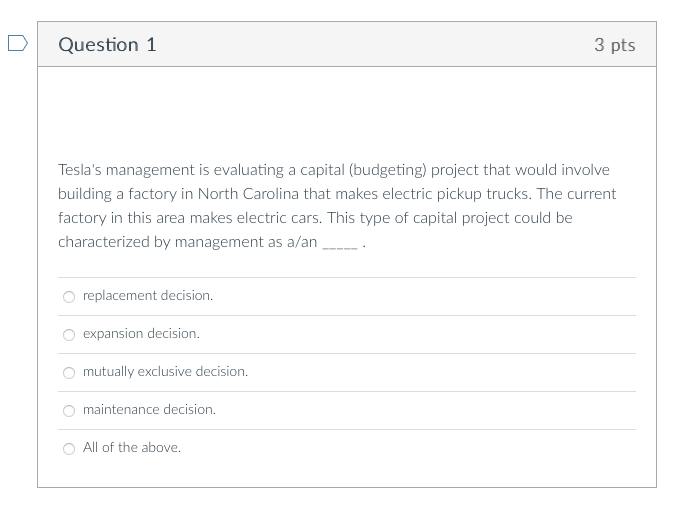

Question: Question 1 3 pts Tesla's management is evaluating a capital (budgeting) project that would involve building a factory in North Carolina that makes electric pickup

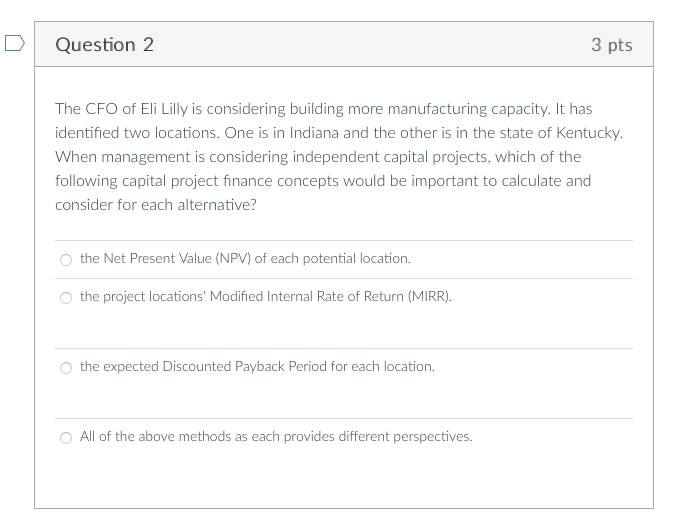

Question 1 3 pts Tesla's management is evaluating a capital (budgeting) project that would involve building a factory in North Carolina that makes electric pickup trucks. The current factory in this area makes electric cars. This type of capital project could be characterized by management as a/an replacement decision. 0 expansion decision O mutually exclusive decision. maintenance decision. All of the above. Question 2 3 pts The CFO of Eli Lilly is considering building more manufacturing capacity. It has identified two locations. One is in Indiana and the other is in the state of Kentucky. When management is considering independent capital projects, which of the following capital project finance concepts would be important to calculate and consider for each alternative? the Net Present Value (NPV) of each potential location. the project locations' Modified Internal Rate of Return (MIRR). the expected Discounted Payback Period for each location. All of the above methods as each provides different perspectives

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts