Question: Question 1 (5 marks) While Rose Company is considering two projects: (A and B). The following table shows the annual operating cash flows for each

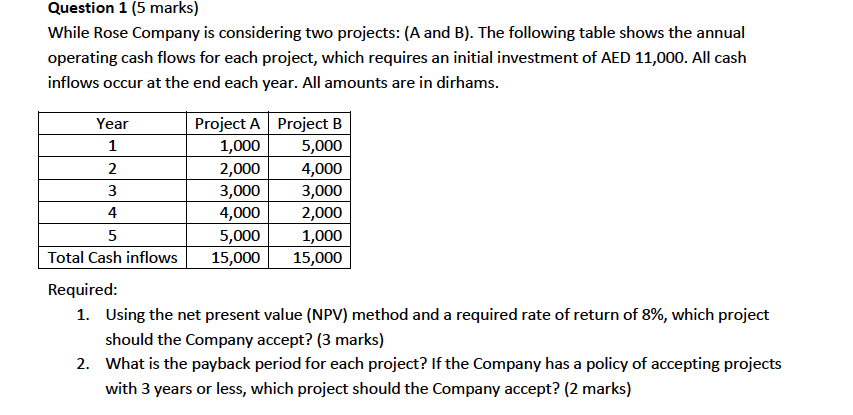

Question 1 (5 marks) While Rose Company is considering two projects: (A and B). The following table shows the annual operating cash flows for each project, which requires an initial investment of AED 11,000. All cash inflows occur at the end each year. All amounts are in dirhams. Project A Project B 5,000 4,000 3,000 2,000 1,000 Total Cash inflows 15,000 15,000 Year 2 3 4 5 1,000 2,000 3,000 4,000 5,000 Required 1. Using the net present value (NPV) method and a required rate of return of 8%, which project e Company accept? (3 marks) 2. What is the payback period for each project? If the Company has a policy of accepting projects with 3 years or less, which project should the Company accept? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts