Question: Question 1 (30 marks) Read the case study below and answer the questions that follow: The following financial information relates to Good Days (Pty) Ltd,

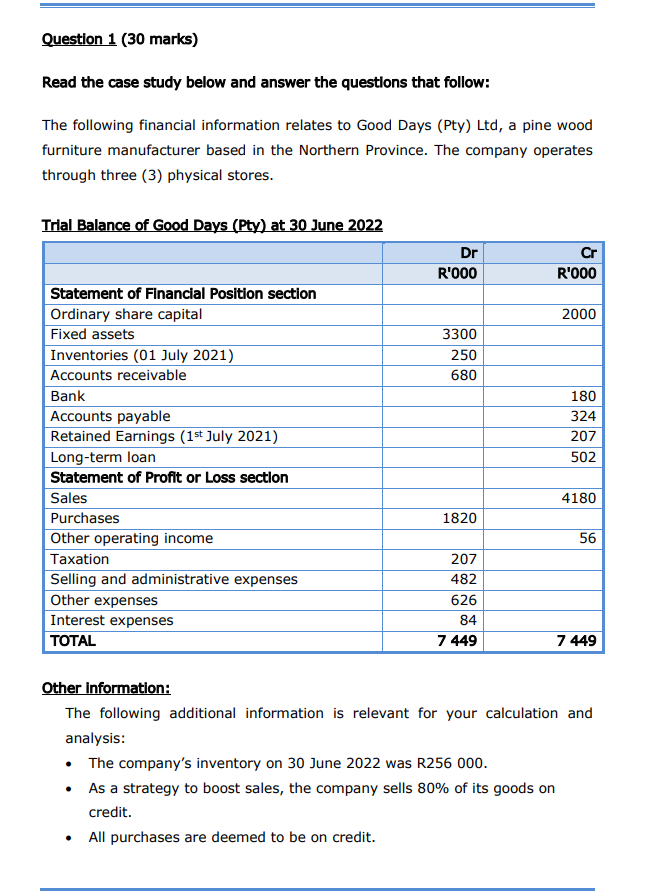

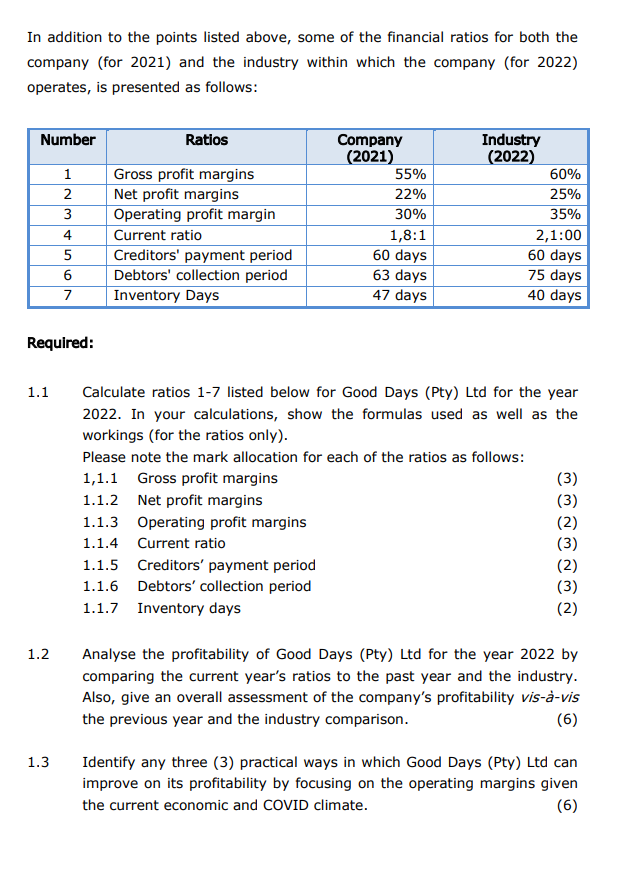

Question 1 (30 marks) Read the case study below and answer the questions that follow: The following financial information relates to Good Days (Pty) Ltd, a pine wood furniture manufacturer based in the Northern Province. The company operates through three (3) physical stores. Trial Balance of Good Days (Pty) at 30 June 2022 Other information: The following additional information is relevant for your calculation and analysis: - The company's inventory on 30 June 2022 was R256 000. - As a strategy to boost sales, the company sells 80% of its goods on credit. - All purchases are deemed to be on credit. In addition to the points listed above, some of the financial ratios for both the company (for 2021) and the industry within which the company (for 2022) operates, is presented as follows: Required: 1.1 Calculate ratios 1-7 listed below for Good Days (Pty) Ltd for the year 2022. In your calculations, show the formulas used as well as the workings (for the ratios only). Please note the mark allocation for each of the ratios as follows: 1,1.1 Gross profit margins (3) 1.1.2 Net profit margins (3) 1.1.3 Operating profit margins (2) 1.1.4 Current ratio (3) 1.1.5 Creditors' payment period (2) 1.1.6 Debtors' collection period (3) 1.1.7 Inventory days 1.2 Analyse the profitability of Good Days (Pty) Ltd for the year 2022 by comparing the current year's ratios to the past year and the industry. Also, give an overall assessment of the company's profitability vis--vis the previous year and the industry comparison. 1.3 Identify any three (3) practical ways in which Good Days (Pty) Ltd can improve on its profitability by focusing on the operating margins given the current economic and COVID climate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts