Question: Question 1 (30 marks) Suppose Pfizer and BioNTech have the following two mutually exclusive development plan for new laboratories and research centers, Project A and

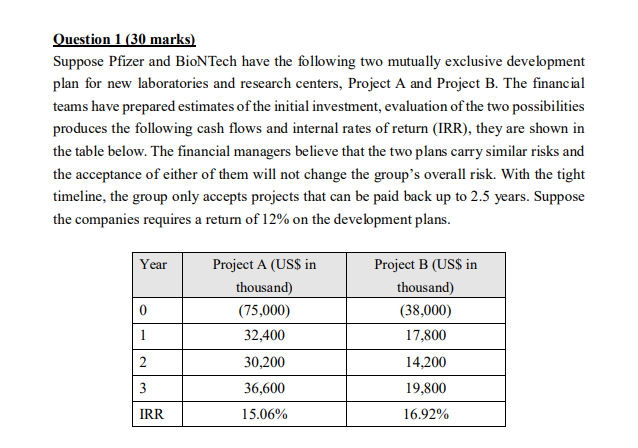

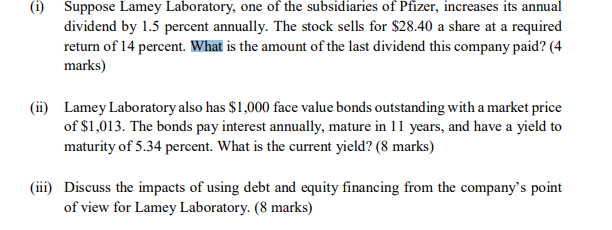

Question 1 (30 marks) Suppose Pfizer and BioNTech have the following two mutually exclusive development plan for new laboratories and research centers, Project A and Project B. The financial teams have prepared estimates of the initial investment, evaluation of the two possibilities produces the following cash flows and internal rates of return (IRR), they are shown in the table below. The financial managers believe that the two plans carry similar risks and the acceptance of either of them will not change the group's overall risk. With the tight timeline, the group only accepts projects that can be paid back up to 2.5 years. Suppose the companies requires a return of 12% on the development plans. Year 0 Project A (US$ in thousand) (75,000) 32,400 30,200 1 Project B (US$ in thousand) (38,000) 17,800 14,200 19,800 16.92% 2 3 36,600 15.06% IRR (i) Suppose Lamey Laboratory, one of the subsidiaries of Pfizer, increases its annual dividend by 1.5 percent annually. The stock sells for $28.40 a share at a required return of 14 percent. What is the amount of the last dividend this company paid? (4 marks) (i) Lamey Laboratory also has $1,000 face value bonds outstanding with a market price of $1,013. The bonds pay interest annually, mature in 11 years, and have a yield to maturity of 5.34 percent. What is the current yield? (8 marks) (ii) Discuss the impacts of using debt and equity financing from the company's point of view for Lamey Laboratory. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts