Question: Question 1 (5 marks): Using the information below, derive the statistics for the portfolio. Assume each bond pays a semi-annual coupon. Duration Modified Value of

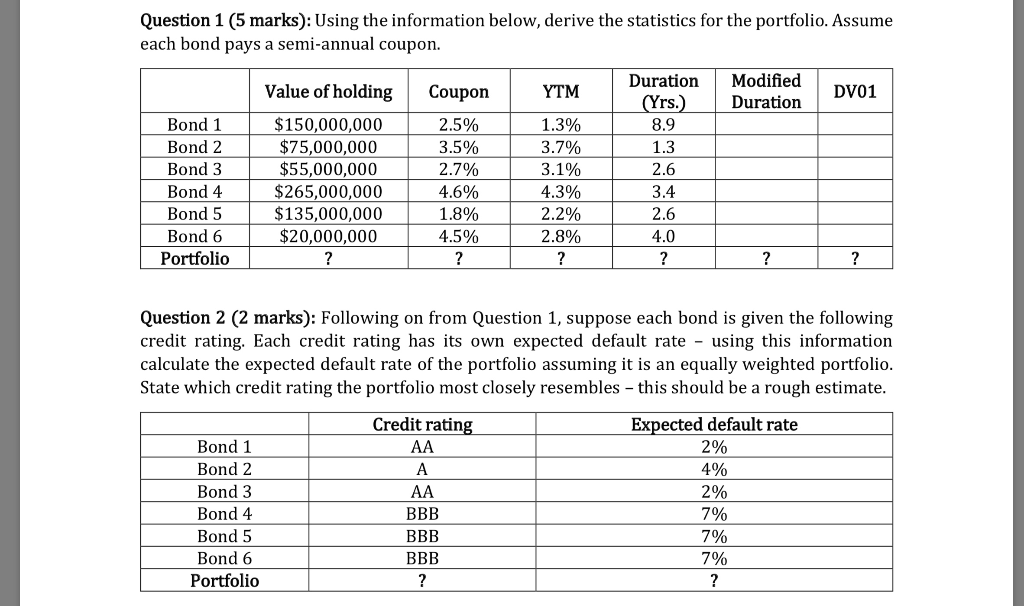

Question 1 (5 marks): Using the information below, derive the statistics for the portfolio. Assume each bond pays a semi-annual coupon. Duration Modified Value of holding Coupon YTM DV01 (Yrs.) Duration Bond 1 $150,000,000 $75,000,000 $55,000,000 $265,000,000 $135,000,000 $20,000,000 2.5% 1.3% 8.9 3.7% Bond 2 3.5% 1.3 Bond 3 2.7% 3.1% 2.6 4.6% Bond 4 4.3% 2.2% 3.4 Bond 5 1.8% 2.6 Bond 6 4.5% 2.8% 4.0 Portfolio ? ? ? ? ? ? Question 2 (2 marks): Following on from Question 1, suppose each bond is given the following credit rating. Each credit rating has its own expected default rate - using this information calculate the expected default rate of the portfolio assuming it is an State which credit rating the portfolio most closely resembles - this should be a rough estimate. equally weighted portfolio. Credit rating Expected default rate 2% Bond 1 AA Bond 2 A 4% Bond 3 AA 2% Bond 4 BBB 7% Bond 5 BBB 7% Bond 6 Portfolio BBB 7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts