Question: QUESTION 1 (35 MARKS) a) Find the future value of RM2,000 received today and deposited at 7.00 percent for four years. (3 marks) b) Your

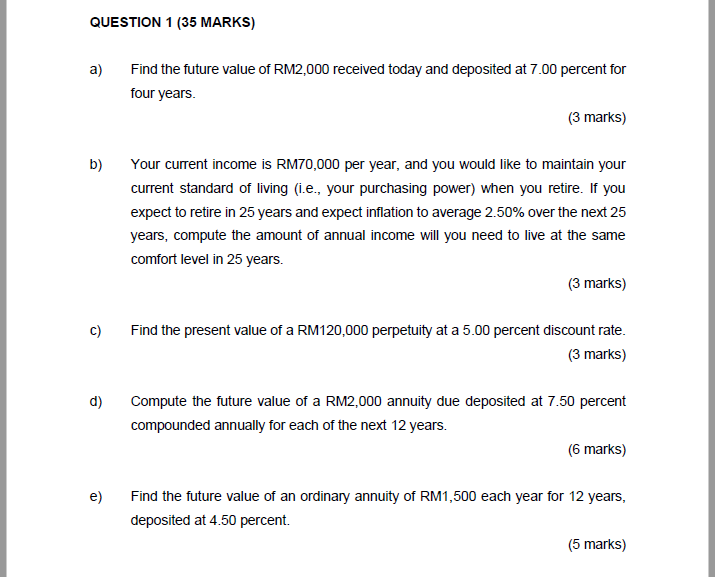

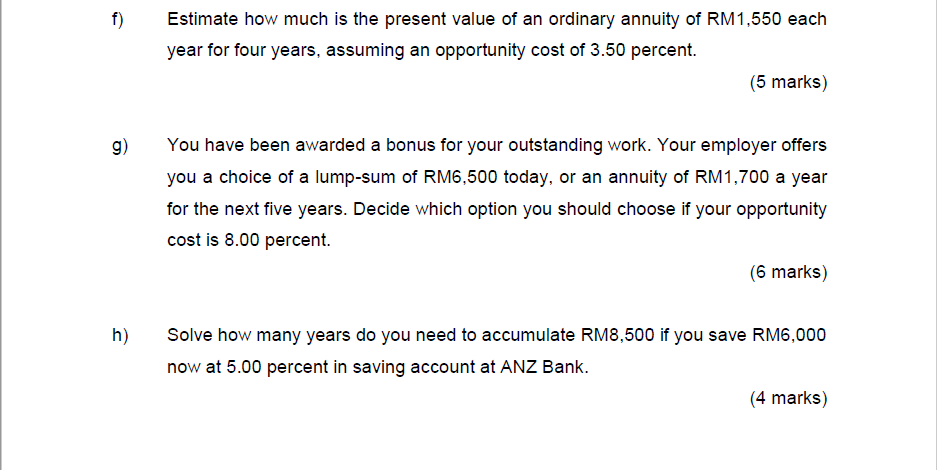

QUESTION 1 (35 MARKS) a) Find the future value of RM2,000 received today and deposited at 7.00 percent for four years. (3 marks) b) Your current income is RM70,000 per year, and you would like to maintain your current standard of living (i.e., your purchasing power) when you retire. If you expect to retire in 25 years and expect inflation to average 2.50% over the next 25 years, compute the amount of annual income will you need to live at the same comfort level in 25 years. (3 marks) c) Find the present value of a RM120,000 perpetuity at a 5.00 percent discount rate. (3 marks) d) Compute the future value of a RM2,000 annuity due deposited at 7.50 percent compounded annually for each of the next 12 years. (6 marks) e) Find the future value of an ordinary annuity of RM1,500 each year for 12 years, deposited at 4.50 percent. (5 marks) f) Estimate how much is the present value of an ordinary annuity of RM1,550 each year for four years, assuming an opportunity cost of 3.50 percent. (5 marks) g) You have been awarded a bonus for your outstanding work. Your employer offers you a choice of a lump-sum of RM6,500 today, or an annuity of RM1,700 a year for the next five years. Decide which option you should choose if your opportunity cost is 8.00 percent. (6 marks) h) Solve how many years do you need to accumulate RM8,500 if you save RM6,000 now at 5.00 percent in saving account at ANZ Bank. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts