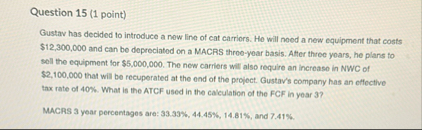

Question: Question 1 5 ( 1 point ) Gustav has decided to introduce a new line of cat carriors. He will noed a new equipment that

Question point

Gustav has decided to introduce a new line of cat carriors. He will noed a new equipment that costs $ and can be depreciated on a MACRS throoyoar basis. Atter three yoars, he plans to soll the equipment for $ The new carriers will also require an increase in NWC of $ that will bo recuperated at the end of the project. Gustav's company has an effective tax rate of What is the ATCF used in the calculation of the FCF in yoar

MACRS year percentages are: and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock