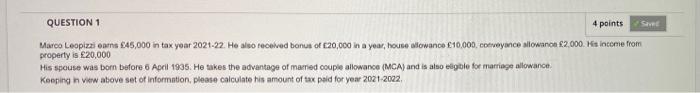

Question: QUESTION 1 4 points Same Marco Leopizzicans 45,000 in tax yoar 2021-22. He also received bonus of 20,000 in a year, house lowance 10,000, Conveyance

QUESTION 1 4 points Same Marco Leopizzicans 45,000 in tax yoar 2021-22. He also received bonus of 20,000 in a year, house lowance 10,000, Conveyance allowanon 2,000. Mis income from property is 20,000 His spouse was born before 6 April 1935. He takes the advantage of married couple allowance (MCA) and is also eligible for marriage allowance Kooping new above set of Information, please calculate his amount of tax paid for year 2021 2022. QUESTION 1 4 points Same Marco Leopizzicans 45,000 in tax yoar 2021-22. He also received bonus of 20,000 in a year, house lowance 10,000, Conveyance allowanon 2,000. Mis income from property is 20,000 His spouse was born before 6 April 1935. He takes the advantage of married couple allowance (MCA) and is also eligible for marriage allowance Kooping new above set of Information, please calculate his amount of tax paid for year 2021 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts