Question: Question 1 5 ( 3 4 points ) Big City Giving ( BCG ) is a not - for - profit organization that provides human

Question points

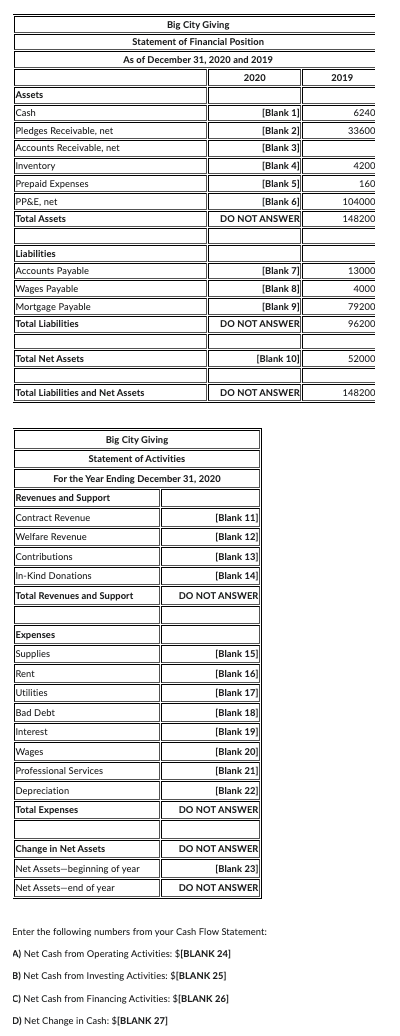

Big City Giving BCG is a notforprofit organization that provides human welfare services in New York City. BCG prepares its financial statements on the accrual basis of accounting and follows GAAP for notforprofit organizations. It ended FY with the following account balances in no particular order:

Mortgage PayableAccounts PayableWages PayableAccounts Receivable, netPledges Receivable, netCashInventoryPrepaid ExpensesNet Assets Without Donor RestrictionsPP&E net

The following financial events occurred during FY which ended December :

BCG earned and received payment on $ of public contracts paid for by the city and state governments during the year. Use "Contract Revenue" as the line item in the financial statements, as appropriate.

BCG used $ of supplies during the year to provide goods and services.

BCG paid $ each month for rent during FY In addition, BCGs landlord required that the organization pay an additional $ for the first month's rent of FY before the end of FY BCG also paid $ per month during the year for utilities. Record rent and utilities separately in the financial statements, as appropriate.

BCG earned $ from providing welfare services to clients and collected of this amount. The remaining balance at the end of the fiscal year has been determined to be uncollectible. Use "Welfare Revenue" as the line item in the financial statements, as appropriate.

BCG earned $ in new donations that are available for any purpose, of which $ was collected in cash. It is anticipated that the remaining balance will be collected in the next fiscal year. Use "Contributions" as the line item in financial statements, as appropriate.

BCG paid the bank $ Of this amount, was for interest and the remainder was for the repayment of principal.

Employees earned $ in salaries for work performed in FY Employees earned $ in FY Salaries are earned evenly throughout the fiscal year and BCG pays salaries with a twomonth lag.

A licensed, professional accountant volunteered and provided tax prep services during the fiscal year. The service is valued at $ and BCG would have paid for the services if the donation had not been made.

BCG sold and received $ in cash for property that the organization was no longer using. BCG also recorded $ of depreciation on its remaining property, plant, and equipment during FY

Record these events in a transactions worksheet and use that sheet to create the Balance Sheet, Activity Statement, and the Cash Flow Statement for BCG for FY

Important Tips PLEASE READ

Round you answers to the nearest WHOLE number and DO NOT include any decimal places eg would be

Do not include symbols $ or commas in your answers

Use a hyphen or dash to indicate negative numbers eg

Make sure you still write a zero in the blank if you believe the value should be zero Empty boxes will be marked incorrect

Big City Giving BCG is a notforprofit organization that provides human welfare

services in New York City. BCG prepares its financial statements on the accrual basis of

accounting and follows GAAP for notforprofit organizations. It ended FY with

the following account balances in no particular order:

The following financial events occurred during FY which ended December

:

BCG earned and received payment on $ of public contracts paid for by

the city and state governments during the year. Use "Contract Revenue" as the

line item in the financial statements, as appropriate.

BCG used $ of supplies during the year to provide goods and services.

BCG paid $ each month for rent during FY In addition, BCGs

landlord required that the organization pay an additional $ for the first

month's rent of FY before the end of FY BCG also paid $ per

month during the year for utilities. Record rent and utilities separately in the

financial statements, as appropriate.

BCG earned $ from providing welfare services to clients and collected

of this amount. The remaining balance at the end of the fiscal year has been

determined to be uncollectible. Use "Welfare Revenue" as the line item in the

financial statements, as appropriate.

BCG earned $ in new donations that are available for any purpose, of

which $ was collected in cash. It is anticipated that the remaining

balance will be collected in the next fiscal year. Use "Contributions" as the line

item in financial statements, as appropriate.

BCG paid the bank $ Of this amount, was for interest and the

remainder was for the repayment of principal.

Employees earned $ in salaries for work performed in FY

Employees earned $ in FY Salaries are earned evenly througho

mportant Tips PLEASE READ

Round you answers to

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock