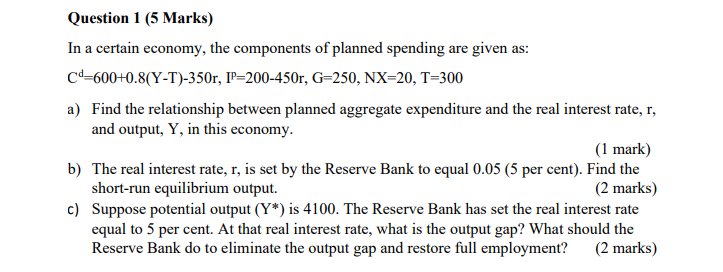

Question: Question 1 (5 Marks) In a certain economy, the components of planned spending are given as: Cd=600+0.8(Y-T)-350r, IP=200-450r, G=250, NX=20, T=300 a) Find the relationship

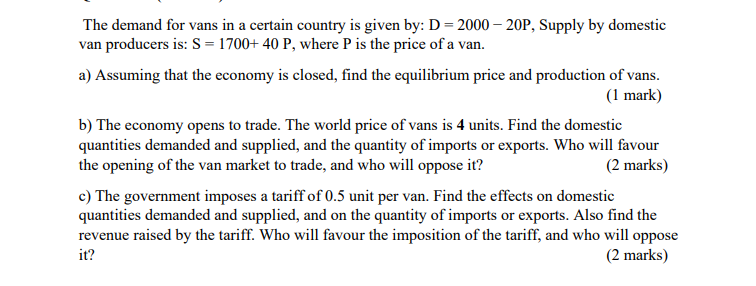

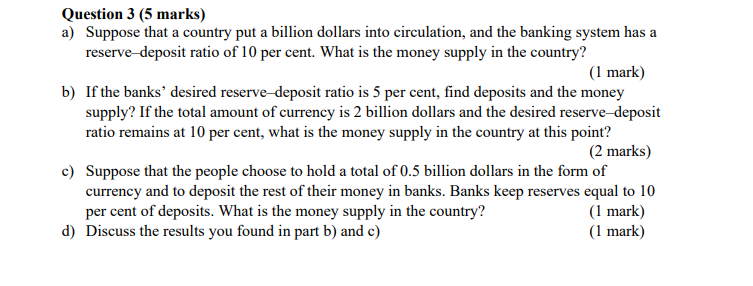

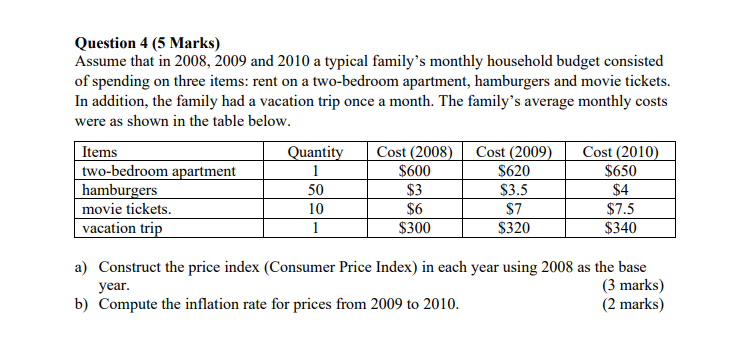

Question 1 (5 Marks) In a certain economy, the components of planned spending are given as: Cd=600+0.8(Y-T)-350r, IP=200-450r, G=250, NX=20, T=300 a) Find the relationship between planned aggregate expenditure and the real interest rate, r, and output, Y, in this economy. (1 mark) b) The real interest rate, r, is set by the Reserve Bank to equal 0.05 (5 per cent). Find the short-run equilibrium output. (2 marks) c) Suppose potential output (Y*) is 4100. The Reserve Bank has set the real interest rate equal to 5 per cent. At that real interest rate, what is the output gap? What should the Reserve Bank do to eliminate the output gap and restore full employment? (2 marks)The demand for vans in a certain country is given by: D = 2000 - 20P, Supply by domestic van producers is: S = 1700+ 40 P, where P is the price of a van. a) Assuming that the economy is closed, find the equilibrium price and production of vans. (1 mark) b) The economy opens to trade. The world price of vans is 4 units. Find the domestic quantities demanded and supplied, and the quantity of imports or exports. Who will favour the opening of the van market to trade, and who will oppose it? (2 marks) c) The government imposes a tariff of 0.5 unit per van. Find the effects on domestic quantities demanded and supplied, and on the quantity of imports or exports. Also find the revenue raised by the tariff. Who will favour the imposition of the tariff, and who will oppose it? (2 marks)Question 3 {5 marks} a} h} d} Suppose that a country put a billion dollars into circulation, and the banking sysmm has a IESBWEdepsit ratio of H] per oent. What is the money supply in the country? (1 mark] If the banks\" desired rewryedeposit ratio is 5 per cent, nd deposits and the money supply? If the total amount of currency is 2 billion dollars and the desired reservedeposit ratio remains at It} per cent, what is the money supply in the country at this point? (2 marks} Suppose that the people choose to hold a total ofj billion dollars in the form of currency and to deposit the next of their money in banks. Banks keep I'ESEWES equal to It} per cent of deposits. What is the money supply in the country? (1 mark] Discuss the results you found in part b] and c} (1 mark] Question 4 (5 Marks) Assume that in 2008, 2009 and 2010 a typical family's monthly household budget consisted of spending on three items: rent on a two-bedroom apartment, hamburgers and movie tickets. In addition, the family had a vacation trip once a month. The family's average monthly costs were as shown in the table below. Items Quantity Cost (2008) Cost (2009) Cost (2010) two-bedroom apartment 1 $600 $620 $650 hamburgers 50 $3 $3.5 $4 movie tickets. 10 $6 $7 $7.5 vacation trip 1 $300 $320 $340 a) Construct the price index (Consumer Price Index) in each year using 2008 as the base year. (3 marks) b) Compute the inflation rate for prices from 2009 to 2010. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts