Question: Question 1 (35 marks) You are assistant to Robert Su, the senior vice president of Ping An Insurance (Group) Company of China Ltd., responsible for

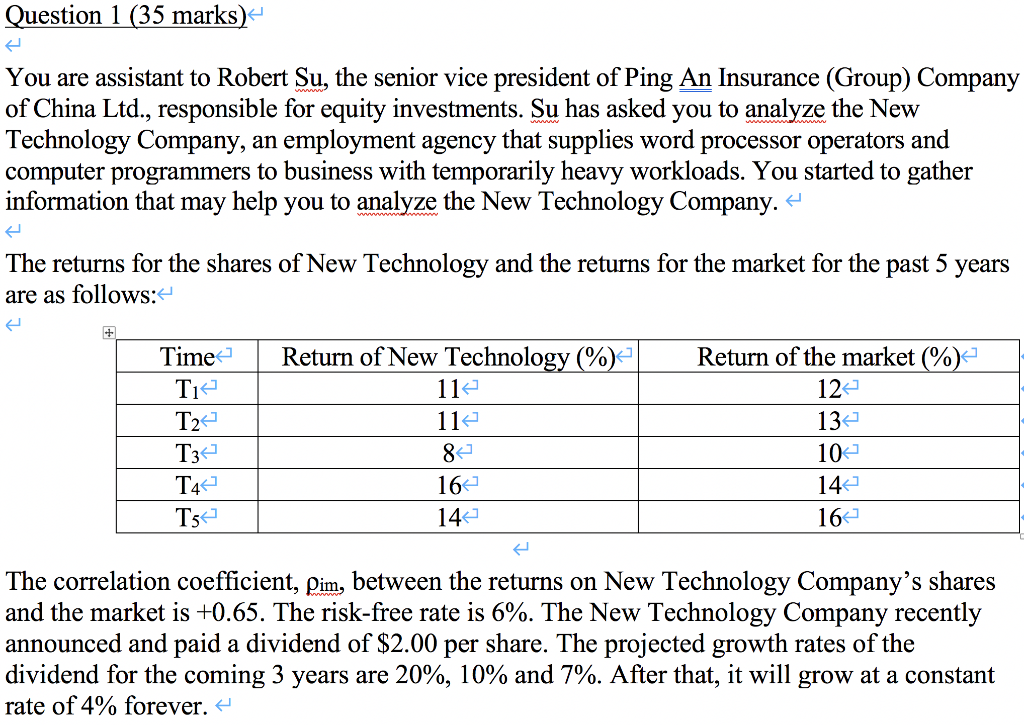

Question 1 (35 marks) You are assistant to Robert Su, the senior vice president of Ping An Insurance (Group) Company of China Ltd., responsible for equity investments. Su has asked you to analyze the New Technology Company, an employment agency that supplies word processor operators and computer programmers to business with temporarily heavy workloads. You started to gather information that may help you to analyze the New Technology Company. H The returns for the shares of New Technology and the returns for the market for the past 5 years are as follows: Time Return of the market (%) T . 12 T24 T34 T4 T5 Return of New Technology (%) 11 11 82 16 14 132 10 14 16 4 The correlation coefficient, Pim, between the returns on New Technology Company's shares and the market is +0.65. The risk-free rate is 6%. The New Technology Company recently announced and paid a dividend of $2.00 per share. The projected growth rates of the dividend for the coming 3 years are 20%, 10% and 7%. After that, it will grow at a constant rate of 4% forever. 4 Required: A Calculate the average return and standard deviation of returns for New Technology and the market. You can use the following formula to estimate the standard deviation of returns: 0 = [(rt ravg)2/(N 1)]1/2. (8 marks) a. Calculate the beta and the required return of New Technology. You can use the following formula to estimate the beta: b = Pim X (0;/0m). For a well-diversified investor, is New Technology more or less risky than the market? Explain in details. |(9 marks) Calculate the stock price. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts