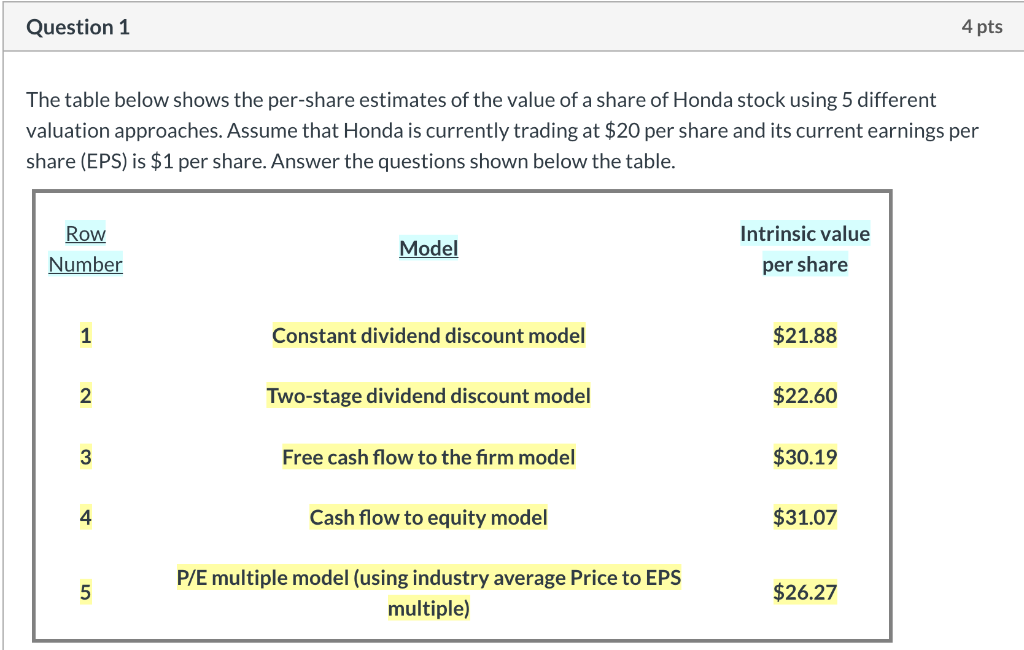

Question: Question 1 4 pts The table below shows the per-share estimates of the value of a share of Honda stock using 5 different valuation approaches.

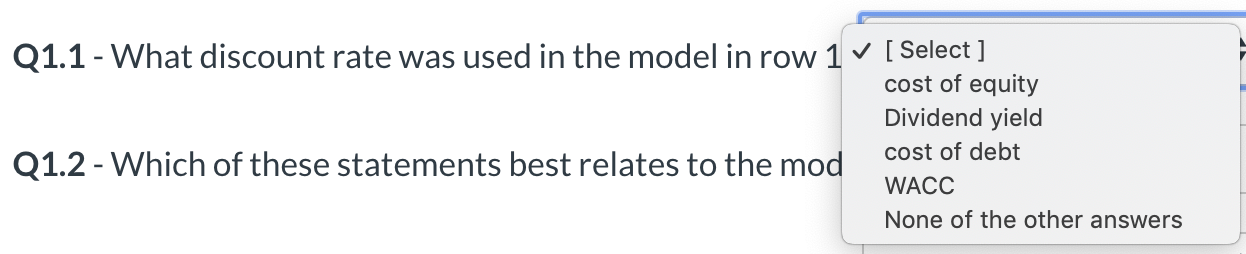

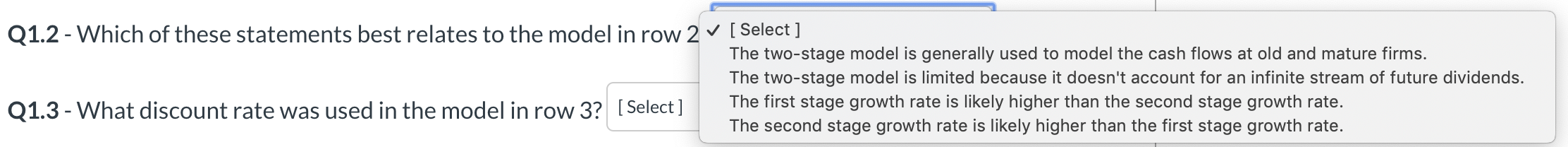

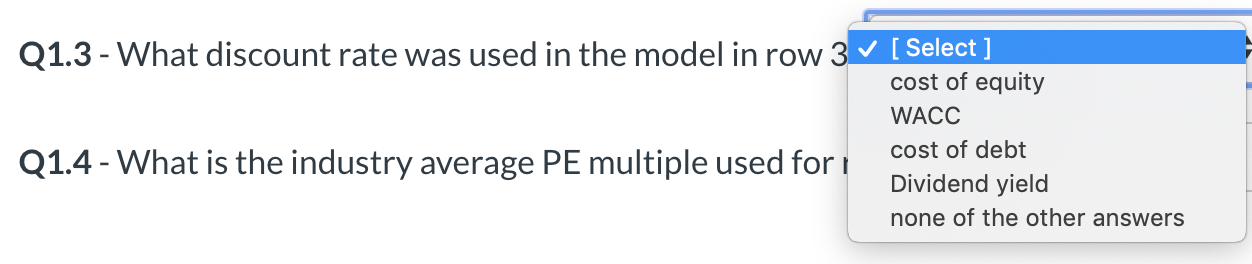

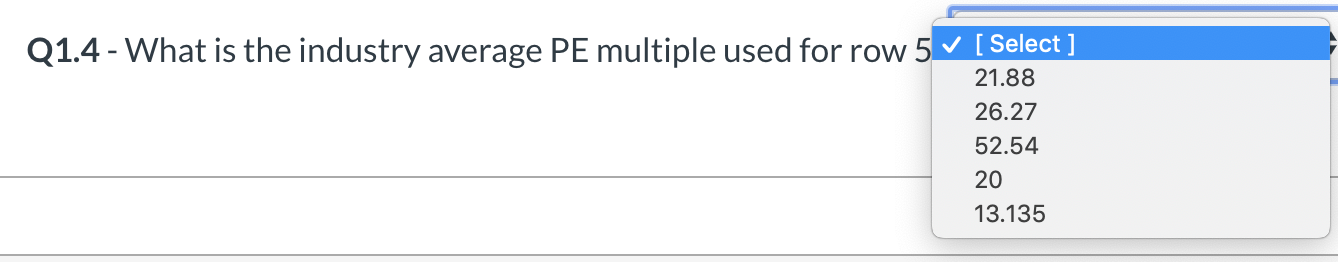

Question 1 4 pts The table below shows the per-share estimates of the value of a share of Honda stock using 5 different valuation approaches. Assume that Honda is currently trading at $20 per share and its current earnings per share (EPS) is $1 per share. Answer the questions shown below the table. Row Number Model Intrinsic value per share Constant dividend discount model $21.88 Two-stage dividend discount model $22.60 Free cash flow to the firm model $30.19 Cash flow to equity model $31.07 P/E multiple model (using industry average Price to EPS multiple) $26.27 Q1.1 - What discount rate was used in the model in row 1 v [ Select ] cost of equity Dividend yield Q1.2 - Which of these statements best relates to the mod cost of debt WACC None of the other answers Q1.2 - Which of these statements best relates to the model in row 2 v [ Select ] The two-stage model is generally used to model the cash flows at old and mature firms. The two-stage model is limited because it doesn't account for an infinite stream of future dividends. Q1.3 - What discount rate was used in the model in row 3? [Select] The first stage growth rate is likely higher than the second stage growth rate. The second stage growth rate is likely higher than the first stage growth rate. Q1.3 - What discount rate was used in the model in row 3 [Select ] cost of equity WACC cost of debt Dividend yield none of the other answers Q1.4 - What is the industry average PE multiple used for i Q1.4 - What is the industry average PE multiple used for row 5 [ Select ] 21.88 26.27 52.54 20 13.135

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts