Question: Question 1 (30 points total, 3 points each) Please provide the short answer word(s) for the descriptions below: What is the name for a group

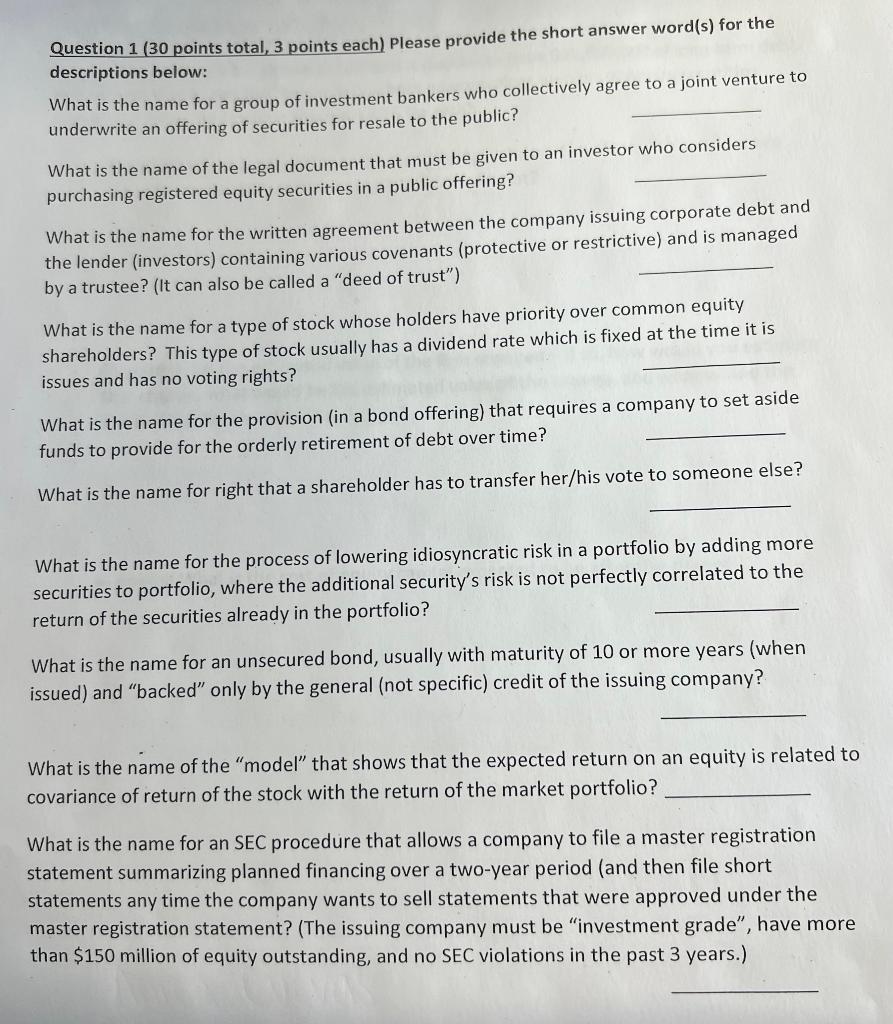

Question 1 (30 points total, 3 points each) Please provide the short answer word(s) for the descriptions below: What is the name for a group of investment bankers who collectively agree to a joint venture to underwrite an offering of securities for resale to the public? What is the name of the legal document that must be given to an investor who considers purchasing registered equity securities in a public offering? What is the name for the written agreement between the company issuing corporate debt and the lender (investors) containing various covenants (protective or restrictive) and is managed by a trustee? (It can also be called a "deed of trust") What is the name for a type of stock whose holders have priority over common equity shareholders? This type of stock usually has a dividend rate which is fixed at the time it is issues and has no voting rights? What is the name for the provision (in a bond offering) that requires a company to set aside funds to provide for the orderly retirement of debt over time? What is the name for right that a shareholder has to transfer her/his vote to someone else? What is the name for the process of lowering idiosyncratic risk in a portfolio by adding more securities to portfolio, where the additional security's risk is not perfectly correlated to the return of the securities already in the portfolio? What is the name for an unsecured bond, usually with maturity of 10 or more years (when issued) and "backed" only by the general (not specific) credit of the issuing company? What is the name of the "model" that shows that the expected return on an equity is related to covariance of return of the stock with the return of the market portfolio? What is the name for an SEC procedure that allows a company to file a master registration statement summarizing planned financing over a two-year period (and then file short statements any time the company wants to sell statements that were approved under the master registration statement? (The issuing company must be "investment grade", have more than $150 million of equity outstanding, and no SEC violations in the past 3 years.) Question 1 (30 points total, 3 points each) Please provide the short answer word(s) for the descriptions below: What is the name for a group of investment bankers who collectively agree to a joint venture to underwrite an offering of securities for resale to the public? What is the name of the legal document that must be given to an investor who considers purchasing registered equity securities in a public offering? What is the name for the written agreement between the company issuing corporate debt and the lender (investors) containing various covenants (protective or restrictive) and is managed by a trustee? (It can also be called a "deed of trust") What is the name for a type of stock whose holders have priority over common equity shareholders? This type of stock usually has a dividend rate which is fixed at the time it is issues and has no voting rights? What is the name for the provision (in a bond offering) that requires a company to set aside funds to provide for the orderly retirement of debt over time? What is the name for right that a shareholder has to transfer her/his vote to someone else? What is the name for the process of lowering idiosyncratic risk in a portfolio by adding more securities to portfolio, where the additional security's risk is not perfectly correlated to the return of the securities already in the portfolio? What is the name for an unsecured bond, usually with maturity of 10 or more years (when issued) and "backed" only by the general (not specific) credit of the issuing company? What is the name of the "model" that shows that the expected return on an equity is related to covariance of return of the stock with the return of the market portfolio? What is the name for an SEC procedure that allows a company to file a master registration statement summarizing planned financing over a two-year period (and then file short statements any time the company wants to sell statements that were approved under the master registration statement? (The issuing company must be "investment grade", have more than $150 million of equity outstanding, and no SEC violations in the past 3 years.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts