Question: Question 1 4.6875 points Save Answer A couple is hoping to save enough so that they can enjoy annual payments of $100,000 in retirement, paid

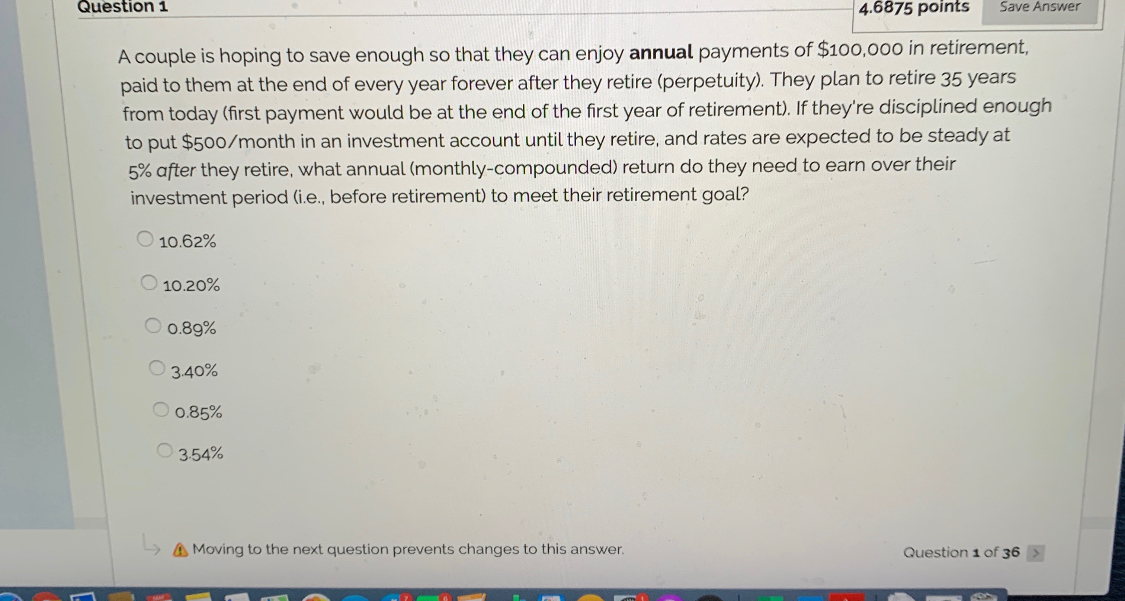

Question 1 4.6875 points Save Answer A couple is hoping to save enough so that they can enjoy annual payments of $100,000 in retirement, paid to them at the end of every year forever after they retire (perpetuity). They plan to retire 35 years from today (first payment would be at the end of the first year of retirement). If they're disciplined enough to put $500/month in an investment account until they retire, and rates are expected to be steady at 5% after they retire, what annual (monthly-compounded) return do they need to earn over their investment period (i.e., before retirement) to meet their retirement goal? 10.62% 10.20% 0.89% 3.40% 0.85% 3.54% > A Moving to the next question prevents changes to this answer. Question 1 of 36 >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts