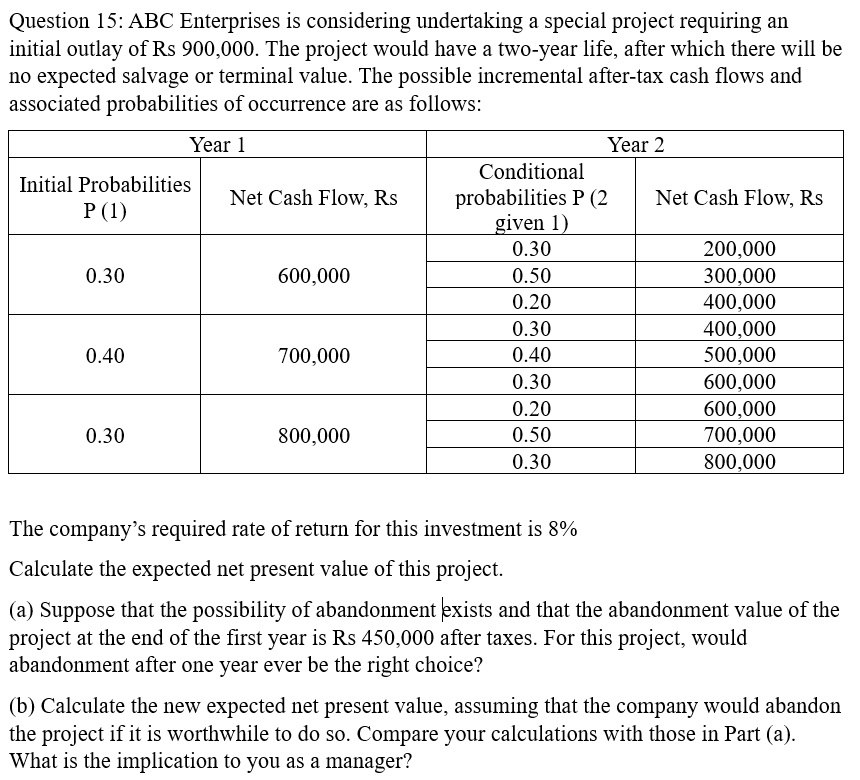

Question: Question 1 5 : ABC Enterprises is considering undertaking a special project requiring an initial outlay of Rs 9 0 0 , 0 0 0

Question : ABC Enterprises is considering undertaking a special project requiring an

initial outlay of Rs The project would have a twoyear life, after which there will be

no expected salvage or terminal value. The possible incremental aftertax cash flows and

associated probabilities of occurrence are as follows:

The company's required rate of return for this investment is

Calculate the expected net present value of this project.

a Suppose that the possibility of abandonment exists and that the abandonment value of the

project at the end of the first year is Rs after taxes. For this project, would

abandonment after one year ever be the right choice?

b Calculate the new expected net present value, assuming that the company would abandon

the project if it is worthwhile to do so Compare your calculations with those in Part a

What is the implication to you as a manager?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock