Question: Question 1 ( 4 0 marks ) After reorganising the management team of Moon Ltd on 1 December 2 0 2 3 , John Li

Question marks

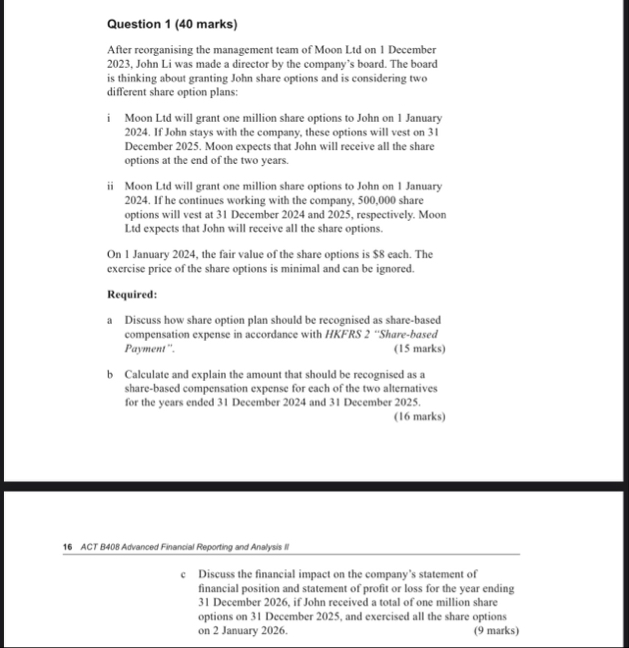

After reorganising the management team of Moon Ltd on December John Li was made a director by the company's board. The board is thinking about granting John share options and is considering two different share option plans:

i Moon Ltd will grant one million share options to John on January If John stays with the company, these options will vest on December Moon expects that John will receive all the share options at the end of the two years.

ii Moon Ltd will grant one million share options to John on January If he continues working with the company, share options will vest at December and respectively. Moon Ltd expects that John will receive all the share options.

On January the fair value of the share options is $ each. The exercise price of the share options is minimal and can be ignored.

Required:

a Discuss how share option plan should be recognised as sharebased compensation expense in accordance with HKFRS "Sharebased Payment".

marks

b Calculate and explain the amount that should be recognised as a sharebased compensation expense for each of the two alternatives for the years ended December and December

marks

c Discuss the financial impact on the company's statement of financial position and statement of profit or loss for the year ending December if John received a total of one million share options on December and exercised all the share options on January

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock