Question: Question 1 (3.5 points) Consider a given lump sum FV, for which we have calculated a present value (PV) using some interest rate (I) and

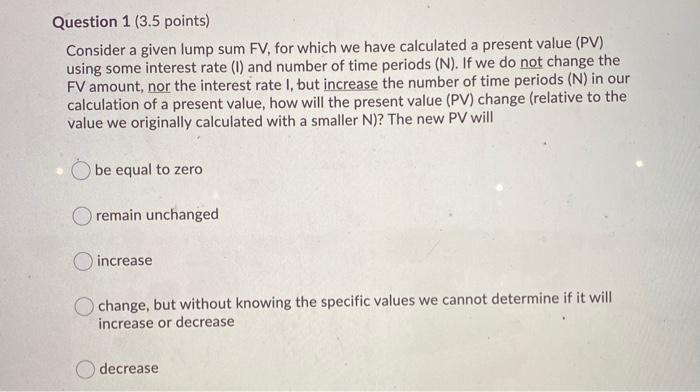

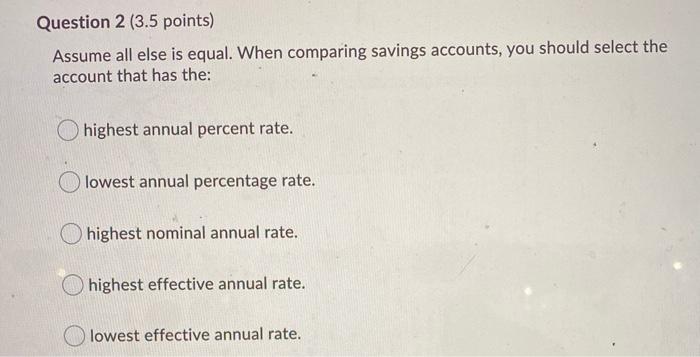

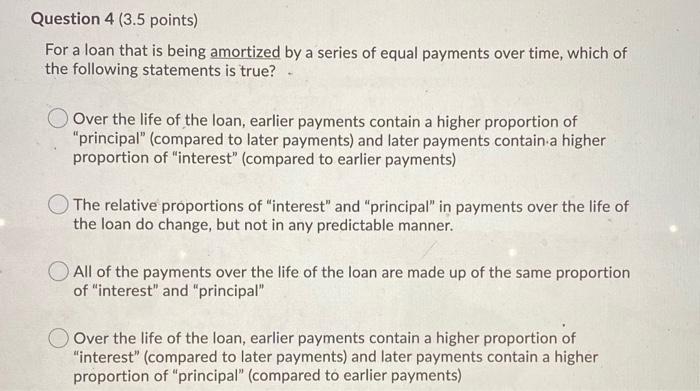

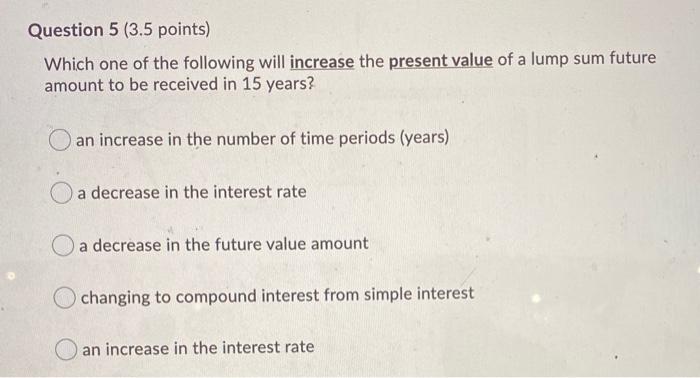

Question 1 (3.5 points) Consider a given lump sum FV, for which we have calculated a present value (PV) using some interest rate (I) and number of time periods (N). If we do not change the FV amount, nor the interest rate I, but increase the number of time periods (N) in our calculation of a present value, how will the present value (PV) change (relative to the value we originally calculated with a smaller N)? The new PV will be equal to zero remain unchanged increase change, but without knowing the specific values we cannot determine if it will increase or decrease decrease Question 2 (3.5 points) Assume all else is equal. When comparing savings accounts, you should select the account that has the: highest annual percent rate. lowest annual percentage rate. highest nominal annual rate. highest effective annual rate. lowest effective annual rate. Question 4 (3.5 points) For a loan that is being amortized by a series of equal payments over time, which of the following statements is true? Over the life of the loan, earlier payments contain a higher proportion of "principal" (compared to later payments) and later payments contain a higher proportion of "interest" (compared to earlier payments) The relative proportions of "interest" and "principal" in payments over the life of the loan do change, but not in any predictable manner. All of the payments over the life of the loan are made up of the same proportion of "interest" and "principal" Over the life of the loan, earlier payments contain a higher proportion of "interest" (compared to later payments) and later payments contain a higher proportion of "principal" (compared to earlier payments) Question 5 (3,5 points) Which one of the following will increase the present value of a lump sum future amount to be received in 15 years? an increase in the number of time periods (years) a decrease in the interest rate a decrease in the future value amount changing to compound interest from simple interest an increase in the interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts