Question: Question 1 ( 4 5 points ) Boris Milkem's financial firm owns six assets. The expected sales price ( in millions of dollars ) for

Question points

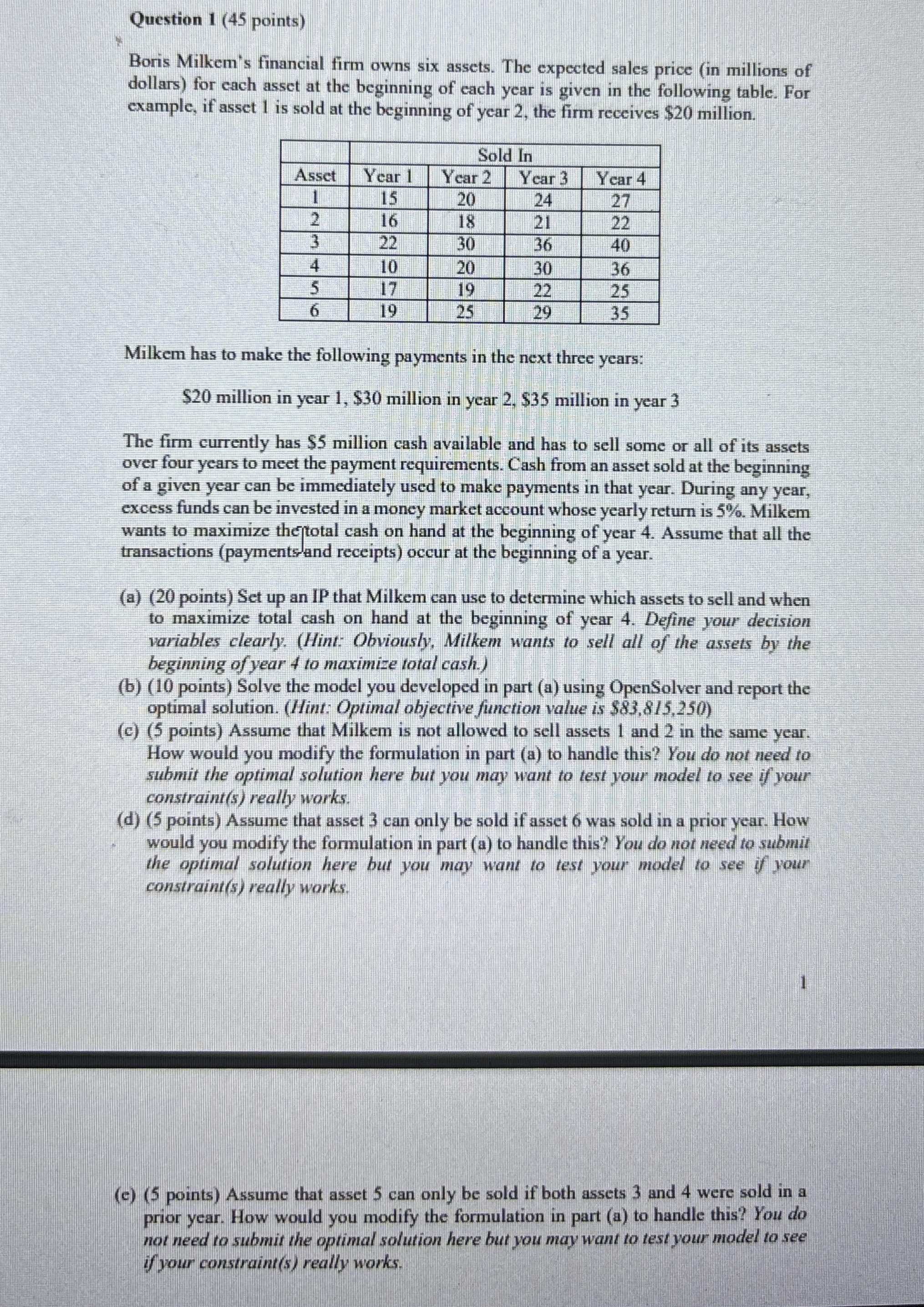

Boris Milkem's financial firm owns six assets. The expected sales price in millions of dollars for each asset at the beginning of each year is given in the following table. For example, if asset is sold at the beginning of year the firm receives $ million.

tableSold lnAssetYear Year Year Ycar

Milkem has to make the following payments in the next three years:

$ million in year $ million in year $ million in year

The firm currently has $ million cash available and has to sell some or all of its assets over four years to meet the payment requirements. Cash from an asset sold at the beginning of a given year can be immediately used to make payments in that year. During any year, excess funds can be invested in a money market account whose yearly return is Milkem wants to maximize the fotal cash on hand at the beginning of year Assume that all the transactions paymentsand receipts occur at the beginning of a year.

a points Set up an IP that Milkem can use to determine which assets to sell and when to maximize total cash on hand at the beginning of year Define your decision variables clearly: Hint: Obviously, Milkem wants to sell all of the assets by the beginning of year to maximize total cash.

b points Solve the model you developed in part a using OpenSolver and report the optimal solution. Hint: Optimal objective function value is $

c points Assume that Milkem is not allowed to sell assets and in the same year. How would you modify the formulation in part a to handle this? You do not need to submit the optimal solution here but you may want to test your model to see if your constraints really works.

d points Assume that asset can only be sold if asset was sold in a prior year. How would you modify the formulation in part a to handle this? You do not need to submit the optimal solution here but you may want to test your model to see if your consiraints really works.

e points Assume that asset can only be sold if both assets and were sold in a prior year. How would you modify the formulation in part a to handle this? You do not need to submit the optimal solution here but you may want to test your model to see if your constraints really works.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock