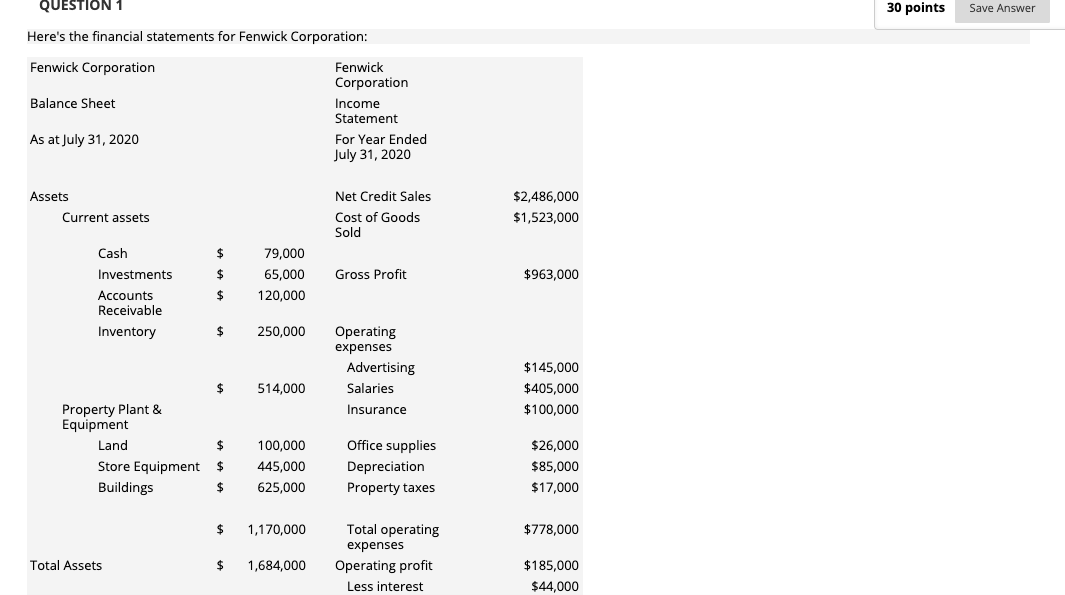

Question: QUESTION 1 30 points Save Answer Here's the financial statements for Fenwick Corporation: Fenwick Corporation Balance Sheet Fenwick Corporation Income Statement For Year Ended July

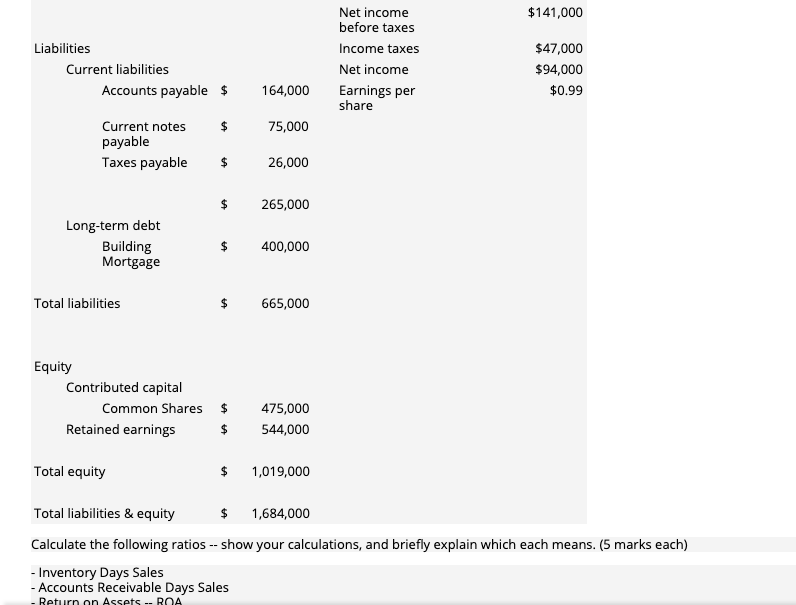

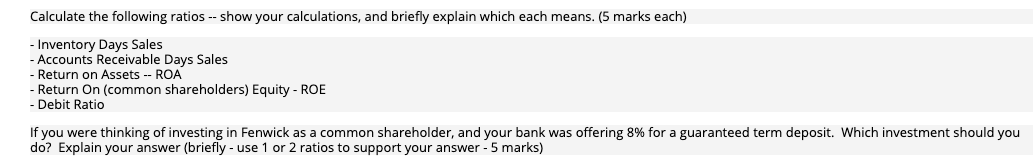

QUESTION 1 30 points Save Answer Here's the financial statements for Fenwick Corporation: Fenwick Corporation Balance Sheet Fenwick Corporation Income Statement For Year Ended July 31, 2020 As at July 31, 2020 Assets Current assets Net Credit Sales Cost of Goods Sold $2,486,000 $1,523,000 Cash $ 79,000 65,000 120,000 Gross Profit $ $ $963,000 Investments Accounts Receivable Inventory $ 250,000 Operating expenses Advertising Salaries Insurance 514,000 $145,000 $405,000 $100,000 $ Property Plant & Equipment Land $ Store Equipment $ Buildings $ 100,000 445,000 625,000 Office supplies Depreciation Property taxes $26,000 $85,000 $17,000 $ 1,170,000 $778,000 Total Assets Total operating expenses Operating profit Less interest $ 1,684,000 $185,000 $44,000 $141,000 Liabilities Current liabilities Accounts payable $ Net income before taxes Income taxes Net income Earnings per share $47,000 $94,000 $0.99 164,000 $ 75,000 Current notes payable Taxes payable $ 26,000 265,000 Long-term debt Building Mortgage 400,000 Total liabilities $ 665,000 Equity Contributed capital Common Shares Retained earnings $ 475,000 544,000 Total equity $ 1,019,000 Total liabilities & equity $ 1,684,000 Calculate the following ratios -- show your calculations, and briefly explain which each means. (5 marks each) - Inventory Days Sales - Accounts Receivable Days Sales Return on Assets -- ROA Calculate the following ratios -- show your calculations, and briefly explain which each means. (5 marks each) - Inventory Days Sales - Accounts Receivable Days Sales - Return on Assets -- ROA - Return On (common shareholders) Equity - ROE - Debit Ratio If you were thinking of investing in Fenwick as a common shareholder, and your bank was offering 8% for a guaranteed term deposit. Which investment should you do? Explain your answer (briefly - use 1 or 2 ratios to support your answer - 5 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts