Question: QUESTION 1 4 points Save Answer Charles River Publishing's degree of operating leverage is .5. To increase net operating income from $3,750,000 to $3,937,500, it

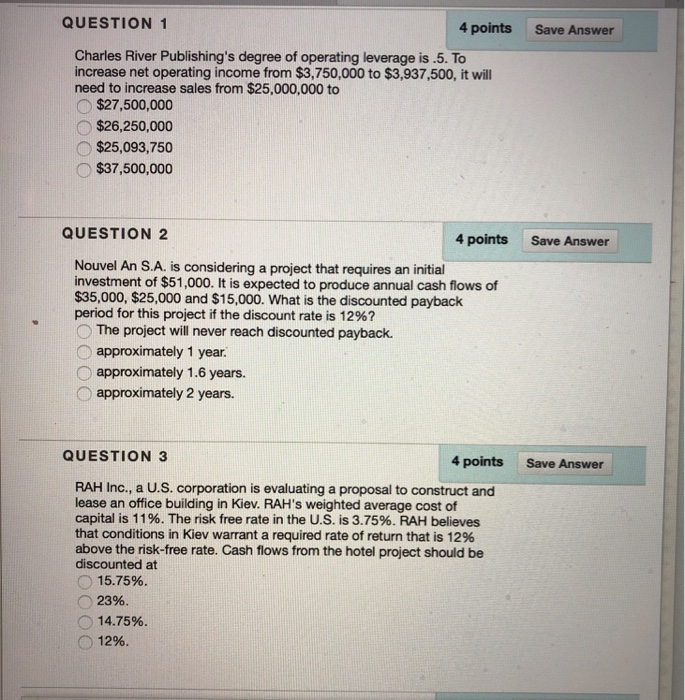

QUESTION 1 4 points Save Answer Charles River Publishing's degree of operating leverage is .5. To increase net operating income from $3,750,000 to $3,937,500, it will need to increase sales from $25,000,000 to $27,500,000 $26,250,000 $25,093,750 O$37,500,000 QUESTION 2 4 points Save Answer Nouvel An S.A. is considering a project that requires an initial investment of $51,000. It is expected to produce annual cash flows of $35,000, $25,000 and $15,000. What is the discounted payback period for this project if the discount rate is 12%? The project will never reach discounted payback. approximately 1 year Oapproximately 1.6 years. D approximately 2 years. QUESTION 3 4 points Save Answer RAH Inc., a U.S. corporation is evaluating a proposal to construct and lease an office building in Kiev. RAH's weighted average cost of capital is 1 1 %. The risk free rate in the U.S. is 3.75%. RAH believes that conditions in Kiev warrant a required rate of return that is 12% above the risk-free rate. Cash flows from the hotel project should be discounted at 15.75%. 2396. 14.75% 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts