Question: Question 1 (35 marks) You have been asked by your client to provide an analysis regarding the feasibility of a proposed real estate investment venture.

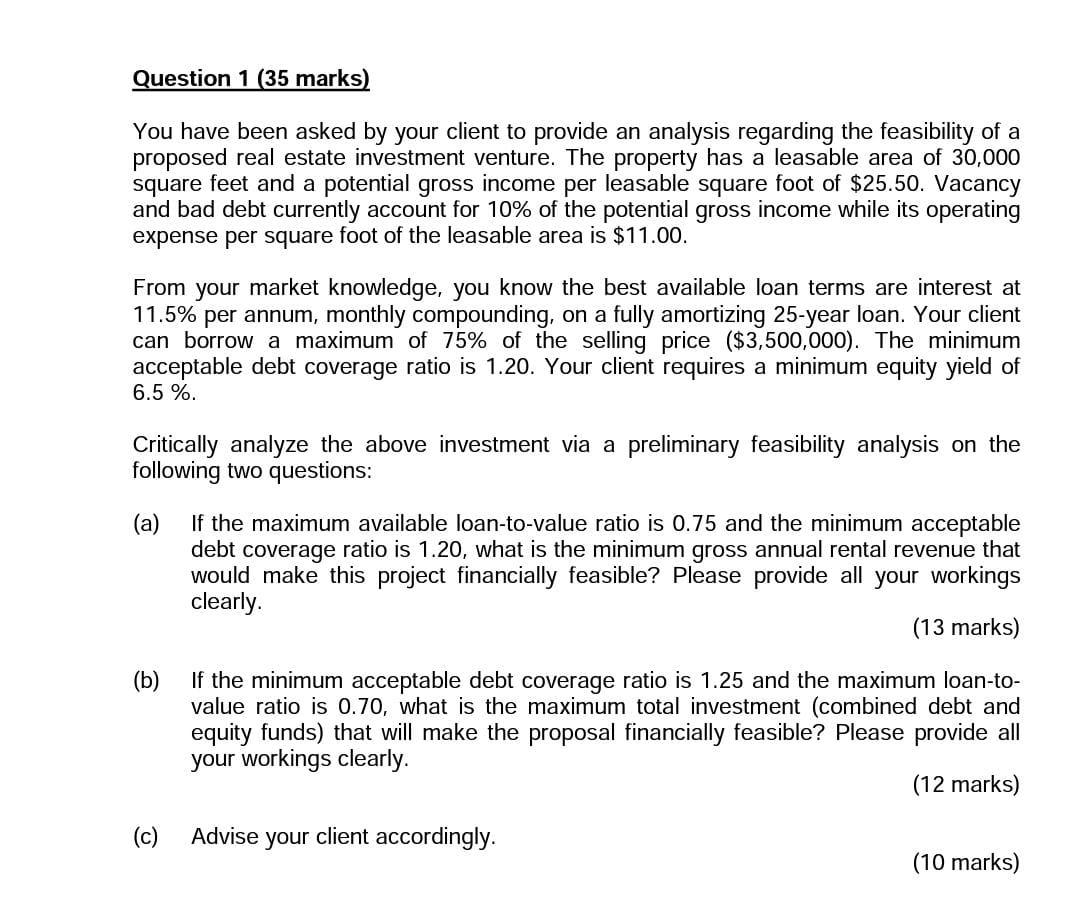

Question 1 (35 marks) You have been asked by your client to provide an analysis regarding the feasibility of a proposed real estate investment venture. The property has a leasable area of 30,000 square feet and a potential gross income per leasable square foot of $25.50. Vacancy and bad debt currently account for 10% of the potential gross income while its operating expense per square foot of the leasable area is $11.00. From your market knowledge, you know the best available loan terms are interest at 11.5% per annum, monthly compounding, on a fully amortizing 25-year loan. Your client can borrow a maximum of 75% of the selling price ($3,500,000). The minimum acceptable debt coverage ratio is 1.20. Your client requires a minimum equity yield of 6.5 %. Critically analyze the above investment via a preliminary feasibility analysis on the following two questions: (a) If the maximum available loan-to-value ratio is 0.75 and the minimum acceptable debt coverage ratio is 1.20, what is the minimum gross annual rental revenue that would make this project financially feasible? Please provide all your workings clearly (13 marks) (b) If the minimum acceptable debt coverage ratio is 1.25 and the maximum loan-to- value ratio is 0.70, what is the maximum total investment (combined debt and equity funds) that will make the proposal financially feasible? Please provide all your workings clearly. (12 marks) (c) Advise your client accordingly. (10 marks) Question 1 (35 marks) You have been asked by your client to provide an analysis regarding the feasibility of a proposed real estate investment venture. The property has a leasable area of 30,000 square feet and a potential gross income per leasable square foot of $25.50. Vacancy and bad debt currently account for 10% of the potential gross income while its operating expense per square foot of the leasable area is $11.00. From your market knowledge, you know the best available loan terms are interest at 11.5% per annum, monthly compounding, on a fully amortizing 25-year loan. Your client can borrow a maximum of 75% of the selling price ($3,500,000). The minimum acceptable debt coverage ratio is 1.20. Your client requires a minimum equity yield of 6.5 %. Critically analyze the above investment via a preliminary feasibility analysis on the following two questions: (a) If the maximum available loan-to-value ratio is 0.75 and the minimum acceptable debt coverage ratio is 1.20, what is the minimum gross annual rental revenue that would make this project financially feasible? Please provide all your workings clearly (13 marks) (b) If the minimum acceptable debt coverage ratio is 1.25 and the maximum loan-to- value ratio is 0.70, what is the maximum total investment (combined debt and equity funds) that will make the proposal financially feasible? Please provide all your workings clearly. (12 marks) (c) Advise your client accordingly. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts