Question: Question 1 (30 marks) Banks A and B based in Singapore have the following assets and liabilities (in million) in their balance sheets Bank A

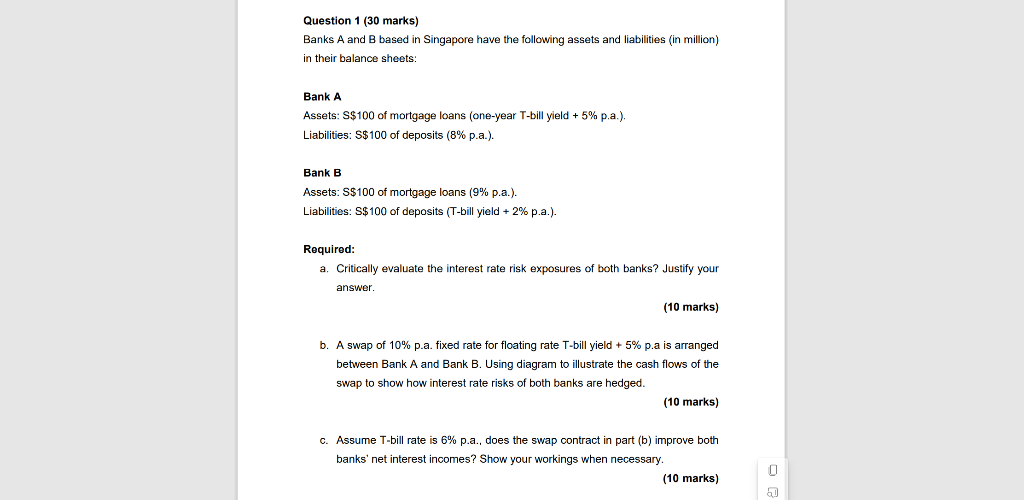

Question 1 (30 marks) Banks A and B based in Singapore have the following assets and liabilities (in million) in their balance sheets Bank A Assets: S$100 of mortgage loans (one-year T-bill yield + 5% p.a.). Liabilities: S$100 of deposits (8% p.a.). Bank B Assets: S$100 of mortgage loans (9% p.a.). Liabilities: S$100 of deposits (T-bill yield + 2% p.a.). Required: a. Critically evaluate the interest rate risk exposures of both banks? Justify your answer (10 marks) b. A swap of 10% p.a. fixed rate for floating rate T-bill yield + 5% p.a is arranged between Bank A and Bank B. Using diagram to illustrate the cash flows of the swap to show how interest rate risks of both banks are hedged. (10 marks) c. Assume T-bill rate is 6% p.a., does the swap contract in part(b) improve both banks' net interest incomes? Show your workings when necessary. (10 marks) Question 1 (30 marks) Banks A and B based in Singapore have the following assets and liabilities (in million) in their balance sheets Bank A Assets: S$100 of mortgage loans (one-year T-bill yield + 5% p.a.). Liabilities: S$100 of deposits (8% p.a.). Bank B Assets: S$100 of mortgage loans (9% p.a.). Liabilities: S$100 of deposits (T-bill yield + 2% p.a.). Required: a. Critically evaluate the interest rate risk exposures of both banks? Justify your answer (10 marks) b. A swap of 10% p.a. fixed rate for floating rate T-bill yield + 5% p.a is arranged between Bank A and Bank B. Using diagram to illustrate the cash flows of the swap to show how interest rate risks of both banks are hedged. (10 marks) c. Assume T-bill rate is 6% p.a., does the swap contract in part(b) improve both banks' net interest incomes? Show your workings when necessary. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts