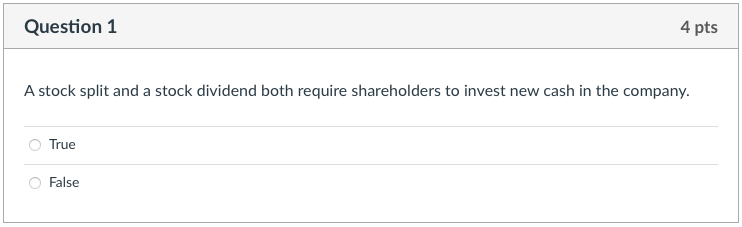

Question: Question 1 4 pts A stock split and a stock dividend both require shareholders to invest new cash in the company. True False Question 2

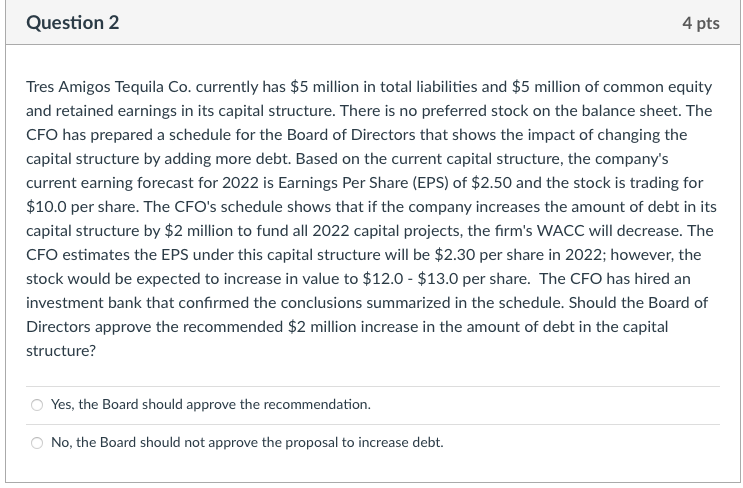

Question 1 4 pts A stock split and a stock dividend both require shareholders to invest new cash in the company. True False Question 2 4 pts Tres Amigos Tequila Co. currently has $5 million in total liabilities and $5 million of common equity and retained earnings in its capital structure. There is no preferred stock on the balance sheet. The CFO has prepared a schedule for the Board of Directors that shows the impact of changing the capital structure by adding more debt. Based on the current capital structure, the company's current earning forecast for 2022 is Earnings Per Share (EPS) of $2.50 and the stock is trading for $10.0 per share. The CFO's schedule shows that if the company increases the amount of debt in its capital structure by $2 million to fund all 2022 capital projects, the firm's WACC will decrease. The CFO estimates the EPS under this capital structure will be $2.30 per share in 2022; however, the stock would be expected to increase in value to $12.0 - $13.0 per share. The CFO has hired an investment bank that confirmed the conclusions summarized in the schedule. Should the Board of Directors approve the recommended $2 million increase in the amount of debt in the capital structure? Yes, the Board should approve the recommendation. No, the Board should not approve the proposal to increase debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts