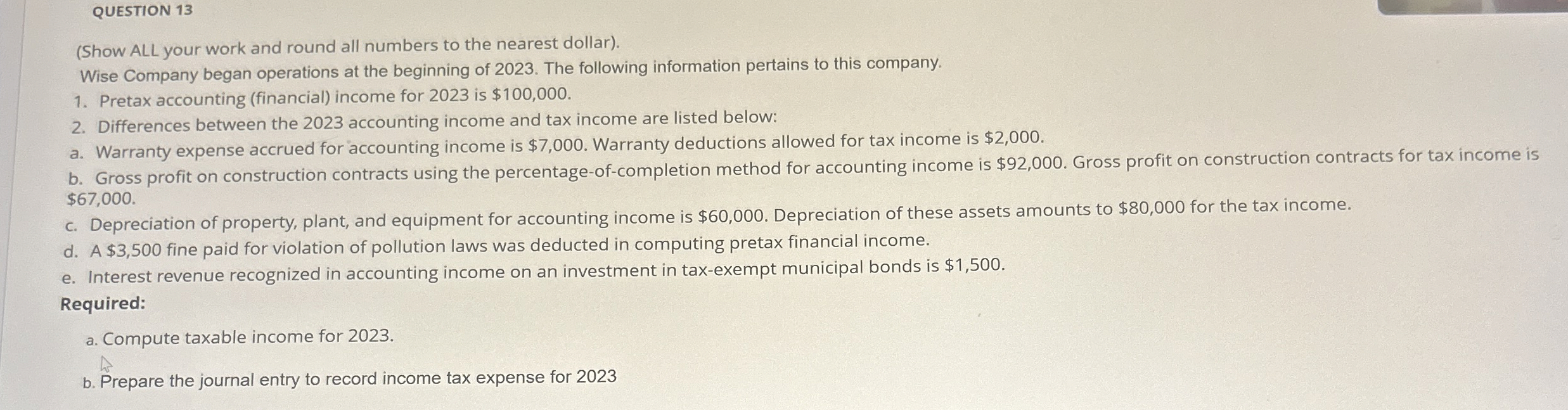

Question: QUESTION 1 3 ( Show ALL your work and round all numbers to the nearest dollar ) . Wise Company began operations at the beginning

QUESTION

Show ALL your work and round all numbers to the nearest dollar

Wise Company began operations at the beginning of The following information pertains to this company.

Pretax accounting financial income for is $

Differences between the accounting income and tax income are listed below:

a Warranty expense accrued for accounting income is $ Warranty deductions allowed for tax income is $

b Gross profit on construction contracts using the percentageofcompletion method for accounting income is $ Gross profit on construction contracts for tax income is $

c Depreciation of property, plant, and equipment for accounting income is $ Depreciation of these assets amounts to $ for the tax income.

d A $ fine paid for violation of pollution laws was deducted in computing pretax financial income.

e Interest revenue recognized in accounting income on an investment in taxexempt municipal bonds is $

Required:

a Compute taxable income for

b Prepare the journal entry to record income tax expense for

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock