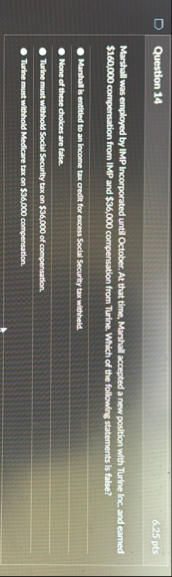

Question: Question 1 4 6 . 2 5 pts Marshall was employed by IMP Incorporated unti October. At that time, Marshal accepted a new poiltion with

Question

pts

Marshall was employed by IMP Incorporated unti October. At that time, Marshal accepted a new poiltion with Turine he and earned $ compensation from IMP and $ compersation from Turine. Which of the following statements is false?

Manhul B entitled to an Income tax credit for eacess Soctyl Security tax witheld

None of these choices are false.

Turine must withinet Soctal Security tax on $ of compensation.

Turne must withhold Medicare tax on $ compensation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock