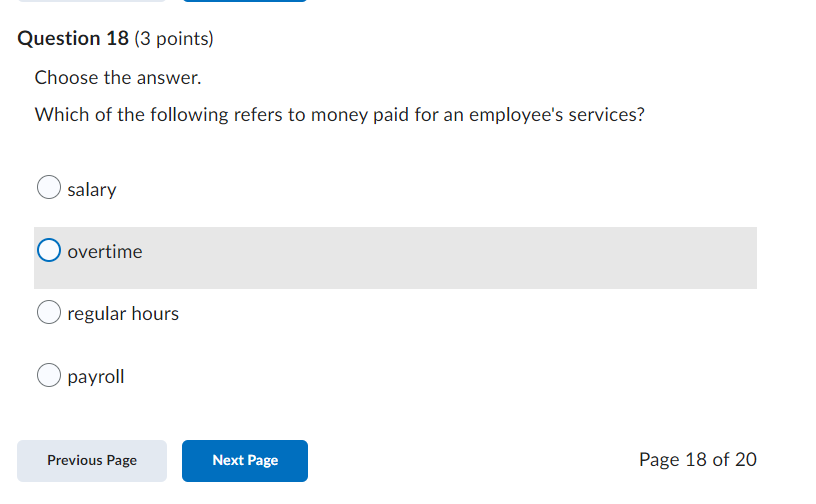

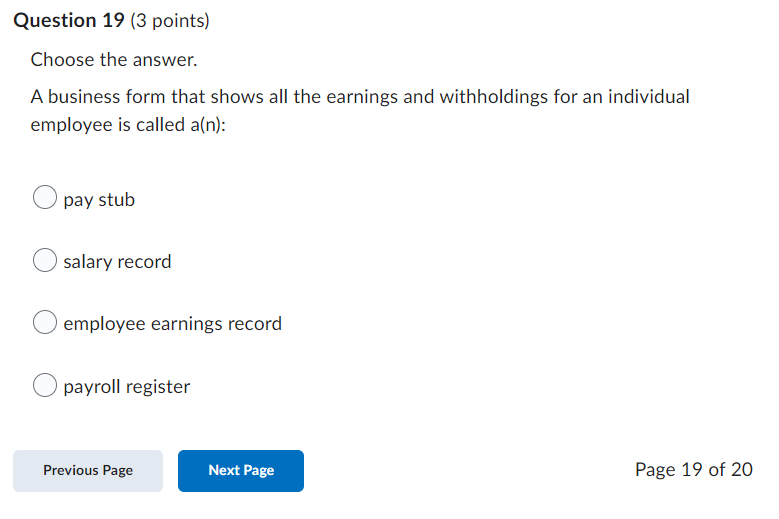

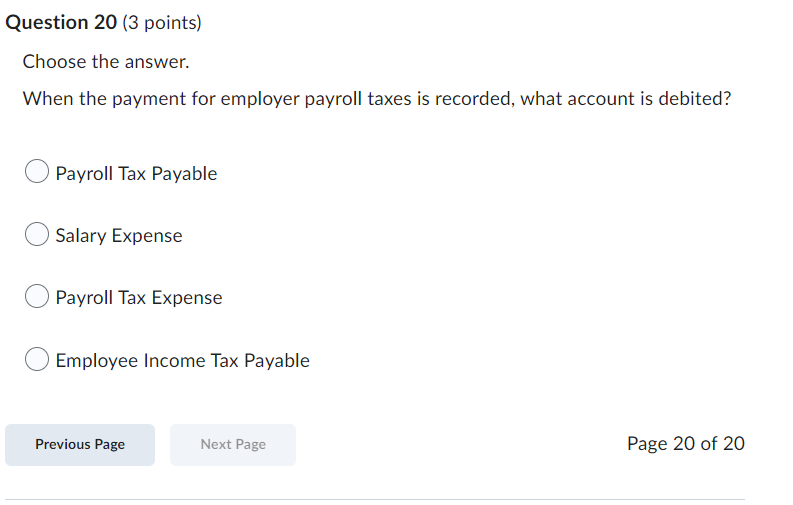

Question 1 (3 points) Choose the answer. Employee regular earnings are calculated as: O regular hours times regular rate O total hours divided by regular rate O regular hours plus overtime hours O regular and overtime hours times regular rateQuestion 2 [3 points} Cheese the answer. A federal tax paid for oldage, survive-rs, and disability insurance is called: x . . '\\_/' Social Security tax /_\\ . L) Income tax /_\\ . '\\_/' Medicare tax 0 insurance tax Previous Page Page 2 Of 20 Question 3 {3 points) Choose the answer. Which tax is required for both the employee and employer to pay? /_"\\ . kw) Medicare tax 0 Social Security tax 0 both a and b /_'\\ '\\_/' neither 3 nor b Previous Page Page 3 Of 20 Question 4 (3 points) Choose the answer. The information used to prepare payroll checks is taken from a(n): O payroll register OW-2 form O income tax withholding table O employee earnings record Previous Page Next Page Page 4 of 20Question 5 (3 points) Choose the answer. Payroll taxes are based on: the employees' total earnings net pay O the employees' regular hours worked the employees' total earnings minus insurance deductions Previous Page Next Page Page 5 of 20Question 6 (3 points) Choose the answer. If an employee works 12 hours of overtime and his or her overtime wage pays at the rate of one and a half times the regular wage of $14.00, what are the total overtime earnings? O $294 $252 O $168 O $21 Previous Page Next Page Page 6 of 20Question F [3 points} Choose the answer. Federal income tax is withheld from employee earnings: (3' only if your employer has oyer 10 employees (3' in all 50 states C} only on the first $1000 you earn (3' only if you earn more than $40,000 a year Previous Page Page 7"" Of 20 Question 8 [3 points} Choose the answer. Social Security tax and Medicare tax are calculated by: (3' subtracting deductions from total earnings (j multiplying the net pay lay the tax rate /_\\ . L) using a tax table (3' multiplying the total earnings lay the tax rate Previous Page Page 8 Of 20 Question 9 [3 points) Choose the answer. What information is listed on the payroll register? /_'\\ . kw) marital status /_\\ L) employee number /_\\ . . '\\_/' Withholding allowances {3' all of the above Previous Page Page 9 0f 20 Question 11 {3 points} Choose the answer. An employee's allowances determine: (3' the amount of Medicare tax withheld (j the amount of unemployment tax owed {j the amount of federal income tax withheld O the amount of Social Security;r tax withheld Previous Page Page 11 Of 20 Question 12 (3 points) Choose the answer. How often does an employer need to supply their employees with a statement of earnings and withholdings? O once a month O quarterly O yearly O This is not a requirement. Previous Page Next Page Page 12 of 20Question 13 {3 points} Choose the answer. When payroll is paid and journalized, the amount that Cash is credited is equal to: /_\\ , '\\_/' total earnings 0 total deductions C} total net pay /_\\ LU) total regular hours Previous Page Page 13 Of 20 Question 14 (3 points) Choose the answer. When journalizing payment of payroll, the tax columns on the payroll register are credited to a(n): O asset account O expense account O liability account O revenue account Previous Page Next Page Page 14 of 20Question 15 (3 points) Choose the answer. What tax is used to fund expenses of the federal unemployment system? Social Security tax O Medicare tax O state unemployment tax O federal unemployment tax Previous Page Next Page Page 15 of 20Question 16 {3 points} Choose the answer. What account is debited when journalizing the payment of payroll? (3' Employee Income Tax Payable (3' Payroll Tax Expense (3' Salary Expense /_'\\ '\\_/' Payroll Expense Previous Page Page 16 Of 20 Question 1? {3 points} Choose the answer. When are employers required to send out Form W-Zs to their employees? (3' at the end of each month C} by January 15th of the following year Q by January 31st of the following year Q by the end of the year Previous Page Page 1? Of 20 Question 18 (3 points) Choose the answer. Which of the following refers to money paid for an employee's services? O salary O overtime O regular hours O payroll Previous Page Next Page Page 18 of 20Question 19 (3 points) Choose the answer. A business form that shows all the earnings and withholdings for an individual employee is called a(n): O pay stub O salary record employee earnings record O payroll register Previous Page Next Page Page 19 of 20Question 20113 points} Choose the answer. When the payment for employer payroll taxes is recorded, what account is debited? 0 Payroll Tax Payable (3' Salary Expense /'_'\\ kw) Payroll Tax Expense 0 Employee Income Tax Payable Previous Page Nc-xt Page Page 20 0f 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts