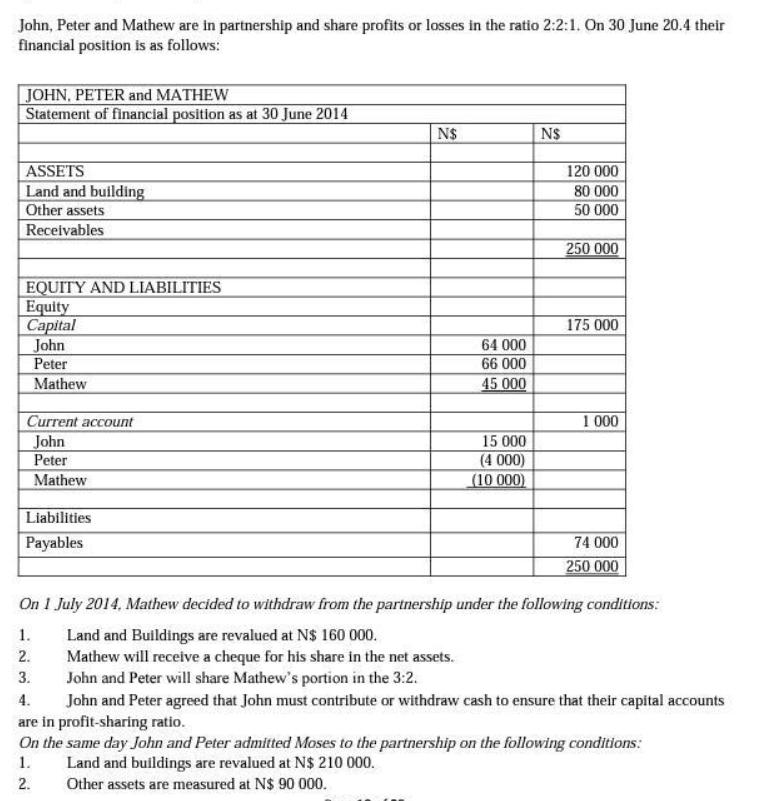

Question: John, Peter and Mathew are in partnership and share profits or losses in the ratio 2:2:1. On 30 June 20.4 their financial position is

John, Peter and Mathew are in partnership and share profits or losses in the ratio 2:2:1. On 30 June 20.4 their financial position is as follows: JOHN, PETER and MATHEW Statement of financial position as at 30 June 2014 ASSETS Land and building Other assets Receivables EQUITY AND LIABILITIES Equity Capital John Peter Mathew Current account John Peter Mathew Liabilities Payables N$ 64 000 66 000 45 000 15 000 (4 000) (10 000) N$ 120 000 80 000 50 000 250 000 175 000 1 000 74 000 250 000 On 1 July 2014. Mathew decided to withdraw from the partnership under the following conditions: 1. Land and Buildings are revalued at N$ 160 000. 2. Mathew will receive a cheque for his share in the net assets. 3. John and Peter will share Mathew's portion in the 3:2. 4. John and Peter agreed that John must contribute or withdraw cash to ensure that their capital accounts are in profit-sharing ratio. On the same day John and Peter admitted Moses to the partnership on the following conditions: 1. Land and buildings are revalued at N$ 210 000. 2. Other assets are measured at N$ 90 000. 3. Moses must contribute N$ 60 000. After the admission of Moses, the abridged statement of financial position of the new partnership is as follows: You are required to: 1.1 Determine the profit-sharing ratio among John, Peter and Moses. (6 marks) 1.2 Prepare the current accounts of the partners in the general ledger on 28 February 2013. (26 Marks)

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

11 Determine the profitsharing ratio among John Peter and Moses First we need to calculate the total value of the net assets after the revaluation of ... View full answer

Get step-by-step solutions from verified subject matter experts