Question: Question 1 30 pts GENERAL UNDERSTANDING Indicate whether the statement is TRUE or FALSE. 1. Future cash flow to equity investors are difficult to forecast

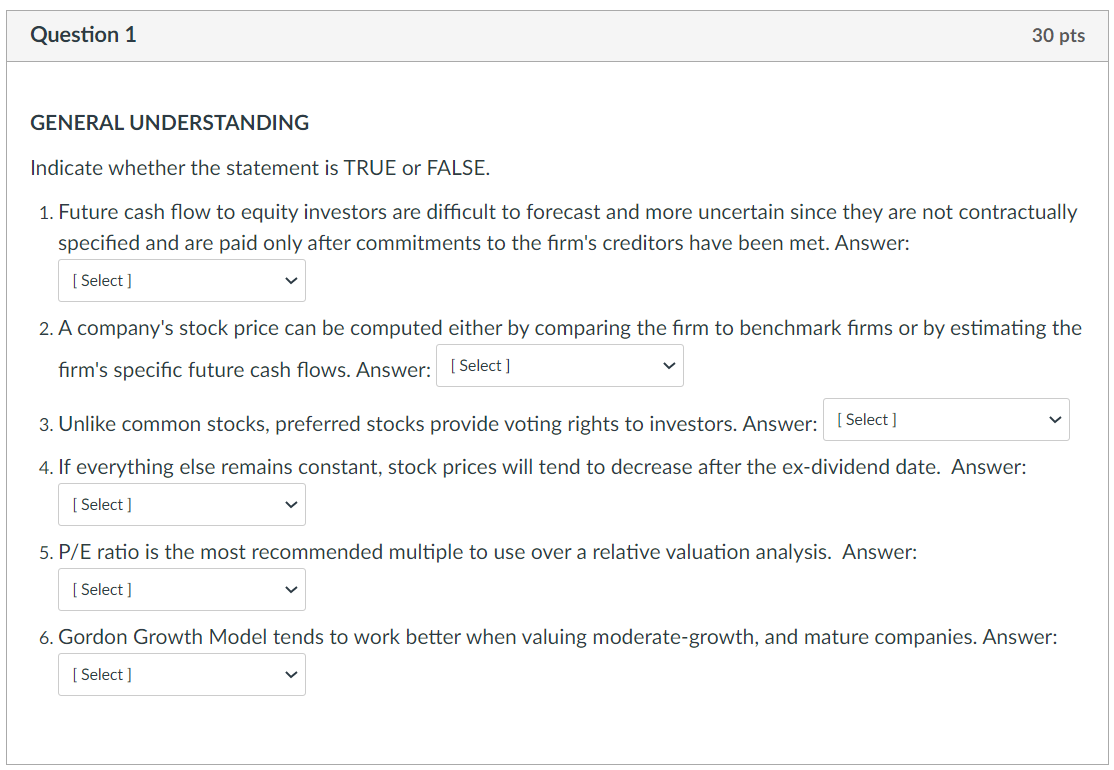

Question 1 30 pts GENERAL UNDERSTANDING Indicate whether the statement is TRUE or FALSE. 1. Future cash flow to equity investors are difficult to forecast and more uncertain since they are not contractually specified and are paid only after commitments to the firm's creditors have been met. Answer: [ Select ] 2. A company's stock price can be computed either by comparing the firm to benchmark firms or by estimating the firm's specific future cash flows. Answer: [Select] 3. Unlike common stocks, preferred stocks provide voting rights to investors. Answer: [Select] 4. If everything else remains constant, stock prices will tend to decrease after the ex-dividend date. Answer: [ Select] 5. P/E ratio is the most recommended multiple to use over a relative valuation analysis. Answer: [ Select ] 6. Gordon Growth Model tends to work better when valuing moderate-growth, and mature companies. Answer: [Select]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts