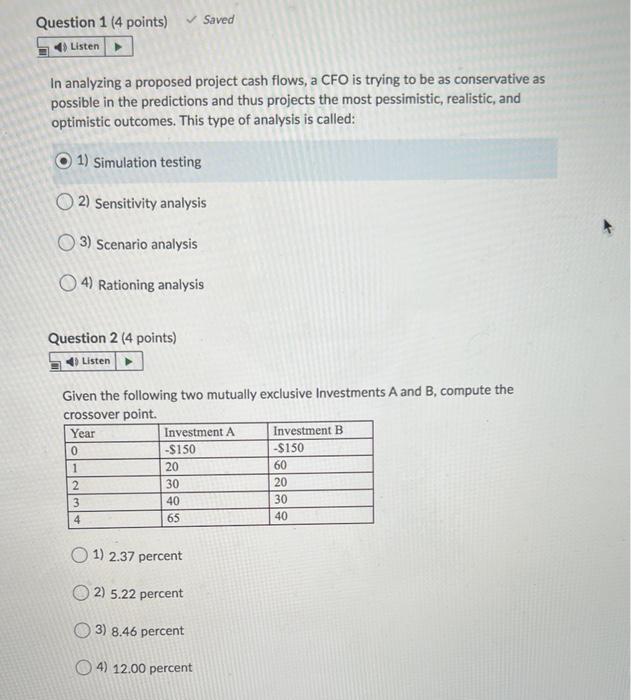

Question: Question 1 (4 points) Saved Listen In analyzing a proposed project cash flows, a CFO is trying to be as conservative as possible in the

Question 1 (4 points) Saved Listen In analyzing a proposed project cash flows, a CFO is trying to be as conservative as possible in the predictions and thus projects the most pessimistic, realistic, and optimistic outcomes. This type of analysis is called: O 1) Simulation testing O2) Sensitivity analysis 3) Scenario analysis 4) Rationing analysis Question 2 (4 points) Listen Given the following two mutually exclusive Investments A and B, compute the crossover point. Year Investment A Investment B -$150 1 2 40 30 0 -S150 20 30 60 20 3 4 65 40 1) 2.37 percent 2) 5.22 percent 3) 8.46 percent 4) 12.00 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts