Question: QUESTION 1 (40 MARKS) The financial reporting framework is the framework used by an entity to prepare its financial statements. In this article, we will

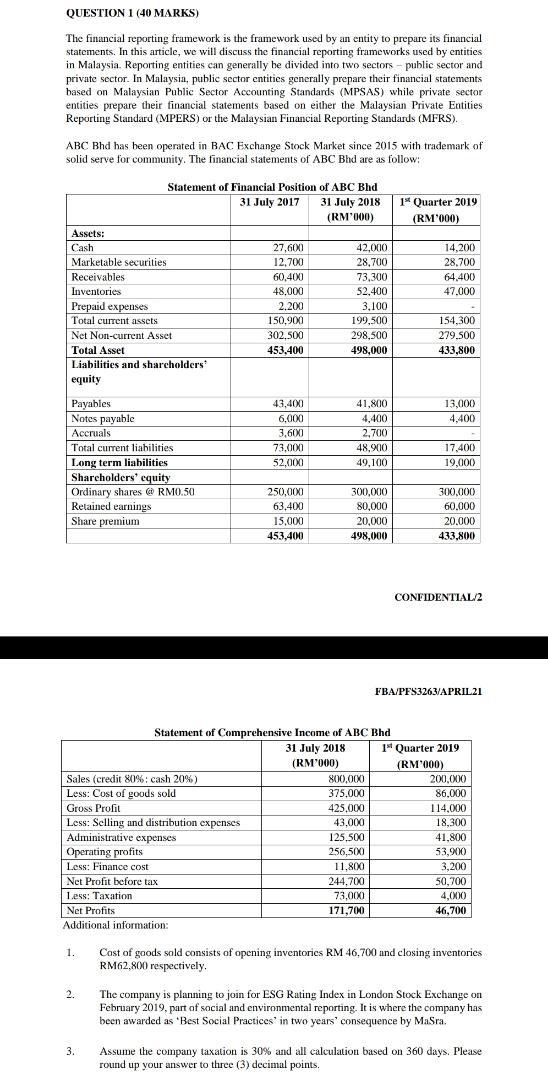

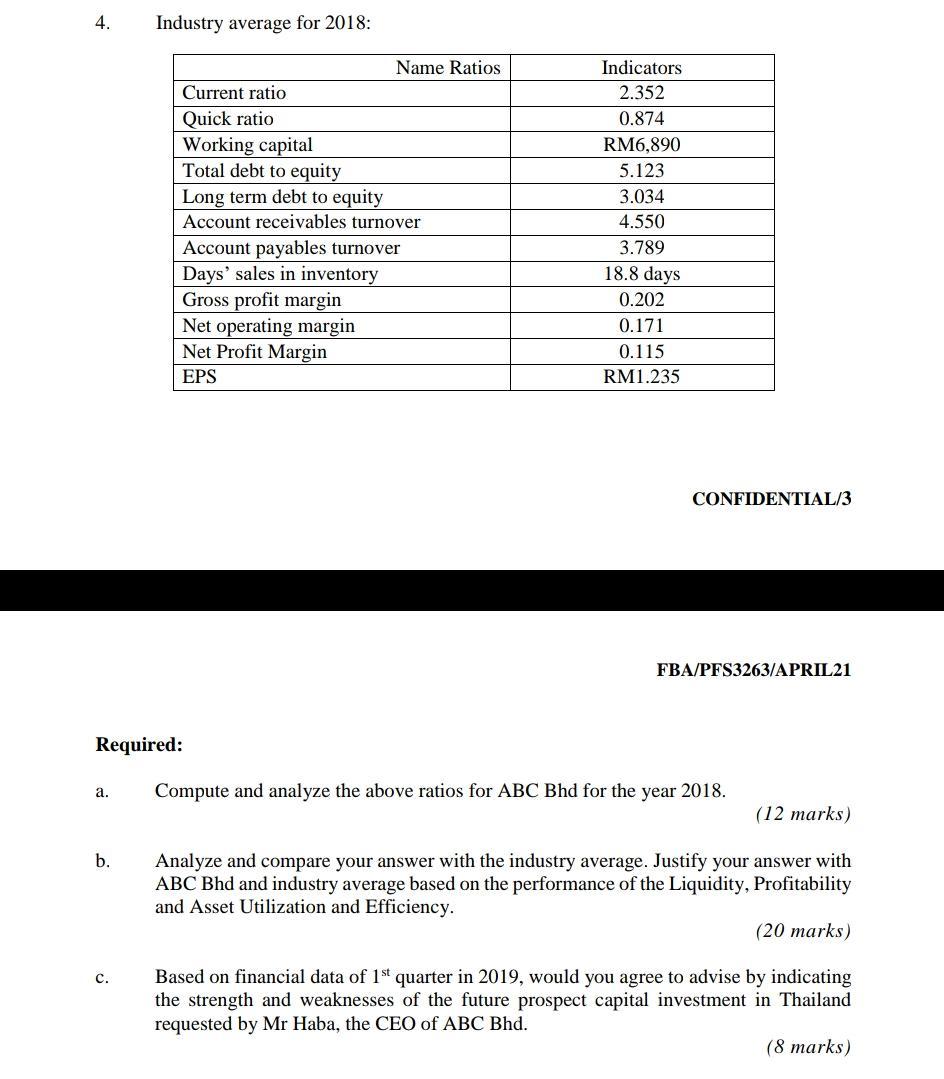

QUESTION 1 (40 MARKS) The financial reporting framework is the framework used by an entity to prepare its financial statements. In this article, we will discuss the financial reporting frameworks used by entities in Malaysia. Reporting entities can generally he divided into two sectors - public sector and private sector. In Malaysia, public sector entities generally prepare their financial statements based on Malaysian Public Sector Accounting Standards (MPSAS) while private sector entities prepare their financial statements based on either the Malaysian Private Entities Reporting Standard (MPERS) or the Malaysian Financial Reporting Standards (MFRS). ABC Bhd has been operated in BAC Exchange Stock Market since 2015 with trademark of solid serve for community. The financial statements of ABC Bhd are as follow: 1 Quarter 2019 (RM'000) Statement of Financial Position of ABC Bhd 31 July 2017 31 July 2018 (RM'000) Assets: Cash 27,600 42.000 Marketable securities 12,700 28,700 Receivables 60,400 73.300 Inventories 48,000 52,400 Prepaid expenses 2.200 3,100 Total current assets 150.900 199,500 Net Non-current Asset 302.5OX 298,500 Total Asset 453.400 498,000 Liabilities and shareholders equity 14.200 28,700 64,400 47.000 154,300 279.500 433.800 13,000 4,400 Payables Notes payable Accruals Total current liabilities Long term liabilities Shareholders' equity Ordinary shares @ RM0.50 Retained earnings Share premium 43,40) 6,000 3,601 73,000 52.000 41,800 4,400 2.700 48,900 49,100 17,400 19,000 250.00 63,400 15.000 453,400 300,000 80,000 20.000 498,000 300.000 60.000 20.000 433,800 CONFIDENTIAL/2 FBA/PFS3263/APRIL21 Statement of Comprehensive Income of ABC Bhd 31 July 2018 14 Quarter 2019 (RM'000) (RM '000) Sales (credit 80% cash 20%) 800,000 200.00) Less: Cost of goods sold 375.000 86,000 Gross Profil 425.000 114.000 Less: Selling and distribution expenses 43.000 18,300 Administrative expenses 125,500 41,800 Operating profits 256,500 ,MC) Less: Finance cost 11,800 3,200 Net Profit before tax 244,700 50,700 1.ess: Taxation 73,000 4,000 Net Profits 171,700 46,700 Additional information: 1. Cost of goods sold consists of opening inventories RM 46.700 and closing inventories RM62,800 respectively, 2. The company is planning to join for ESG Rating Index in London Stock Exchange on February 2019, part of social and environmental reporting. It is where the company has been awarded as 'Best Social Practices in two years' consequence by MaSra. 3. Assume the company taxation is 30% and all calculation based on 360 days. Please round up your answer to three (3) decimal points. 4. Industry average for 2018: Name Ratios Current ratio Quick ratio Working capital Total debt to equity Long term debt to equity Account receivables turnover Account payables turnover Days' sales in inventory Gross profit margin Net operating margin Net Profit Margin Indicators 2.352 0.874 RM6,890 5.123 3.034 4.550 3.789 18.8 days 0.202 0.171 0.115 RM1.235 EPS CONFIDENTIAL/3 FBA/PFS3263/APRIL21 Required: a. Compute and analyze the above ratios for ABC Bhd for the year 2018. (12 marks) b. Analyze and compare your answer with the industry average. Justify your answer with ABC Bhd and industry average based on the performance of the Liquidity, Profitability and Asset Utilization and Efficiency. (20 marks) C. Based on financial data of 1st quarter in 2019, would you agree to advise by indicating the strength and weaknesses of the future prospect capital investment in Thailand requested by Mr Haba, the CEO of ABC Bhd. (8 marks) QUESTION 1 (40 MARKS) The financial reporting framework is the framework used by an entity to prepare its financial statements. In this article, we will discuss the financial reporting frameworks used by entities in Malaysia. Reporting entities can generally he divided into two sectors - public sector and private sector. In Malaysia, public sector entities generally prepare their financial statements based on Malaysian Public Sector Accounting Standards (MPSAS) while private sector entities prepare their financial statements based on either the Malaysian Private Entities Reporting Standard (MPERS) or the Malaysian Financial Reporting Standards (MFRS). ABC Bhd has been operated in BAC Exchange Stock Market since 2015 with trademark of solid serve for community. The financial statements of ABC Bhd are as follow: 1 Quarter 2019 (RM'000) Statement of Financial Position of ABC Bhd 31 July 2017 31 July 2018 (RM'000) Assets: Cash 27,600 42.000 Marketable securities 12,700 28,700 Receivables 60,400 73.300 Inventories 48,000 52,400 Prepaid expenses 2.200 3,100 Total current assets 150.900 199,500 Net Non-current Asset 302.5OX 298,500 Total Asset 453.400 498,000 Liabilities and shareholders equity 14.200 28,700 64,400 47.000 154,300 279.500 433.800 13,000 4,400 Payables Notes payable Accruals Total current liabilities Long term liabilities Shareholders' equity Ordinary shares @ RM0.50 Retained earnings Share premium 43,40) 6,000 3,601 73,000 52.000 41,800 4,400 2.700 48,900 49,100 17,400 19,000 250.00 63,400 15.000 453,400 300,000 80,000 20.000 498,000 300.000 60.000 20.000 433,800 CONFIDENTIAL/2 FBA/PFS3263/APRIL21 Statement of Comprehensive Income of ABC Bhd 31 July 2018 14 Quarter 2019 (RM'000) (RM '000) Sales (credit 80% cash 20%) 800,000 200.00) Less: Cost of goods sold 375.000 86,000 Gross Profil 425.000 114.000 Less: Selling and distribution expenses 43.000 18,300 Administrative expenses 125,500 41,800 Operating profits 256,500 ,MC) Less: Finance cost 11,800 3,200 Net Profit before tax 244,700 50,700 1.ess: Taxation 73,000 4,000 Net Profits 171,700 46,700 Additional information: 1. Cost of goods sold consists of opening inventories RM 46.700 and closing inventories RM62,800 respectively, 2. The company is planning to join for ESG Rating Index in London Stock Exchange on February 2019, part of social and environmental reporting. It is where the company has been awarded as 'Best Social Practices in two years' consequence by MaSra. 3. Assume the company taxation is 30% and all calculation based on 360 days. Please round up your answer to three (3) decimal points. 4. Industry average for 2018: Name Ratios Current ratio Quick ratio Working capital Total debt to equity Long term debt to equity Account receivables turnover Account payables turnover Days' sales in inventory Gross profit margin Net operating margin Net Profit Margin Indicators 2.352 0.874 RM6,890 5.123 3.034 4.550 3.789 18.8 days 0.202 0.171 0.115 RM1.235 EPS CONFIDENTIAL/3 FBA/PFS3263/APRIL21 Required: a. Compute and analyze the above ratios for ABC Bhd for the year 2018. (12 marks) b. Analyze and compare your answer with the industry average. Justify your answer with ABC Bhd and industry average based on the performance of the Liquidity, Profitability and Asset Utilization and Efficiency. (20 marks) C. Based on financial data of 1st quarter in 2019, would you agree to advise by indicating the strength and weaknesses of the future prospect capital investment in Thailand requested by Mr Haba, the CEO of ABC Bhd. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts