Question: Question 1 5 , 1 . 2 - 8 HW Score: 8 5 . 9 4 % , 1 3 . 7 5 of 1

Question

HW Score: of points

Points: of

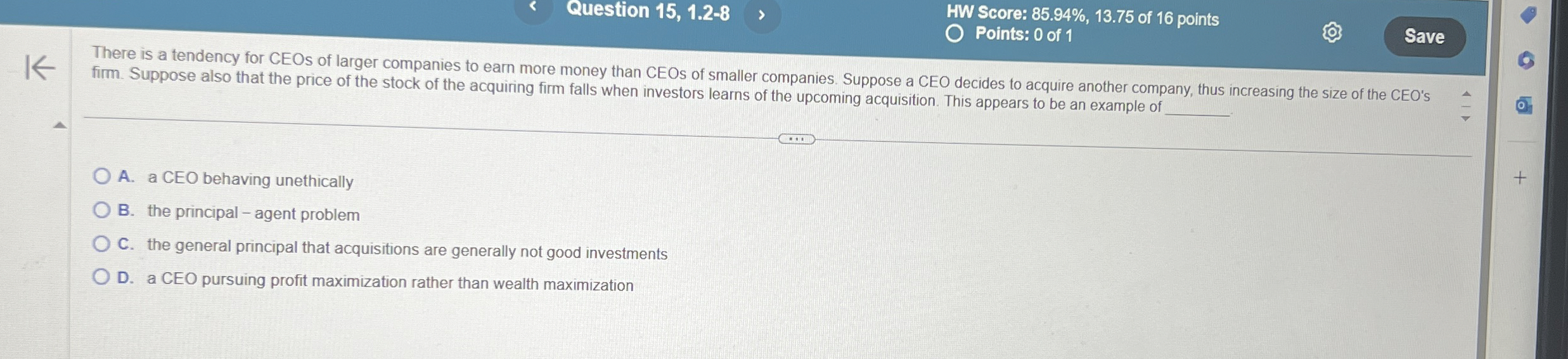

There is a tendency for CEOs of larger companies to earn more money than CEOs of smaller companies. Suppose a CEO decides to acquire another company, thus increasing the size of the CEO's firm. Suppose also that the price of the stock of the acquiring firm falls when investors learns of the upcoming acquisition. This appears to be an example of

A a CEO behaving unethically

B the principal agent problem

C the general principal that acquisitions are generally not good investments

D a CEO pursuing profit maximization rather than wealth maximization

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock