Question: Question : 1. (30% of the grade) Can you methodically decompose any business optimization problem into: i. decision variables ii. objective function iii. constraints 2.

Question:

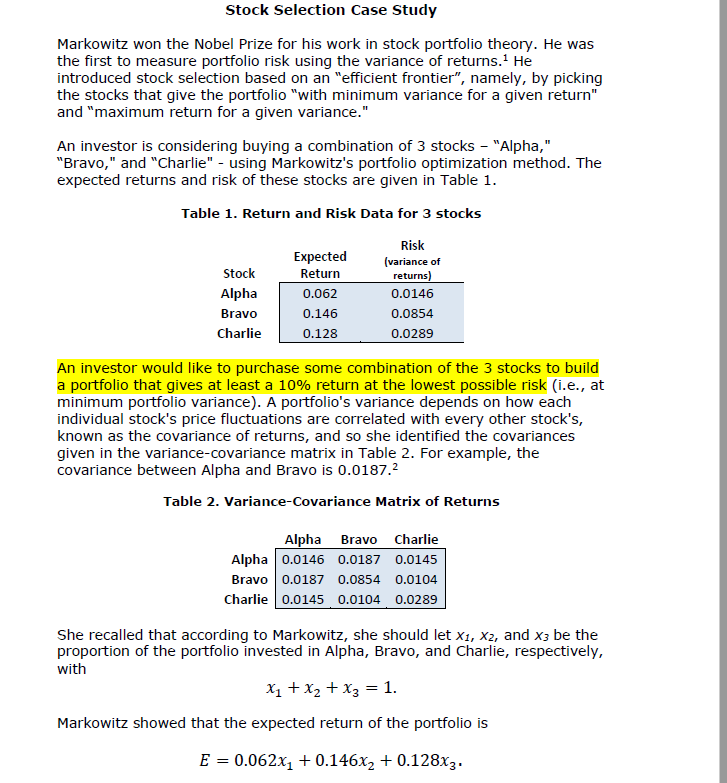

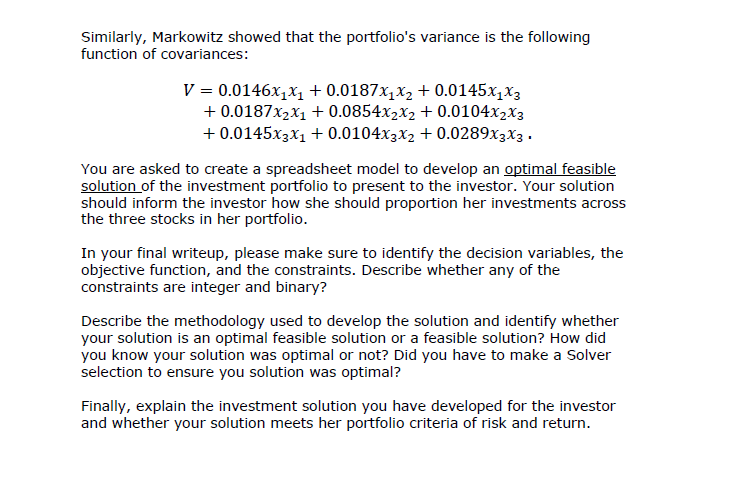

1. (30% of the grade) Can you methodically decompose any business optimization problem into: i. decision variables ii. objective function iii. constraints 2. (15% of the grade) Can you express these above three components i. verbally ii. mathematically iii. in a spreadsheet 3. (20% of the grade) How do you identify the correct type of methodology to employ to develop a solution? 4. (20% of the grade) Can you interpret the results of Excel Solver output using simple words that your clients and managers can understand?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock