Question: Question 1 40 Marks a) What is meant when a bond is said to be trading cum-interest? Marks b) A municipality Bond has face value

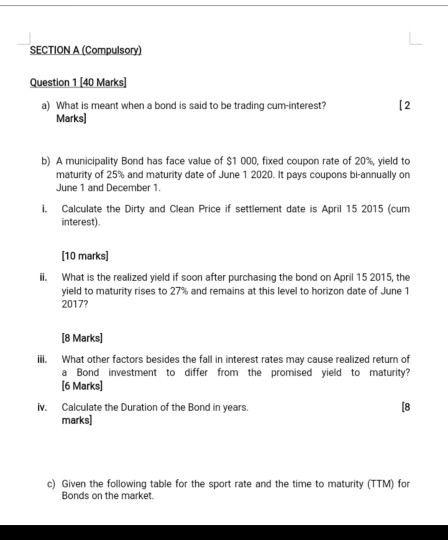

Question 1 40 Marks a) What is meant when a bond is said to be trading cum-interest? Marks b) A municipality Bond has face value of $1000, fixed coupon rate of 20% yield to maturity of 25% and maturity date of June 1 2020. It pays coupons bi-annually on June 1 and December 1 i. Calculate the Dirty and Clean Price if settlement date is April 15 2015 (cum interest). 10 marks] yield to maturity rises to 27% and remains at this level to horizon date of June 1 i. What is the realized yield if soon after purchasing the bond on April 15 2015, the 2017? [8 Marksl ili. What other factors besides the fall in interest rates may cause realized return of a Bond investment to differ from the promised yield to maturity? 6 Marks] iv. Calculate the Duration of the Bond in years. marks c) Given the following table for the sport rate and the time to maturity (TTM) for Bonds on the market Question 1 40 Marks a) What is meant when a bond is said to be trading cum-interest? Marks b) A municipality Bond has face value of $1000, fixed coupon rate of 20% yield to maturity of 25% and maturity date of June 1 2020. It pays coupons bi-annually on June 1 and December 1 i. Calculate the Dirty and Clean Price if settlement date is April 15 2015 (cum interest). 10 marks] yield to maturity rises to 27% and remains at this level to horizon date of June 1 i. What is the realized yield if soon after purchasing the bond on April 15 2015, the 2017? [8 Marksl ili. What other factors besides the fall in interest rates may cause realized return of a Bond investment to differ from the promised yield to maturity? 6 Marks] iv. Calculate the Duration of the Bond in years. marks c) Given the following table for the sport rate and the time to maturity (TTM) for Bonds on the market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts