Question: QUESTION 1 40 MARKS PCA Ltd declared bankruptcy in June 2020 soon after publishing the financial statements for the year ended December 2019. PCA Ltd's

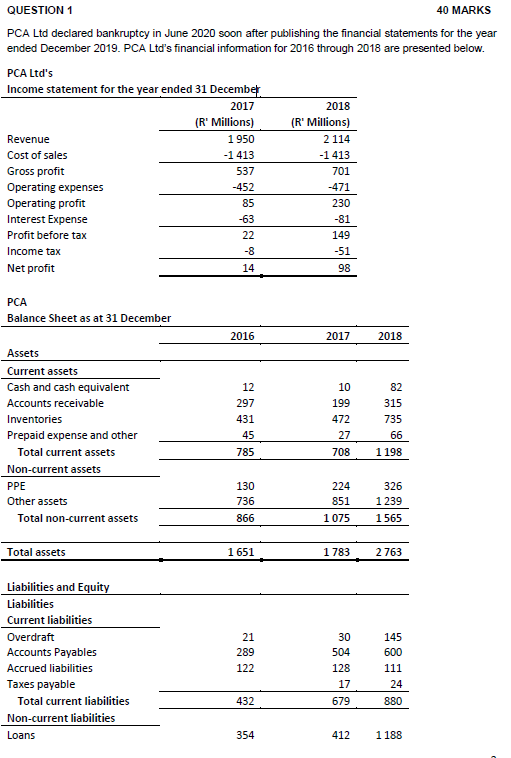

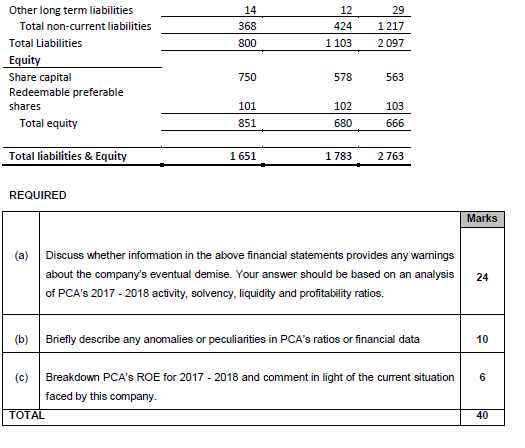

QUESTION 1 40 MARKS PCA Ltd declared bankruptcy in June 2020 soon after publishing the financial statements for the year ended December 2019. PCA Ltd's financial information for 2016 through 2018 are presented below. PCA Ltd's Income statement for the year ended 31 December 2017 2018 (R' Millions) (R' Millions) Revenue 1950 2 114 Cost of sales -1 413 -1 413 537 701 -452 -471 Gross profit Operating expenses Operating profit Interest Expense 85 230 -63 -81 Profit before tax 22 149 Income tax -8 -51 Net profit 14 98 PCA Balance Sheet as at 31 December 2016 2017 2018 Assets Current assets Cash and cash equivalent 12 10 82 Accounts receivable 297 199 315 Inventories 431 472 735 Prepaid expense and other 45 27 66 Total current assets 785 708 1 198 Non-current assets PPE 130 224 326 Other assets 736 851 1 239 Total non-current assets 866 1 075 1565 Total assets 1 651 1783 2763 Liabilities and Equity Liabilities Current liabilities Overdraft 21 30 145 Accounts Payables 289 504 600 Accrued liabilities 122 128 111 17 24 432 679 880 Taxes payable Total current liabilities Non-current liabilities Loans 354 412 1 188 14 12 29 Other long term liabilities Total non-current liabilities 368 424 1 217 Total Liabilities 800 1 103 2 097 750 578 563 Equity Share capital Redeemable preferable shares 101 102 103 Total equity 851 680 666 Total liabilities & Equity 1 651 1783 2763 REQUIRED Marks (a) Discuss whether information in the above financial statements provides any warnings about the company's eventual demise. Your answer should be based on an analysis 24 of PCA's 2017 - 2018 activity, solvency, liquidity and profitability ratios. (b) Briefly describe any anomalies or peculiarities in PCA's ratios or financial data 10 (c) Breakdown PCA'S ROE for 2017 - 2018 and comment in light of the current situation 6 faced by this company. TOTAL 40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts