Question: Question 1 (4 marks) Adam Abbot (AA) had been planning to set up his own business for a long time, and his life long dream

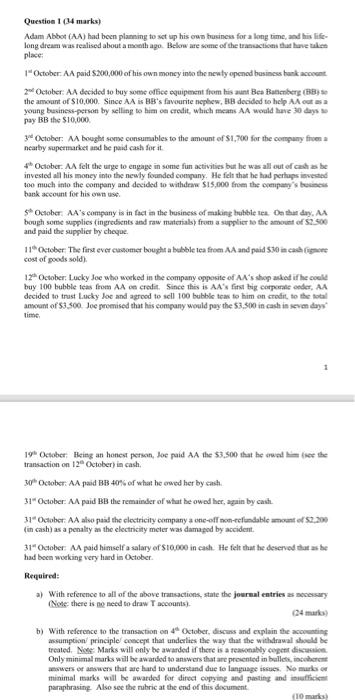

Question 1 (4 marks) Adam Abbot (AA) had been planning to set up his own business for a long time, and his life long dream was realised about a month ago. Below are some of the transactions that have taken place 1"October. A paid $200,000 of his own money into the newly opened business hunk accent 20 October: AA decided to buy some office equipment from his aunt Bea Batiborg (18) the amount of $10,000. Since AA is BB's favourite nephew, BB decided to help out as a young business-person by selling to him on credit, which means AA would have 30 days pay the $10,000 3 October: AA bought some consumables to the amount of $1,700 for the company free nearby supermarket and he paid cash for it * Odiober. A felt the urge to engage in some fun activities but he was all out of cash asbe invested all his money into the newly founded company. He felt that he had perlapsed too much into the company and decided to withdraw $15.000 from the company's bee bank account for his own use OctoberAA's company is in fact in the business of making bubble tea De that day. As bough some supplies ingredients and raw materials from a supplier to the amount of 2.500 and paid the supplier by cheque 11 October The first ever comer bought a bubble tea from AA and paid 530 in cathore cost of poods sold). 12 October, Lucky Joe who worked in the company opposite of AA's shop asked if he could buy 100 bubble teas from AA on credit. Since this is AA's first big corporate order, AA decided to trust Lucky Joe and agreed to sell 100 bubble tea to him on credit to the total amount of $3.500. Joe promised that his company would pay the 53.500 in cash in seven days 19 OctoberHeing an honest person, Joe paid AA the 53,500 that he was the transaction on 12 October) in cash. 30 October. AA paid BB-40% of what he owed her by cash, 31 October: AA paid BB the remainder of what he owed her again by cash. 31" October: AA also paid the clectricity company a one-off non-refundable amount of 52.200 (in cash) as a penalty as the electricity meter was damaged by accident October paid himself a salary of $10,000 in cad. He felt that he deserved that as he had been working very hard in October Required: With reference to all of the above transactions, state the journal entries as necessary (Note: there is no need to draw accounts). b) With reference to the transaction on October, discuss and explain the coming assumption principle concept that underlies the way that the withdrawal show treated. Nee Marks will only be awarded if there is a reasonably open discussion Only minimal marks will be awarded to answers that are presented in bulles, increme answers or answers that are hard to understand due to language issues. No marks or minimal marks will be awarded for direct copying and pasting and insufficient paraphrasing Also see the rubric at the end of this document (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts