Question: QUESTION 1 40 points Save Answer On June 5, 2018, Roxy Company purchases a passenger auto for $60,000. Roxy does not take a Sec. 179

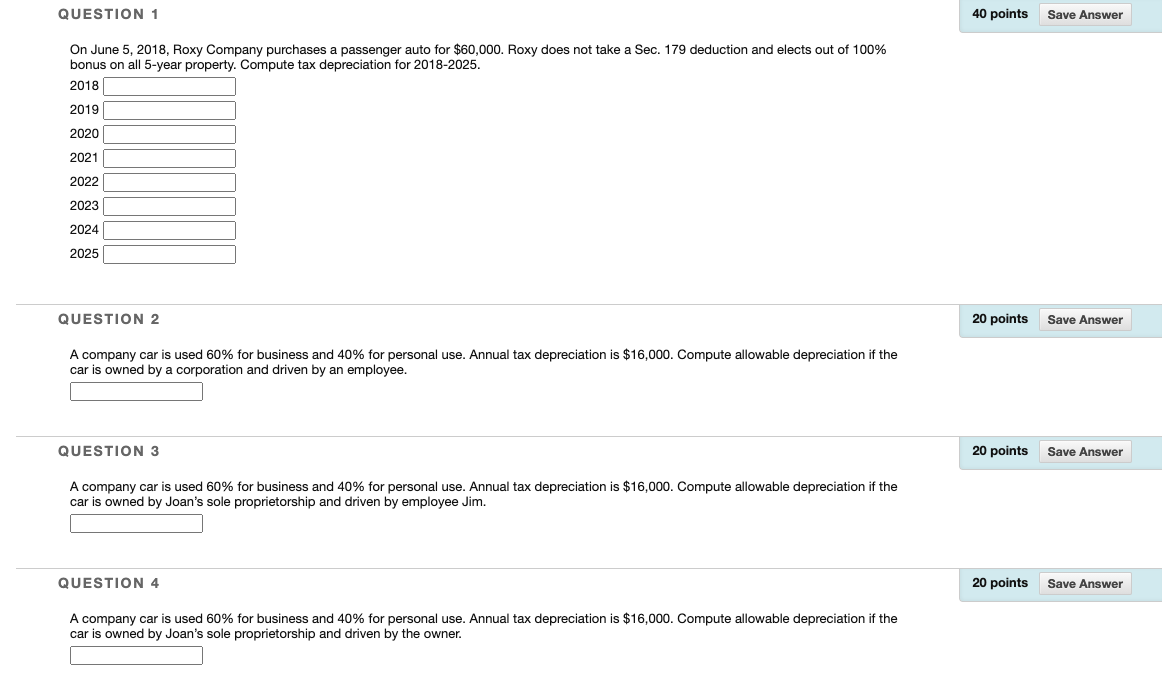

QUESTION 1 40 points Save Answer On June 5, 2018, Roxy Company purchases a passenger auto for $60,000. Roxy does not take a Sec. 179 deduction and elects out of 100% bonus on all 5-year property. Compute tax depreciation for 2018-2025. 2018 2019 2020 2021 2022 2023 2024 2025 QUESTION 2 20 points Save Answer A company car is used 60% for business and 40% for personal use. Annual tax depreciation is $16,000. Compute allowable depreciation if the car owned by a corporation and driven by an employee. QUESTION 3 20 points Save Answer A company car is used 60% for business and 40% for personal use. Annual tax depreciation is $16,000. Compute allowable depreciation if the car is owned by Joan's sole proprietorship and driven by employee Jim. QUESTION 4 20 points Save Answer A company car is used 60% for business and 40% for personal use. Annual tax depreciation is $16,000. Compute allowable depreciation if the car is owned by Joan's sole proprietorship and driven by the owner. QUESTION 1 40 points Save Answer On June 5, 2018, Roxy Company purchases a passenger auto for $60,000. Roxy does not take a Sec. 179 deduction and elects out of 100% bonus on all 5-year property. Compute tax depreciation for 2018-2025. 2018 2019 2020 2021 2022 2023 2024 2025 QUESTION 2 20 points Save Answer A company car is used 60% for business and 40% for personal use. Annual tax depreciation is $16,000. Compute allowable depreciation if the car owned by a corporation and driven by an employee. QUESTION 3 20 points Save Answer A company car is used 60% for business and 40% for personal use. Annual tax depreciation is $16,000. Compute allowable depreciation if the car is owned by Joan's sole proprietorship and driven by employee Jim. QUESTION 4 20 points Save Answer A company car is used 60% for business and 40% for personal use. Annual tax depreciation is $16,000. Compute allowable depreciation if the car is owned by Joan's sole proprietorship and driven by the owner

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts